Japanese megabanks face challenges in improving their price-to-book ratios as global interest rate changes slow policy normalization in the world's fourth-biggest economy.

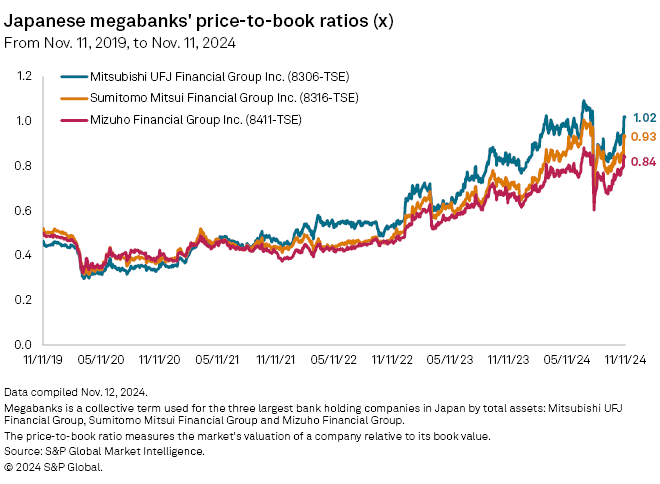

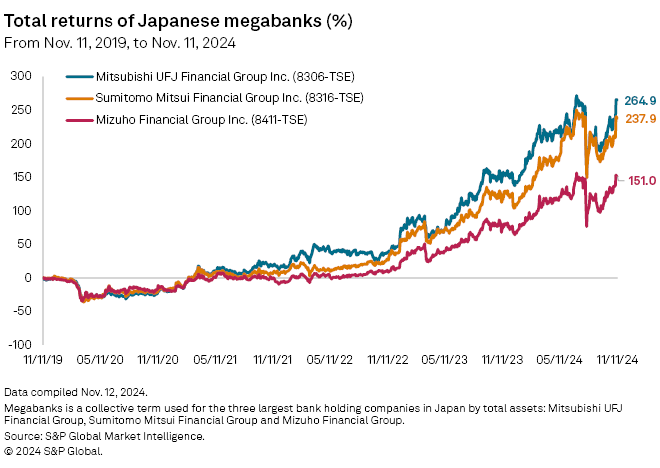

The price-to-book (P/B) ratios of Mitsubishi UFJ Financial Group Inc. (MUFG), Sumitomo Mitsui Financial Group Inc. (SMFG) and Mizuho Financial Group Inc. have risen steadily over the past three years, according to S&P Global Market Intelligence data. As of Nov. 12, MUFG's P/B ratio was 1.02, meeting the Tokyo Stock Exchange's target for listed companies. In August, the banks' P/B ratios reached five-year highs before declining due to market volatility.

Right direction

Japanese megabanks "are moving in the right direction to reach [a P/B ratio of] 1.0 ... but maintaining ratios above that level won't be easy," said Toyoki Sameshima, a senior analyst at SBI Securities Co.

In an October note, Sameshima projected MUFG's P/B ratio to settle at 0.89 by the fiscal year ending March 2025 and fall to 0.84 the following year. The analyst also anticipates declines for SMFG and Mizuho.

To improve P/B ratios, banks need to boost return on equity (ROE) above 10%, requiring economic growth and increased lending, Sameshima said.

The Japanese equity market rose after the central bank abandoned its negative interest rate policy in March. The Bank of Japan raised rates twice before the US Federal Reserve shifted to lower rates in September, pressuring global central banks to adjust to avoid disruptions in foreign exchange and trade.

Attracting investors

Japan's megabanks have increased dividends, announced share buybacks and reduced cross-shareholdings to attract investors. They are also expanding in key markets such as the US and Asia. Despite these efforts, they are valued lower than global banks such as Morgan Stanley and JPMorgan Chase & Co. Even Singapore's DBS Group Holdings Ltd. has a P/B ratio of about 2.

"Japanese megabanks haven't been as focused on growing only very profitable areas," said Michael Makdad, a senior analyst at Morningstar. "They have limited growth in less-profitable areas like housing loans but not to the extent of some foreign banks."

Global banks such as Morgan Stanley have improved profitability by concentrating on wealth and asset management, Makdad noted, while DBS Group's success is partly due to its focus on wealth management in Asia.

"Investors only half believe that [Japanese] banks can improve capital efficiency," said Hideo Oshima, a senior economist at the Japan Research Institute, a unit of SMFG.

Targets

MUFG aims to achieve a 9% ROE by the fiscal year ending March 2027, up from 8.5% in March, according to a statement from the bank in May. In the long term, it expects an ROE of 9%-10%. SMFG is aiming for a 9% ROE by March 2029, rising from 7% in March. Mizuho is aiming for over 8% ROE by March 2026, up from 7.6%.

"Bringing the [P/B ratio] above 1.0 ... is our biggest agenda," said Mizuho CEO Masahiro Kihara at a Nov. 14 earnings conference. "We have to make further efforts." Mizuho plans to improve its P/B ratio by increasing ROE and controlling capital costs, including loan-loss provisions.

MUFG did not focus on P/B ratios. Rather, the lender said in a statement it seeks to boost ROE by increasing net operating profit and managing the cost-income ratio and risk-weighted assets.