Skyrocketing U.S. inflation is contributing to a slowdown in North American deal-making this year after a record-breaking 2021.

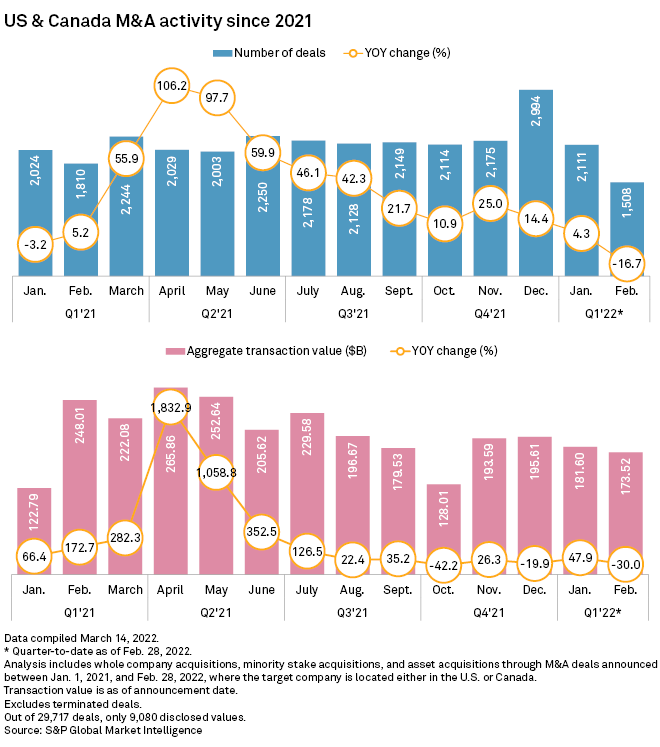

The number of deals fell 16.7% year over year in February, while the value of those deals dropped 30% over the same month in 2021, according to S&P Global Market Intelligence data. Aggregate deal value in February was still higher than the pre-pandemic level of $90.93 billion in February 2020. This has occurred even as the Federal Reserve's push to hike interest rates in response to prices rising at the fastest level in 40 years is setting the stage for higher borrowing costs, a drag on corporate cashflows and greater uncertainty.

Explore data insights to navigate market volatility

Request Demo

"We've had a really favorable rate environment for a couple of years here, but I think the market is coming around to the understanding that the party is coming to an end," said Brad Laken, a partner at White & Case's debt finance practice.

Microsoft Corp.'s $67.65 billion takeover of Activision Blizzard Inc. in January could have kicked off another year of strong M&A as cash-rich companies looked to take advantage of the growing economy. Instead, further COVID-19 restrictions, persistently high inflation and Russia's invasion of Ukraine have shifted the landscape.

Sector declines

The biggest decline in the value of M&A in February was in the financials sector with a 74.4% drop-off year over year. That was followed by healthcare with a 61.3% decline and energy and utilities at 40.7%.

M&A activity is strongest when interest rates are low, equity markets are strong, and uncertainty is relatively low, said Steven Kaplan, a professor at the University of Chicago's Booth School of Business.

Those three factors will likely be upended by the rise in inflation. Interest rates have begun to rise, equity markets could be hindered, and cost forecasts have been thrown into doubt, Kaplan said.

Stocks and the Fed

While equity markets remain below recent highs, they have rallied in spite of rising inflation, soaring energy and other commodity costs and ongoing geopolitical uncertainty, particularly Russia's invasion of Ukraine. On April 1, the S&P 500 settled down 5.2% from its Jan. 3 high. The large-cap index, however, climbed 8.9% between March 14 and April 1.

Equity market conditions are particularly important for the health of the M&A market since a strong stock market gives buyers comfort in using their stock to fund equity-financed deals and offers sellers assurances of attractive equity values, Kaplan said.

The Fed's push to fight inflation by raising its benchmark federal funds rate may be one of the chief deterrents to M&A activity this year, said Emilie Feldman, a professor at the University of Pennsylvania's Wharton School.

"As rates rise, the cost of financing transactions increases, potentially preventing certain companies from pursuing M&A deals that they might otherwise have undertaken," Feldman said.

Many factors

Inflation is impacting M&A activity, largely through anticipation of higher interest rates. With so many factors at play, it is difficult to pin the slowdown on just one point, said Melissa Sawyer, global head of Sullivan & Cromwell's M&A group.

Russia's ongoing invasion of Ukraine, among other factors, will boost uncertainty around the path forward for the global economy, potentially hindering future M&A plans.

"The biggest driver of reduced M&A activity is just generalized uncertainty, which could be a symptom not just of the inflationary environment but also lingering COVID-related impacts, supply chain challenges and the situation in the Ukraine and Russia, among other things," Sawyer said.

In addition to an elevated inflation outlook and views of a hawkish Fed, some of the increase in M&A in 2021 may have been due to expectations that the Biden administration would repeal some of the corporate tax changes put in place during the Trump administration. Those plans have not come to fruition, but M&A activity was sped up in anticipation anyway, potentially cannibalizing some of the activity that would have otherwise taken place this year, Laken with White & Case said.

"It's a really unique environment, and it's going to be hard to disentangle all the various factors at play," Laken said.