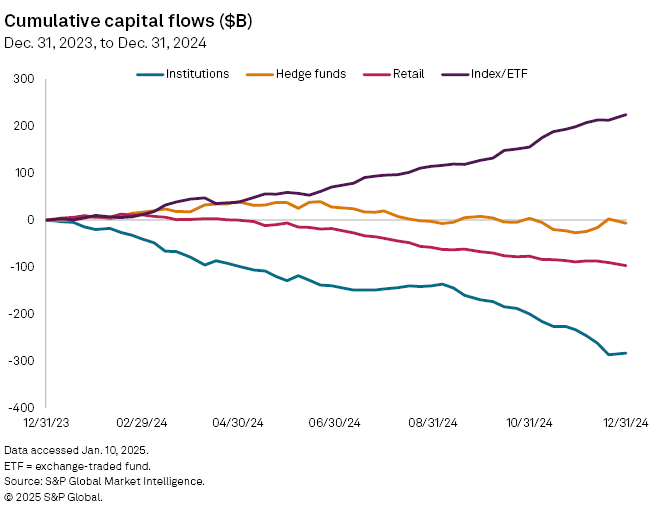

Institutions continued to aggressively sell equities through the end of 2024, but capital kept flowing into index and exchange traded funds and passive, broad-based investment strategies.

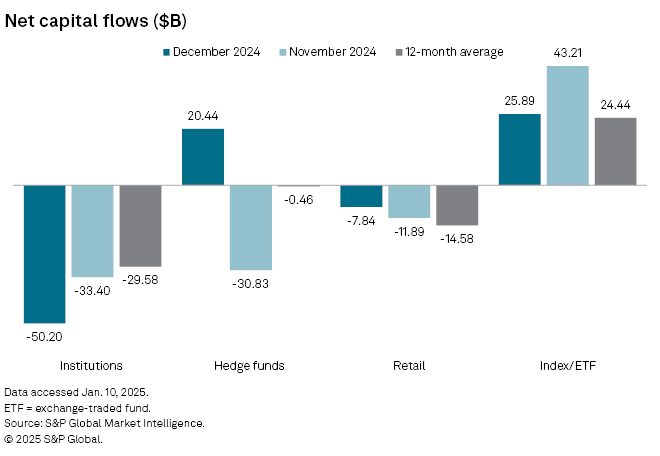

Institutional investors in December 2024 sold a net $50.20 billion of equities, up about 50% from November and the highest level of monthly selling in 2024, according to the latest data from S&P Global Market Intelligence. Institutions sold roughly $283.50 billion in stocks over the course of 2024, the data shows, averaging nearly $29.58 billion in net monthly sales over the past 12 months.

"This selling activity intensified toward the year's end, highlighting 2024 as a pivotal year for index investing," said Thomas McNamara, a director for issuer solutions at S&P Global Market Intelligence. "As stock pickers continued to reduce their allocations to individual securities, the post-election market rally provided further motivation for broad-based investment strategies."

Index funds and ETFs, meanwhile, continued to buy stocks on net. They bought a net $25.89 billion in stocks in December, down from the $43.21 billion bought in November, but close to the 12-month average of $24.44 billion.

Institutions are likely to keep selling while and index and ETFs continue to buy in 2025, with a significant flow of capital back to institutional active management unlikely if the ongoing rally in stocks persists, McNamara said. The S&P 500 gained about 23.3% in 2024 and was up about 27.6% until a downturn in mid-December.

Hedge fund, retail flows

Hedge funds bought a net $20.44 billion in equities in December after selling $30.83 billion in November. Buying and selling by hedge funds was nearly flat on average throughout 2024.

"Hedge funds remained focused on short-term gains throughout 2024, demonstrating a sector-agnostic approach and capitalizing on 'buy the dip' opportunities," McNamara said.

Hedge fund trading strategies were impacted by increased institutional selling and ETFs buying up stocks, as market volatility has been amplified by the absence of substantial long-only investments.

"As long-only capital diminishes and ETFs command a larger market share, market fluctuations become more pronounced, resulting in shorter trading windows for hedge fund strategies," McNamara said. "This dynamic has effectively increased the frequency and volume of trading activity."

Retail investors remained net sellers of equities in December, albeit at a slower clip. In December, retail investors sold a net $7.84 billion in stocks, below the $11.89 billion sold on net in November and the $14.58 billion monthly average sold throughout the year.

Retail investors may return to buying in 2025 as the market may appear increasingly attractive to these investors, McNamara said.

"