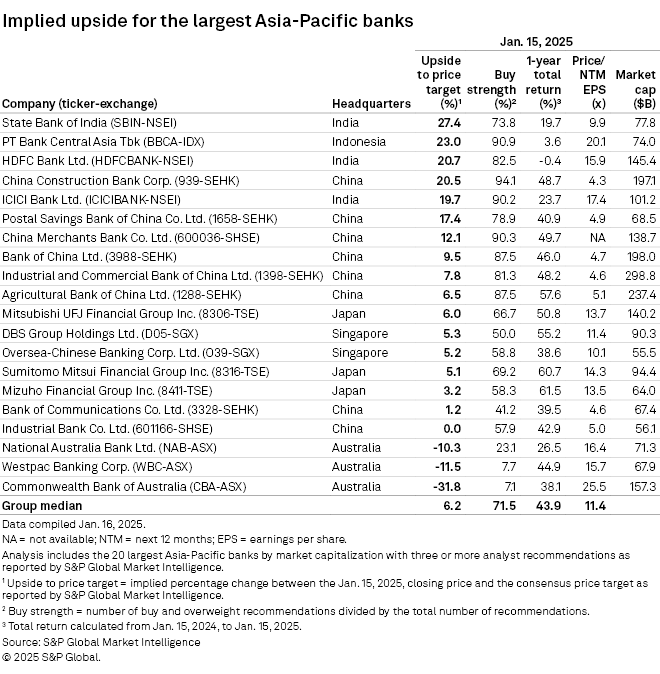

Shares in large Indian and Chinese banks trail their consensus price targets by the widest margins among peers in the Asia-Pacific region, suggesting the most upside, according to implied upside data compiled by S&P Global Market Intelligence.

