Shares of Australia's largest banks face a subdued outlook in 2025 amid slowing economic growth and anticipated interest rate cuts.

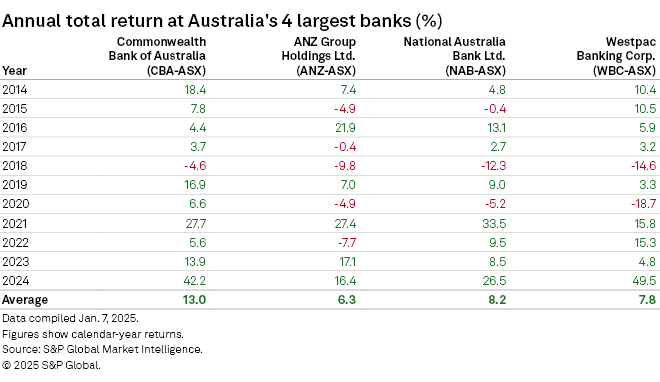

Commonwealth Bank of Australia (CBA), National Australia Bank Ltd. (NAB), ANZ Group Holdings Ltd. and Westpac Banking Corp. delivered strong stock performances recently. CBA, the country's biggest lender by assets, posted a total return of 42.2% in 2024, up from 13.9% in 2023, according to S&P Global Market Intelligence data. Westpac led its peers with a 49.5% total return in 2024, followed by NAB at 26.5% and ANZ at 16.4%.

Bank stocks' strong performance in 2024 was driven by equity inflows, Andrew Dale, portfolio manager and partner at ECP Asset Management, told S&P Global Market Intelligence. "It was definitely a surprise," Dale said.

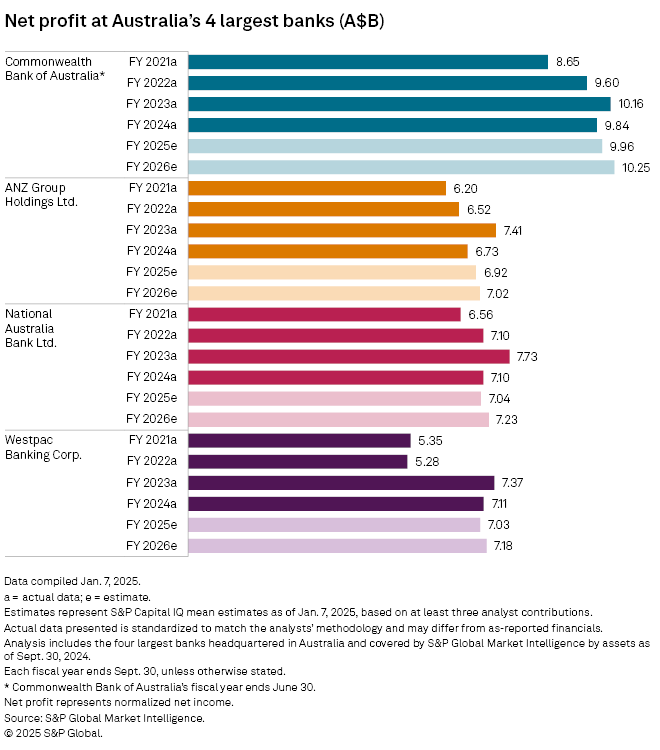

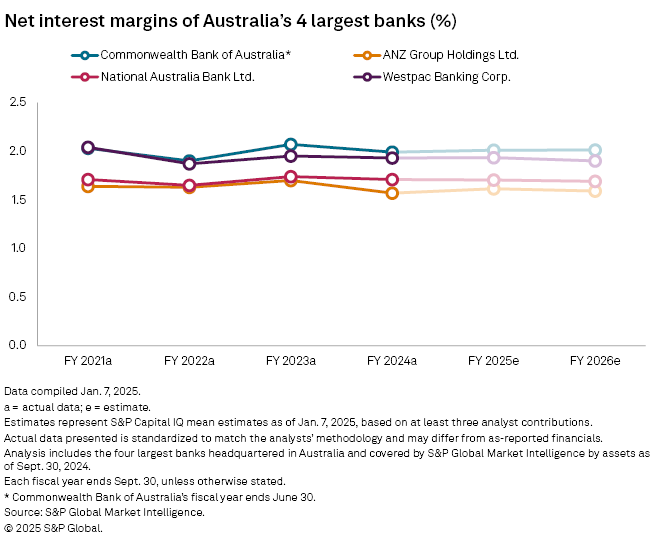

The robust stock gains of Australia's four biggest banks contrasted with their weak earnings. Net income across the sector faced pressure from narrowing net interest margins (NIMs) amid intensifying competition and rising operational costs. CBA's net income declined to A$9.84 billion in the fiscal year ended June 30, 2024, from A$10.16 billion a year earlier. The other three banks, which report earnings for fiscal years ending Sept. 30, also posted lower net incomes.

