|

|

Fundraising via IPOs in India is set for another landmark year after economic growth, favorable market conditions and improvements in the regulatory framework helped companies raise record amounts in 2024.

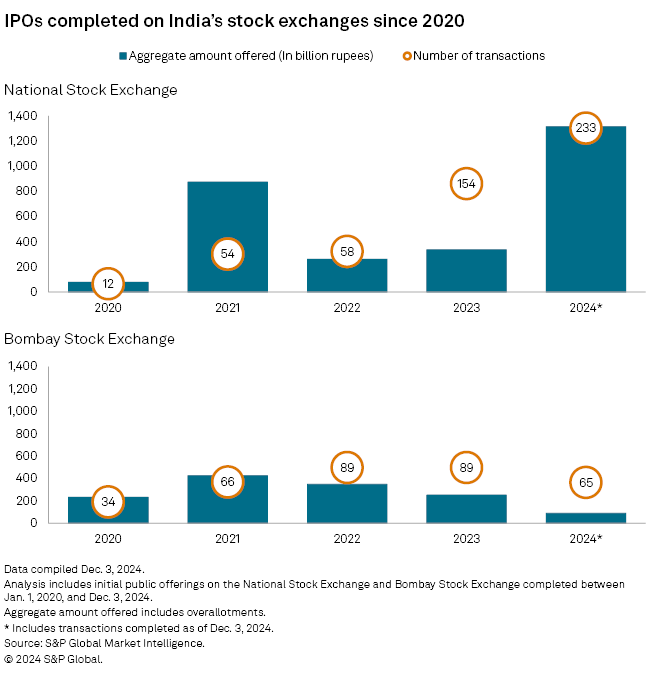

A total of 298 companies listed on the country's bourses — National Stock Exchange of India Ltd. (NSE) and BSE Ltd. — as of Dec. 3, raising a combined 1.406 trillion rupees, according to data compiled by S&P Global Market Intelligence.

The year-to-date IPO count grew 22.6% from 243 listings in 2023, while fundraising volumes jumped 139% from 588.27 billion rupees, according to Market Intelligence data.

"It is imminent that 2025 shall be a record year for IPOs in India," said Sandeep Upadhyay, managing director and CEO of Centrum Infrastructure Advisory, adding that the market may see an IPO pipeline exceeding $20 billion, or 2.176 trillion rupees, in the next 12 months to 18 months.

The previous best was in the financial year that ended March 31, 2022, when a total of 1.304 trillion rupees was raised via equity sales, the highest in the last 35 years based on numbers from PRIME Database Group, a capital markets data provider.

India retains the lead in global growth, S&P Global Ratings said in a Nov. 27 report, with the country's GDP forecast to grow 6.8% in the fiscal year ending March 31, 2025. Economic growth, however, slumped to a surprise 5.4% in the July-to-September quarter, compared to 8.1% in the same period a year ago, according to government data released Nov. 29.

The miss has put the Indian central bank's fiscal full-year forecast of 7.2% year over year at risk, Radhika Rao, senior economist at DBS Bank, said in a Dec. 4 note. "Even as this GDP print likely marked the bottom of the cycle, and we look for a modest recovery in the second half, FY'25 growth is on course to settle in a lower 6.2% to 6.4% range compared to the previous 6.7% to 7.0%," Rao said. The Reserve Bank of India is currently reviewing its monetary policy settings and is due to make an announcement Dec. 6.

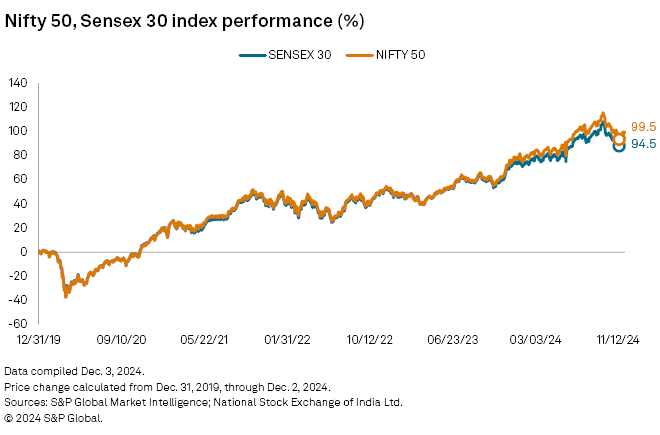

The NSE's benchmark index, the NIFTY 50, reached an all-time high of 26,216 points on Sept. 27, while the BSE Sensex peaked at 85,836 points on Sept. 26. The stock market gains have been underpinned by India's robust economic growth prospects.

