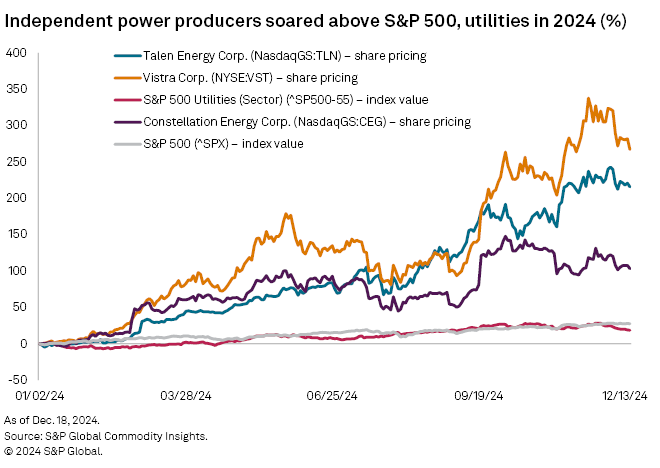

In 2024, merchant generators Constellation Energy Corp. and Talen Energy Corp. signed high-priced contracts to provide electricity to Microsoft Corp. and Amazon.com Inc. for their datacenters. Struggling independent power producers' stock prices ballooned, while utilities also contemplated financial upside from AI's insatiable power needs.

With utilities set to spend billions on generation, transmission and distribution infrastructure to facilitate 128 GW of electricity demand from datacenters over the next five years, they are turning attention to protecting residential ratepayers from shouldering those costs and themselves from the potential for stranded assets.

"Twelve months ago at [the Edison Electric Institute Financial Conference], it seemed like almost every company was saying datacenters should be deflationary for the rest of their customer base because they're paying more than their fair share," Scotia Capital (USA) analyst Andrew Weisel said in an interview. "Today it's a very different tone. It's much more about, how can we structure tariffs to protect our retail customer base to make sure their bills won't be negatively impacted."

Special tariffs emerge

Utilities are spending $50 million to $150 million on transmission and distribution infrastructure for large datacenters, CreditSights analyst Andrew DeVries said in an interview.

"The risk is you spend that $100 million, and then that datacenter runs for two or three years, and suddenly the usage drops off to nothing," he said, adding that the utility will still have to recover the cost of that investment in its rate base.

In Iowa, Berkshire Hathaway Energy affiliate MidAmerican Energy Co. developed an individual rate for datacenters and other hyperscalers based on the actual cost to serve that particular customer. Black Hills Power Inc. also designed a special tariff for traditional datacenters.

In October 2024, American Electric Power Co. Inc. subsidiary Ohio Power Co., doing business as AEP Ohio, and parties including Google LLC, Microsoft, Amazon and a Meta Platforms Inc. affiliate filed a settlement agreement with state regulators to implement a new tariff structure for datacenters with a "load ramp period" and minimum demand charge.

The hyperscalers petitioned for the creation of a new tariff on customers with monthly demand of at least 50 MW at a single location if AEP Ohio provided proof of a transmission capacity constraint in the service area.

"No one really knew how we were going to deal with this" until the AEP settlement, DeVries said. "You get some money up front for building the datacenters, and then you get commitments to run that datacenter for 10 years or so — a minimum volume commitment — and then an early exit fee."

Mizuho analyst Anthony Crowdell agreed in an interview that "when you see the size and investment required to meet what we expect to be once-in-a-lifetime load growth, I think the utilities are correct in making sure they have protections for the ratepayer."

Utility shareholders, meanwhile, are also concerned about potential overbuilding.

They "want to make sure that the contracts utilities are striking with datacenter customers" prevent investments from becoming stranded assets, Wells Fargo Securities Managing Director of Utility Equity Research Neil Kalton said in an interview.

Waiting for FERC clarity

For independent power producers, 2025 will bring continued scrutiny from the Federal Energy Regulatory Commission after the agency rejected PPL Corp.'s amended interconnection agreement with Talen's 2,494-MW Susquehanna Nuclear plant to provide behind-the-meter power to an Amazon datacenter campus.

Talen has asked FERC to rehear the agreement, which PJM Interconnection LLC had already approved, and Constellation asked FERC to issue an order leveling the playing field for interconnected generators in PJM's territory seeking to serve datacenters with power taken off the grid.

Following FERC's November 2024 technical conference on colocation, Vistra Corp. urged the commission to fill the "current policy vacuum" that could hinder colocation deals.

Integrated utility companies could ultimately benefit from these hurdles, according to Morningstar analyst Andrew Bischof.

"They might be able to get colocated projects done more quickly and without regulatory pushback from FERC," Bischof said in an interview. "After the Talen decision, after hearing the timeline for Constellation to bring on its new generation, I wouldn't be surprised to see some more incremental projects going to the regulated utilities in some of the states where there's a history of constructive regulation and growth."

Bischof pointed to Entergy Corp., whose subsidiary Entergy Louisiana LLC plans to build two new gas-fired power plants to serve a $10 billion Meta datacenter.

"It turns out that we have some real advantages in this space, not just from dealing with large customers but by the fact that we are a one-stop shop for everything that they need," Entergy Chair and CEO Drew Marsh said in a recent interview.

"Everybody thinks that a rate-regulated environment is going to be inherently slow because of the approval process," Marsh said. "But it turns out, if you can have the integrated conversation, that can help things move along incredibly fast."