After being on opposite sides of a lawsuit, Walt Disney Co. and fuboTV Inc. are joining forces to create a new aggregated offering.

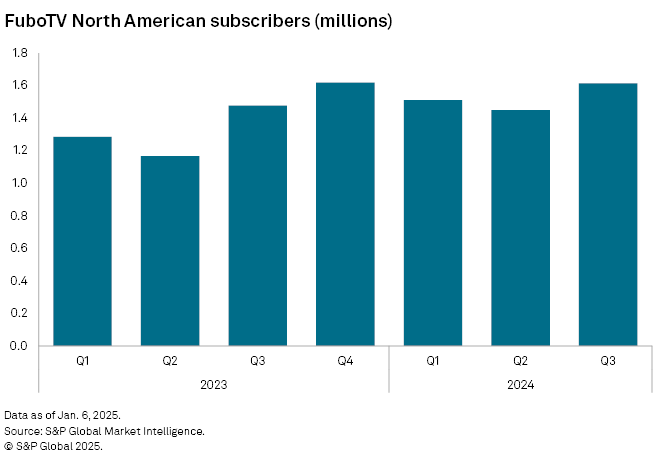

Disney and the sports streamer said Jan. 6 that they reached a merger agreement under which Disney will combine its Hulu + Live TV business with Fubo to create a new virtual multichannel video programming distributor. The combined company, which will be 70% owned by Disney, would count some 6.2 million subscribers, including 1.6 million from Fubo and 4.6 million from Hulu + Live TV. Among virtual MVPDs, that trails only YouTubeTV. Not including ad-supported or subscription video-on-demand services such as Netflix Inc. or Amazon.com Inc.'s Prime Video, the new Fubo would rank as the sixth-largest US distributor overall behind Charter Communications Inc., Comcast Corp., DIRECTV Entertainment Holdings LLC, DISH Network LLC and Alphabet Inc.'s YouTube Live.

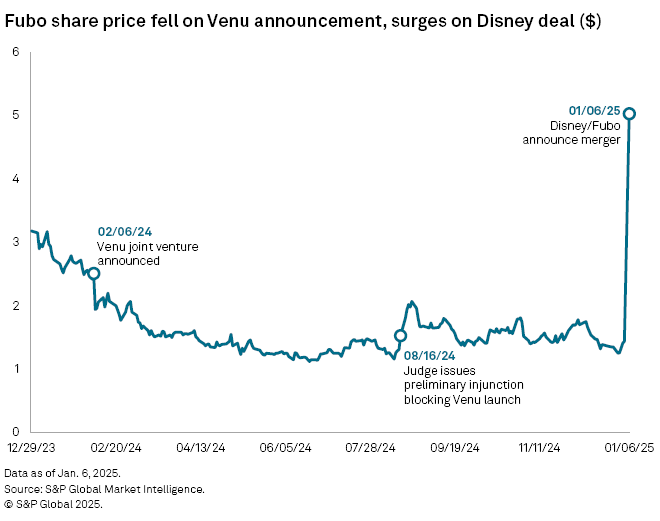

The merger comes almost a year after Fubo sued to block the launch of Venu, a joint streaming venture between Disney's ESPN, Fox Corp. and Warner Bros. Discovery Inc. Venu was set to feature 14 sports-oriented networks from its three owners, and ESPN+, for a suggested retail price of $42.99 per month. In its lawsuit, Fubo said it had tried to launch a similar sports-oriented package but was forced by the programmers to carry entertainment and other nonsports networks, which pushed up its overall cost and limited subscriber growth. Fubo's English-language packages range from $79.99 to $99.99 per month.

Fubo's lawsuit successfully prevented Venu from launching in tandem with 2024's NFL and college football seasons.

Now, as part of the new deal the parties have reached a settlement under which Disney, Fox and Warner Bros. Discovery will make an aggregate cash payment of $220 million to Fubo to resolve the legal dispute. Disney will also provide a $145 million term loan to Fubo in 2026.

In exchange, Disney will enter into a new carriage agreement with Fubo enabling the latter to create a new sports and broadcast service featuring Disney-owned sports and broadcast networks such as ABC (US) and ESPN (US) as well as ESPN+.

"Fubo will now be able to provide even more sports, including ESPN+, through amended distribution agreements with Disney, as well as Fox," Fubo co-founder and CEO David Gandler said. "Crucially, Fubo has the potential to create skinnier sports, news and entertainment bundles, according to consumer needs."

Listen to David Gandler talk about Fubo in an exclusive podcast with S&P Global Market Intelligence:

Gandler and Fubo's extant management team will lead the combined business that will operate under the Fubo name on the New York Stock Exchange.

Shares in Fubo closed at $5.06 on Jan. 6, up from $1.44 the previous trading day.

The parties' game plan initially calls for the Fubo and Hulu + Live TV to remain separate brands while the company works on assembling a streaming bundle that will feature ESPN networks and other channels.

The lawsuit settlement also potentially clears the way for a Venu launch, though S&P Global Market Intelligence Kagan analyst Scott Robson said he cannot imagine Disney maintaining the three separate vMVPD offerings — Fubo, Hulu + Live TV and Venu — indefinitely. This is especially true given the upcoming launch of Disney's direct-to-consumer flagship ESPN offering, set for later this year.

"With the ESPN DTC product set to launch [this] fall, I can't imagine that growing Fubo and Venu are top priorities for Disney in 2025," Robson said.

Kagan research analyst Seth Shafer said it will be interesting to see the broader implications for rival service providers such as YouTube TV, DISH's Sling and DIRECTV Stream.

Shafer wonders if Disney will allow those vMVPDs to take ESPN and a few other sports networks to offer a skinny sports bundle akin to what Fubo is promising. He said the company could potentially wind up back in court if they offer Fubo preferential treatment.

Together, Hulu and Fubo expect to garner $6 billion in revenue this year, Fubo executives told investors on a Jan. 6 call. In 2028, the company anticipates having over $7.5 billion in revenue and $550 million in EBITDA, according to executives on the call.

On the sports side, the brands currently have different offerings. While Hulu + Live TV is not in the regional sports network game, Fubo is the top virtual RSN provider, carrying the FanDuel Sports Networks, YES Network and NESN, among others.

Gandler said the companies are still working through plans for the packages, both in terms of networks and pricing.

Asked on the call if the sports bundle would be in the $40 range akin to Venu, Gandler said: "I think the name speaks for itself. It's going to be skinnier. So as a result, it will be a lower-cost bundle with fewer networks in there. We haven't actually worked on what that might be. We've been very focused over the last three weeks on amending our agreements to allow us to create these skinnier bundles. So as you know, we still have other programming deals, and we have to work through those as well."

Given Fubo's enhanced position and broader reach, Gandler expects "to negotiate improved content licensing agreements with all programmers. With more competitive licensing terms, we expect to return money to consumers in the form of increased value and better content offerings."

The transaction is subject to regulatory approvals, Fubo shareholder approval and the satisfaction of other customary closing conditions. Fubo is eligible to receive a $130 million termination fee if the merger fails to close due to the inability to secure necessary regulatory approvals.