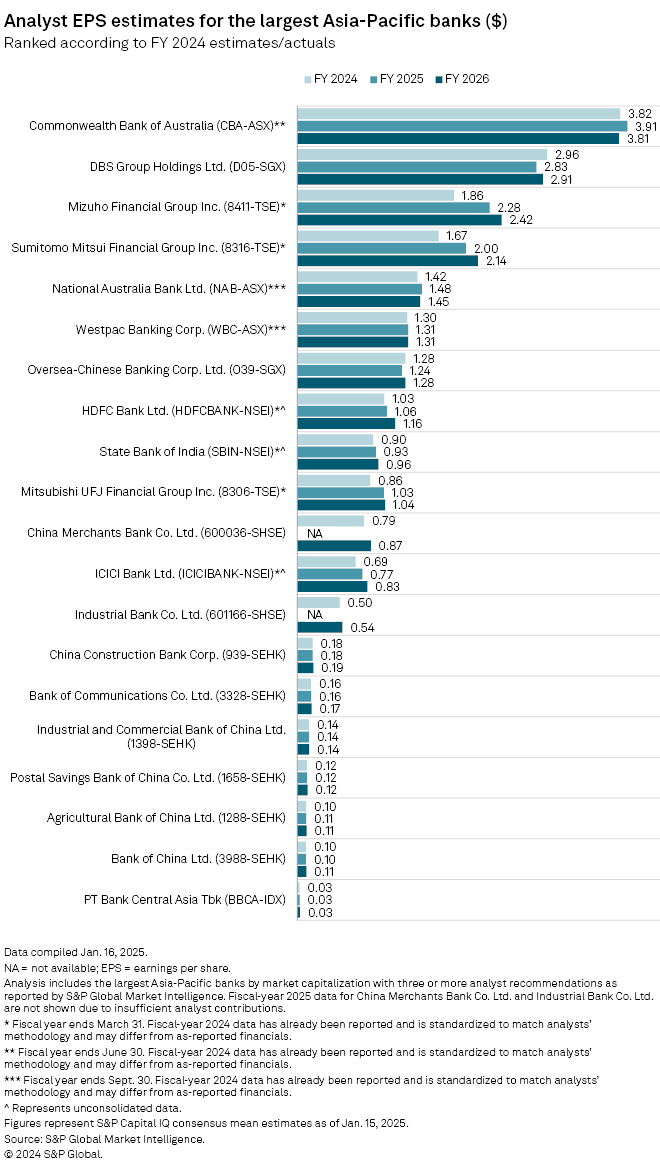

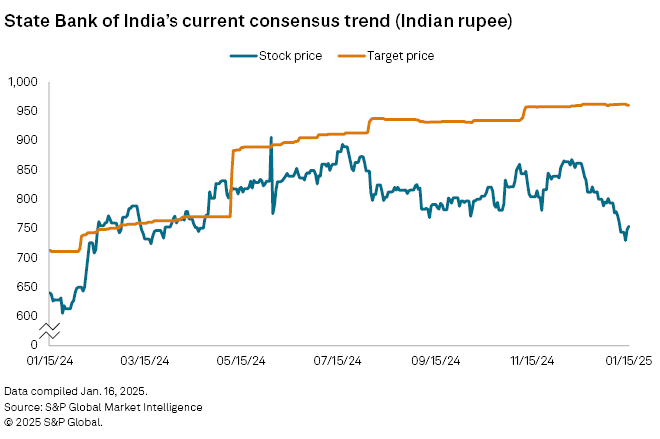

State Bank of India, the South Asian country's biggest lender by assets, has the biggest gap to its price target at 27.4% and a buy strength of 73.8%, the data shows. HDFC Bank Ltd., India's largest lender by market capitalization, ranks third on a list of the region's 20 biggest banks, with upside potential of 20.7%. ICICI Bank Ltd. is in fifth.

Upside to price target refers to the implied percentage change between the current share price and the consensus price targets as reported by Market Intelligence. Buy strength reflects the percentage of buy and overweight recommendations relative to the total number of recommendations. The Market Intelligence data was based on lenders covered by three or more analysts.

Six Chinese banks, including the four state-owned giants, are among the top 10 by expected share price gains in the region. China Construction Bank Corp. is in fourth place with a 20.5% upside, the data shows. Shares in Bank of China Ltd., Industrial and Commercial Bank of China Ltd. and Agricultural Bank of China Ltd. have upsides ranging from 6.5% to 9.5%.

Indonesia's PT Bank Central Asia Tbk, in second place with a potential upside of 23.0% and a buy strength of 90.9%, is the only lender not based in China or India to make the top 10.

Slow growth

Relatively slow economic growth in China and India, Asia-Pacific's two main growth engines, took a toll on bank shares in recent months. No banks from either of the two economies featured on a Market Intelligence ranking of the 2024 top 15 Best-performing Asia-Pacific bank stocks by total returns.

China, the world's second-biggest economy, posted 5.0% growth in gross domestic product in 2024, meeting the government's target for the year, according to data released on Jan. 17. The International Monetary Fund subsequently raised China's 2025 GDP growth forecast to 4.6% from 4.5%, citing the effects of stimulus measures.

The Reserve Bank of India, meanwhile, projects the South Asian nation's GDP to grow at 6.6% in the fiscal year ending March 31, down from 8.2% for the year ended March 31, 2024.

In China, "insurance funds are in the process of raising their stakes in banks," analysts at Shanghai-based Minsheng Securities said in a Jan. 19 note. "The momentum is not diminishing as we enter 2025."

Insurance funds are attracted to high-dividend-yielding banking stocks, which typically offer about 5.5% at state-owned banks, amid declining returns from the bond market, according to the brokerage.

Three of Australia's largest banks are expected to have the poorest share performance in the region despite a strong 2024, according to Market Intelligence data.

The share price of Commonwealth Bank of Australia is expected to fall as much as 31.8%. National Australia Bank Ltd. has a 10.3% downside, while Westpac Banking Corp. is projected to decline 11.5%, the data shows.