Renewed investor interest in equities supported Australian bank stocks in 2024, but sustaining that momentum in 2025 will require "some earnings improvements or upgrades," Dale said. "If inflation continues to be an issue over the first half, the banks will continue to have earnings pressure because their costs of operating will continue to rise. And you'll see further downward pressure on earnings. And if you then start to see a rate cut, you get pressure on the net interest margin."

ANZ CEO Shayne Elliott said in the bank's Nov. 8, 2024, full-year results release that competition in home lending and deposits remained intense. Westpac's outgoing CEO Peter King said in a Nov. 4 results announcement that the bank managed "margins well in a competitive environment while growing in line with system in loans and deposits."

The Reserve Bank of Australia (RBA) has kept its cash rate target at 4.35% since November 2023, even as inflation has eased from its 2022 peak. The consumer price index rose 2.8% year over year in the September 2024 quarter, while monthly inflation slowed to 2.3% in November 2024. The central bank said after its Dec. 10, 2024, monetary policy review that inflation is not expected to return sustainably to the midpoint of its 2%-3% target range until 2026.

Australia's GDP grew 0.8% in the 12 months ended Sept. 30, 2024, down from 1.0% in the prior-year period, according to a Dec. 4, 2024, news release from the Australian Bureau of Statistics.

"Economic growth is expected to improve gradually in 2025 but will likely remain below trend due to cautious consumer spending, modest household income increases and stabilizing house prices," My Nguyen, deputy head of finance and senior lecturer in finance at RMIT University, told S&P Global Market Intelligence in an email.

Nguyen said slower growth could reduce demand for loans and financial services, cutting into banks' interest income and profitability. "Additionally, slow growth often correlates with higher loan impairments as businesses and consumers struggle to meet their financial obligations, increasing the risk of defaults and necessitating higher provisions for bad debts," Nguyen said.

"Asset quality will likely be a key concern for banks in 2025 due to several interconnected factors," Nguyen said. "High inflation and rising living costs can strain household and business finances, increasing the risk of overdue loan payments."

The end of loan repayment deferrals, introduced during the COVID-19 pandemic, has already led to a slight decline in asset quality, Nguyen noted. "To manage this risk, banks must maintain robust provision balances as financial buffers to absorb potential loan losses."

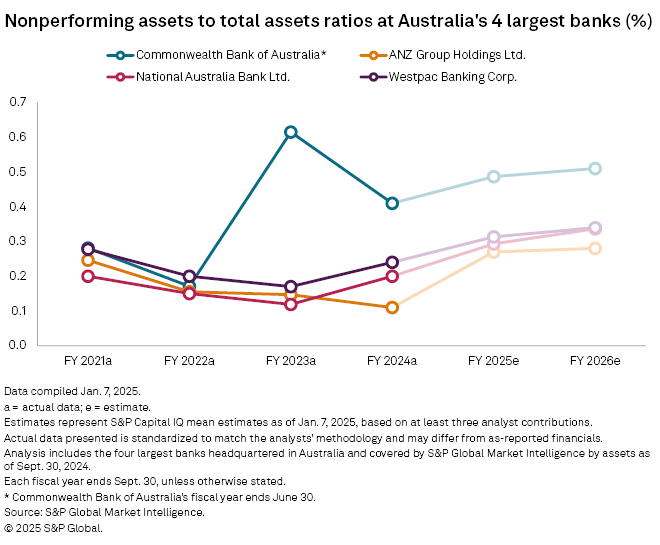

Nonperforming assets (NPA) at Australia's biggest banks are likely to rise in fiscal 2025, according to Market Intelligence estimates. CBA's NPA ratio is projected to increase to 0.49% from 0.41%, ANZ's to 0.27% from 0.11%, Westpac's to 0.31% from 0.24%, and NAB's to 0.29% from 0.19%.

"Banks will need to closely monitor their loan portfolios, identify early signs of distress and take proactive steps to mitigate risks," Nguyen said. "This includes improving stress-testing capabilities and adopting more dynamic risk assessment tools."