S&P Global Market Intelligence presents In Play Today, a periodic summary of potential private equity deal activity, including rumored transactions. This summary is based on information obtained on a best-efforts basis and may not be inclusive of all potential deal activity.

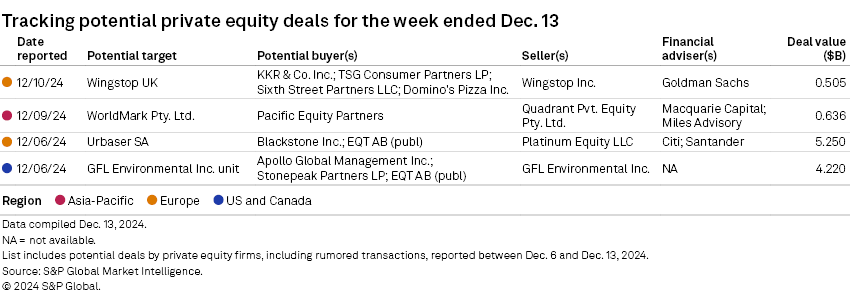

– KKR & Co. Inc., TSG Consumer Partners LP, Sixth Street Partners LLC and Domino's Pizza Inc. are competing to take over the UK operations of restaurant chain Wingstop Inc. for about £400 million, the Financial Times reported, citing people familiar with the process. Wingstop tapped bankers from Goldman Sachs to run the sale for Wingstop UK earlier this year, the report added.

– Pacific Equity Partners is considering a purchase of Australian automotive services provider WorldMark Pty. Ltd., which does business as MotorOne, from Quadrant Pvt. Equity Pty. Ltd., The Australian reported, citing DataRoom. Macquarie Capital and Miles Advisory are facilitating a roughly A$1 billion sale for MotorOne.

– Blackstone Inc. and EQT AB (publ) have progressed to the second round of bidding to acquire Spanish waste management company Urbaser SA from Platinum Equity LLC, Reuters reported, citing sources with knowledge of the situation. Citi and Santander are advising on the sale, which could value Urbaser at about €5 billion, the report added, citing the people.

– Apollo Global Management Inc., Stonepeak Partners LP and EQT are vying to buy the environmental services business of Canadian company GFL Environmental Inc., Bloomberg News reported, citing people with knowledge of the matter. GFL Environmental expects to net at least C$6 billion after tax from the sale, the report added.

To view potential M&A in other regions, click here.