Growth drivers

India's capital market is also getting a lift from the growing popularity of mutual funds among local investors seeking higher returns than traditional savings options such as fixed deposits with banks.

The "financialization of domestic savings away from [fixed deposits] and real assets to capital markets has been a consistent and most dominant reason for the growth in the primary as well as secondary markets over the last few years post-COVID, despite selling from foreign institutional investors (FIIs)," Prashant Singhal, partner and emerging markets leader for EY India, told Market Intelligence via email.

Retail investors' participation in India's capital market grew significantly post-pandemic, with demat accounts — which hold securities for trading digitally — surging to 171 million as of Aug. 31 from 41 million in March 2020, according to a Sept. 12 report from SBI Securities. While stock market investment benefited from the unremunerative returns on debt and other asset classes, better awareness and a global trend toward financialization of savings also helped, the brokerage said.

Singhal said local investment has counterbalanced FII outflows in recent years, and a potential reversal of FIIs' flows back into India could increase overall liquidity further.

While FIIs have been selling Indian equities, Centrum's Upadhyay expects them to return to the country given the allure of its long-term growth story.

"With the US Federal Reserve likely to pause its rate cuts, and with expectations of a sharp rebound in Indian corporate earnings growth for [fiscal 2026], along with more attractive valuations for Indian stocks, FIIs are expected to begin reallocating incremental investments into Indian equities from early calendar year 2025," Upadhyay added.

Big listings, robust pipeline

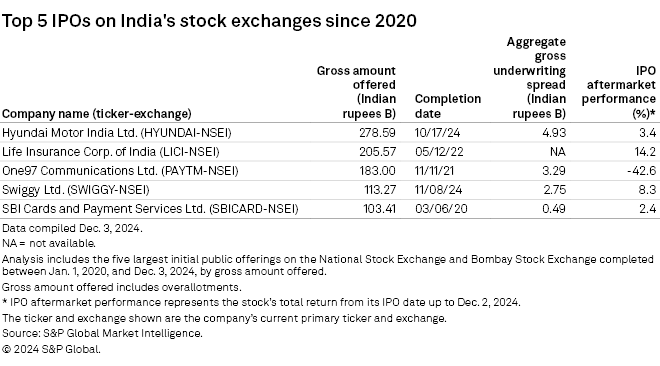

India is likely to see bigger listings like those of Hyundai Motor India Ltd. and food delivery platform Swiggy, given a robust listing pipeline, market performance and better liquidity, analysts said. Hyundai Motor India's 278.59 billion rupee IPO, which was completed in October, is the country's largest listing ever.

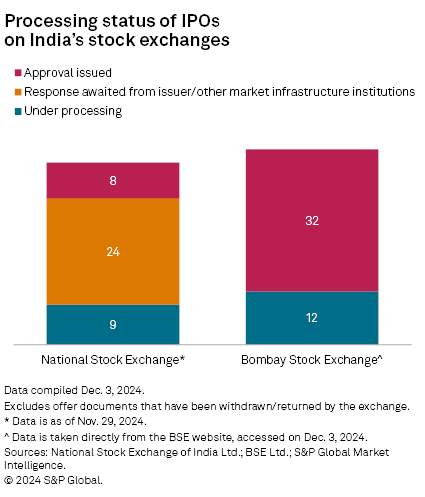

As of Nov. 29, 85 companies were at various stages of the NSE and BSE listing process, of which 40 had already received approval to kick off their offerings, data compiled by Market Intelligence show. The lot included 21 companies whose IPOs were under process at the stock exchanges.

Some of the larger IPO candidates include telecom company Reliance Jio Infocomm Ltd., with an estimated valuation of $100 billion, as well as Imagine Marketing and Ather Energy, Upadhyay said. Citing reports, Upadhyay added that Reliance Jio may launch an IPO of more than $6.25 billion in the second or third quarter of calendar year 2025.

As of Dec. 4, US$1 was equivalent to 84.71 Indian rupees.