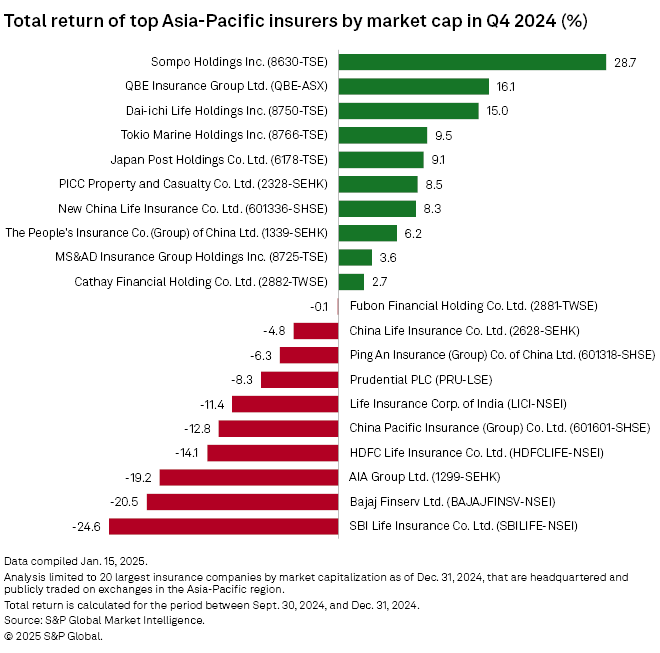

Japanese insurers provided the top returns for shareholders among the largest underwriters in the Asia-Pacific region during the final quarter of 2024, according to S&P Global Market Intelligence calculations.

Sompo Holdings Inc. recorded the best total return for the period at 28.7%. Dai-ichi Life Holdings Inc., Tokio Marine Holdings Inc. and Japan Post Holdings Co. Ltd. posted respective returns of 15.0%, 9.5% and 9.1%. Australia's QBE Insurance Group Ltd. generated the second-highest return at 16.1%.

Indian insurers struggled in the last three months of 2024, with SBI Life Insurance Co. Ltd. and Bajaj Finserv Ltd. logging negative returns of 24.6% and 20.5%, respectively. Hong Kong-listed AIA Group Ltd. posted a negative 19.2% return.

Mainland China turned in a mixed performance, with PICC Property and Casualty Co. Ltd., New China Life Insurance Co. Ltd. and The People's Insurance Co. (Group) of China Ltd. giving total positive returns of 8.5%, 8.3% and 6.2%, respectively. China Pacific Insurance (Group) Co. Ltd., Ping An Insurance (Group) Co. of China Ltd. and China Life Insurance Co. Ltd. recorded negative returns of 12.8%, 6.3% and 4.8%, respectively

Market cap movement

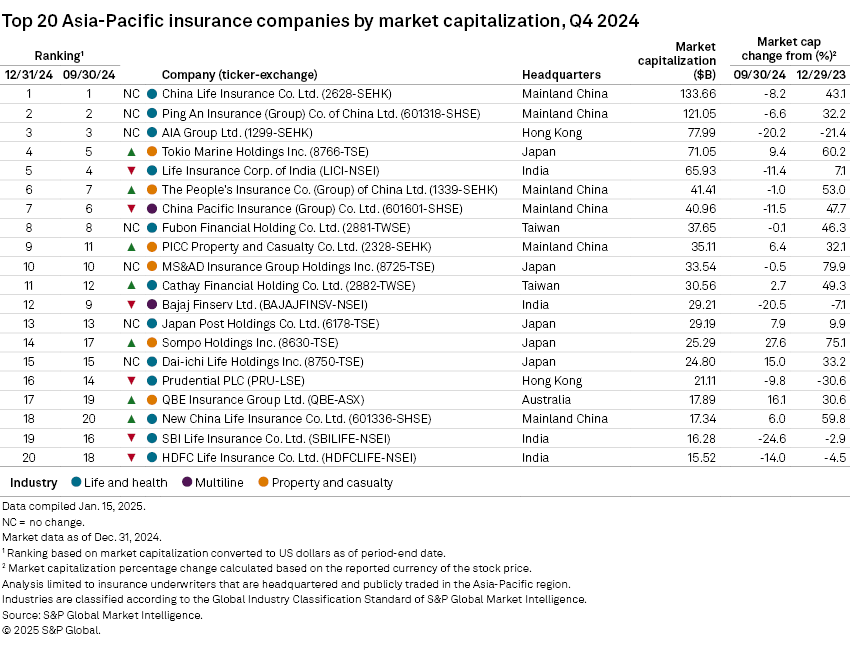

Overall, the market capitalizations of 12 of the top 20 insurers in the Asia-Pacific region decreased sequentially in the fourth quarter of 2024.

Four of the six largest mainland Chinese insurers posted market cap declines. China Life remains the largest Asia-Pacific insurer even as its market cap dropped 8.2% to $133.66 billion. Ping An Insurance's market cap slid 6.6% to $121.05 billion. People's Insurance and China Pacific Insurance saw their market caps decline 1.0% and 11.5%, respectively.

AIA remains the third-largest Asian insurer by market cap even as its decreased 20.2% to $77.99 billion.

Tokio Marine and Life Insurance Corp. of India traded places in the fourth and fifth positions after the Japanese insurer's market cap climbed 9.4% to $71.05 billion. The Indian insurer's market cap declined 11.4% to $65.93 billion.

China Pacific Insurance ceded the sixth spot to People's Insurance following its double-digit percentage drop.

PICC Property and Casualty entered the top 10 after its market cap increased 6.4% to $35.11 billion. Bajaj Finserv fell to 12th from ninth after its market cap slumped 20.5% to $29.21 billion.

– Use the screener to access market capitalization data on the S&P Capital IQ Pro platform.

– Access deep dives into insurance transactions across the globe via our Deal Profile feature.

– Click here for a look into the IFRS 17 metrics of Mainland Chinese insurers.