Japan's three megabanks will likely accelerate earnings growth after strong fiscal first-half results, supported by rising net interest margins driven by higher interest rates.

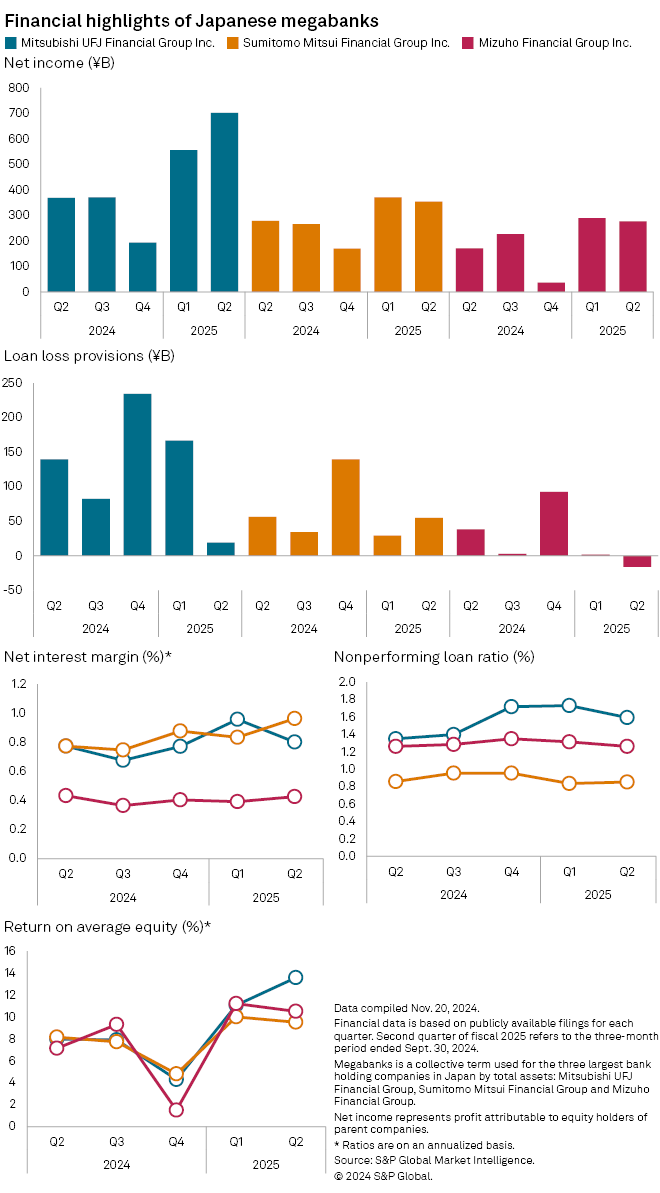

Mitsubishi UFJ Financial Group Inc. (MUFG) posted a net interest margin (NIM) of 0.80% in the July-September quarter, up from 0.77% a year earlier, according to data compiled by S&P Global Market Intelligence. But the lender's NIM declined sequentially from the previous quarter.

NIM at Sumitomo Mitsui Financial Group Inc. (SMFG) increased to 0.96% from 0.77%, while Mizuho Financial Group Inc.'s NIM remained flat at 0.43%.

Net income surged across the banks during the quarter. MUFG's profit rose to ¥702.30 billion from ¥368.89 billion, SMFG's to ¥353.82 billion from ¥278.45 billion and Mizuho's to ¥276.84 billion from ¥170.56 billion.

"There is robust demand for loans," SMFG CEO Toru Nakashima said at a Nov. 14 earnings press conference. "Interest rates are trending upward, positively affecting banks."

Economists expect the Bank of Japan to consider a third policy rate hike in December or January. The central bank ended its negative rate policy with a March hike, its first in over 16 years, followed by another increase in July. Banks typically benefit from rising rates by passing on higher lending costs to borrowers faster than they raise deposit rates, boosting net interest margins.

The two previous rate hikes are projected to add ¥85 billion in net interest income at Mizuho and about ¥70 billion each at MUFG and SMFG for the fiscal year ending March 2025, according to their Nov. 14 earnings statements. A potential third hike of 25 basis points to 0.5% is expected to generate an additional ¥25 billion in net interest income for MUFG this fiscal year. SMFG and Mizuho anticipate a similar rate increase to add ¥100 billion or more annually.

But falling interest rates in the US could challenge Japanese banks with significant overseas exposure. The Federal Reserve cut rates by 25 basis points on Nov. 7, following a 50-basis-point reduction in September.

SMFG's outstanding overseas loans fell to ¥35.700 trillion in September from ¥36.600 trillion in March, while MUFG's declined to ¥45.200 trillion from ¥46.800 trillion. In contrast, Mizuho's overseas lending increased to $236.20 billion from $231.20 billion over the same period.

As of Nov. 27, US$1 was equivalent to ¥151.26.