|

|

Japan's IPO activity will likely gain momentum in 2025 as more stable macroeconomic conditions attract both issuers and investors.

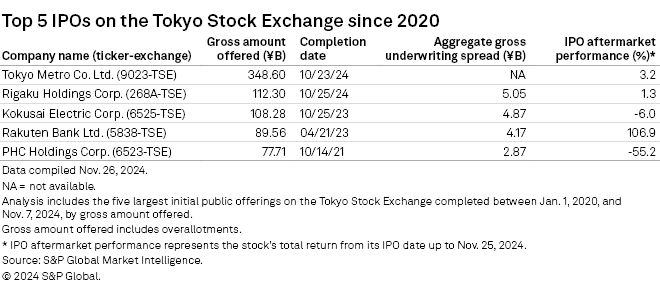

Tokyo Metro Co. Ltd. debuted on the Tokyo Stock Exchange (TSE) on Oct. 23, raising ¥348.6 billion with an initial offering price of ¥1,200, marking the largest IPO fundraising in six years. Its shares traded at ¥1,775 on Nov. 28, well above the issue price. Rigaku Holdings Corp., an X-ray analysis instrument maker, raised ¥112.3 billion on Oct. 25, the second-biggest since 2020.

"The listing of Metro and other major companies is attracting investors to the IPO market," said Katsumi Udagawa, a manager in research and strategy at Ichiyoshi Securities Co. "Metro's success in the secondary market helps create a favorable environment for others to follow."

Healthy pipeline

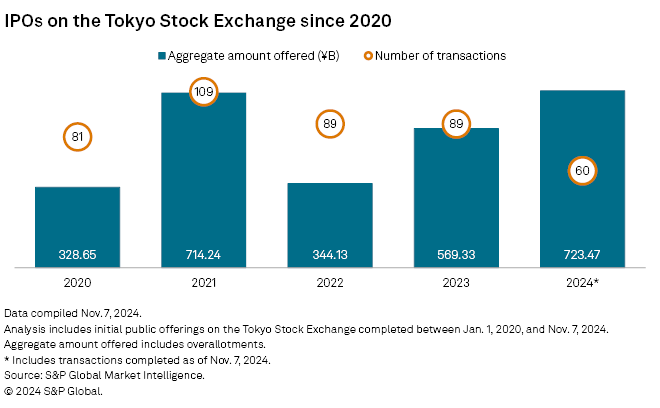

Among upcoming IPOs, Globe-ing Inc. is expected to raise ¥1.95 billion from Nov. 29 to Dec. 5, and Informetis Co. Ltd. may raise ¥2.01 billion on Dec. 9. With more than 20 IPOs in the pipeline, the total number of share sales in 2024 is set to match the previous two years' figures, though the amount raised is already at its highest in at least the last five years, according to S&P Global Market Intelligence data.

As of Nov. 7, a total of 60 companies had raised a combined ¥723.47 billion, compared with 89 IPOs that raised an aggregate ¥569.33 billion in 2023, Market Intelligence data show.

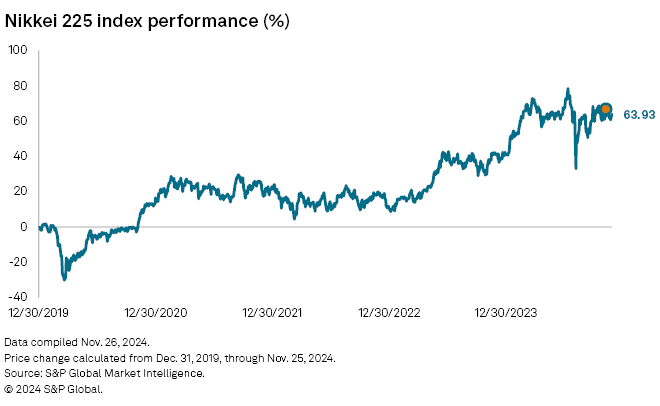

The Japanese central bank ended years of negative rates in March with its first rate hike in about 17 years and followed it up with another hike in July. Even with the global interest rate cycle pivoting toward rate cuts led by the US Federal Reserve, the Bank of Japan is expected to raise rates further in the coming quarters. Japan's benchmark Nikkei 225 index closed at 38,283.85 on Nov. 22, still up nearly 14.4% since the start of this year. The benchmark had touched a high of 42,224.02 on July 11 on hopes of economic revival as interest rates return to more normal levels.

Advantage over neighbors

As earnings of Japanese companies improve and US equities markets gain on hopes of a soft landing of the world's largest economy, interest from global investors in Japanese equities is expected to grow. In its neighborhood, China's economy still faces a drag from real estate.

"Money could flow out of China in favor of Japan," said Chizuru Morishita, an analyst at NLI Research Institute.

Japan is trying to attract IPOs of companies in the region, especially startups, with the promise of greater stability of its stock markets and higher liquidity. The TSE launched its Asia Startup Hub program in March and has selected 14 prospective IPO candidates from Taiwan, Malaysia, Singapore, Vietnam, Indonesia and South Korea. But no time frame has been set for their potential listings.

"We want to introduce attractive Asian startups to investors," said a TSE spokesperson. "The benefit of listing here is our market's liquidity and the opportunity to raise their profile."

The trading value at the TSE's Growth market, a primary section for startups, totaled $271 billion in 2023, according to a Mitsubishi UFJ Trust and Banking research report. By market capitalization, Tokyo's Growth market was valued at $48 billion at the end of 2023, compared with $7 billion for Hong Kong and $6 billion for Singapore, according to the report published in October.

Foreign issuers

Foreign companies expressing interest in listing on the TSE increased by more than 50% over two years to 89 as of the end of September, according to the report. As many as 17 foreign firms are planning to list in Tokyo during three fiscal years through March 2027, it added.

Sumitomo Mitsui DS Asset Management forecast in an April report that over 300 Japanese companies listed on the TSE will achieve an average 7.5% year-over-year net income gain in the fiscal year ending March 2025, alongside a 2.4% revenue increase.

"Earnings estimates for local businesses, along with the US economy, are key to determining if the domestic stock market will maintain strong momentum," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management, in an Oct. 7 report.

As of Nov. 27, US$1 was equivalent to ¥151.26.