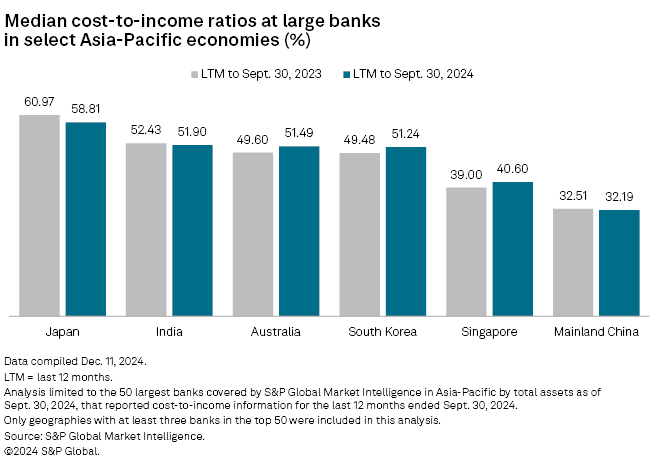

Major Japanese banks logged gains in efficiency measured by their cost-to-income ratios over the 12 months ended Sept. 30, helped by improved profits.

Mitsubishi UFJ Financial Group Inc., Japan's largest bank by assets, reduced its cost-to-income ratio by 5.50 percentage points to 49.89% over the 12-month period, according to S&P Global Market Intelligence data.

The cost-to-income ratio measures the proportion of a bank's operating expenses to its operating income. A lower ratio indicates better efficiency, while a higher ratio reflects increased costs relative to income.

Japan's central bank ended its eight-year cycle of negative benchmark interest rates this year, with two hikes taking the Bank of Japan's benchmark rate to 0.25% by July. The BOJ expects to hike rates further to align them with other developed economies such as the US, though the pace of increases has been clouded by falling rates in the US and Europe. With the US Federal Reserve indicating two rate cuts in 2025 from the previous expectation of three, the Bank of Japan may announce its next hike in early 2025.

Higher interest rates supported bank profitability by widening net interest income margins as lenders are usually able to pass higher interest rates to borrowers faster than they can to depositors. MUFG posted a net profit of ¥1.258 trillion for the six months ended Sept. 30, marking a 35.7% year-over-year increase from ¥927.28 billion. The megabank has set a midterm cost-to-income ratio target of about 60% by March 2027.

Sumitomo Mitsui Financial Group Inc. recorded the largest efficiency gain among the top 50 banks in the Asia-Pacific region, cutting its cost-to-income ratio by 6.76 percentage points to 53.38%, down from 60.14% last year. Net income for the fiscal first half surged 37.7% to ¥725.2 billion.

Mizuho Financial Group Inc.'s efficiency improved slightly, as its cost-to-income ratio edged down to 60.09% from 60.97%.

Rising costs

Australian banks experienced reduced efficiency due to rising operational costs. Westpac Banking Corp.'s cost-to-income ratio increased by 1.24 percentage points to 50.61%, up from 49.36% a year earlier. The lender's annual profit dropped 3% to A$6.99 billion for the year ended Sept. 30, down from A$7.20 billion a year earlier.

Australian banks faced intense competition from traditional rivals and nonbank lenders, compressing net interest margins. Operating expenses increased due to inflation, particularly in personnel costs, though reduced investment spending offset some of the impact.

The Reserve Bank of Australia's decision to hold the benchmark cash rate at 4.35% since December 2023 dampened demand and heightened cost pressures.

ANZ Group Holdings Ltd. experienced a similar trend, with its cost-to-income ratio up 2.53 percentage points to 52.38% from 49.84%, driven by mortgage market competition. It reported a full-year 2024 cash profit of A$6.73 billion in the year ended Sep. 30, down 9% year over year from A$7.41 billion.

"The banking sector globally is facing significant pressure as results become squeezed from both ends — intensified competition across a more concentrated set of profit pools, while costs have seen no structural shift as investment needs from technology and regulation endure," Sam Garland, banking and capital markets leader at PwC Australia, said in a Nov. 8 note.

Most efficient

Mainland Chinese banks maintained their lead as Asia-Pacific's most efficient lenders. Bank of Jiangsu Co. Ltd. topped the list of 50 banks with a cost-to-income ratio of 23.73%, down 3.58 percentage points.

Bank of Shanghai Co. Ltd. ranked second despite a 2.32 percentage points increase in its cost-to-income ratio to 26.41%. The median cost-to-income ratio for mainland Chinese banks improved by 0.32 percentage points, with 22 out of the 23 mainland Chinese banks on the list scoring below 40%.

Indian banks were a mixed bag. HDFC Bank Ltd., the country's largest lender by market cap, reported an unchanged cost-to-income ratio of 42.19%. State Bank of India, the largest bank by assets, reduced its cost-to-income ratio by 2.09 percentage points to 51.90%, reflecting lower operating expenses and higher income from interest and non-interest earnings.

South Korean banks saw their median cost-to-income ratio increase by 1.76 percentage points, with four banks reporting reduced efficiency. Shinhan Financial Group Co. Ltd. was the exception, cutting its cost-to-income ratio by 2.47 percentage points to 42.02%.