Large lenders in mainland China have narrowed the gap between their stock prices and tangible book values since September 2024, as shares were boosted by various government stimulus measures to support economic growth.

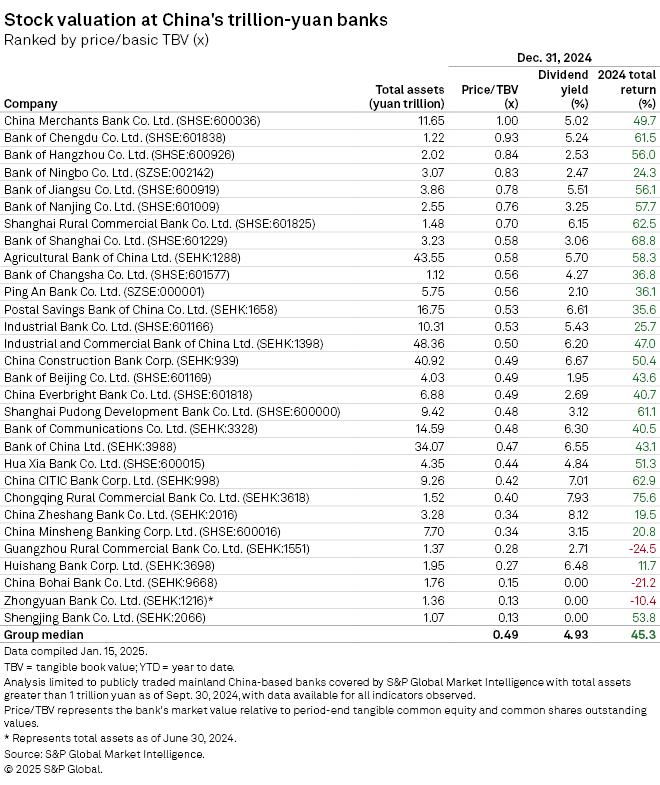

China Merchants Bank Co. Ltd. remained the most expensive among lenders with more than 1 trillion yuan in assets. The Shenzhen-based bank's price-to-tangible book value (P/TBV) climbed to 1.0 as of Dec. 31, 2024, from 0.83 on Aug. 7, 2024, according to data from S&P Global Market Intelligence. Bank of Chengdu Co. Ltd. ranked second with a P/TBV of 0.93 in December 2024, compared to 0.80 in August 2024. Bank of Hangzhou Co. Ltd. maintained its third position and Bank of Ningbo Co. Ltd. maintained its fourth position, although their P/TBVs also increased.

The P/TBV ratio, which measures a company's share price against the value of its tangible common equity and common shares outstanding, is often used to indicate the value of a company's stock against its assets.

"Banking stocks are currently in favor with many mainland investors, especially insurers, who are looking for bond proxies given the high dividend yields," Louisa Fok, executive director and China equity strategist at Bank of Singapore, told Market Intelligence at a Jan. 21 conference. A bond proxy refers to stocks that are likely to offer predictable returns higher than yields from the bond market.

Still, Fok said a significant jump in valuations in China's banking sector regarding P/TBV is unlikely, given market perceptions of asset quality during the prolonged downtrend in the country's housing market and local government debts.

The P/TBV ratios of the four biggest state-owned banks, which are also the biggest lenders in the world by assets, increased between August and December 2024, Market Intelligence data showed. According to Market Intelligence analysis, Agricultural Bank of China Ltd. ranked ninth with a ratio of 0.58 in December 2024 versus 0.44 in August 2024. Industrial and Commercial Bank of China Ltd., China Construction Bank Corp. and Bank of China Ltd. all posted higher P/TBVs during the period, the data showed.

The median P/TBV of the 30 mainland Chinese lenders analyzed in December 2024 was 0.49, compared to 0.44 for 27 lenders with assets exceeding 1 trillion yuan in August 2024.

Government stimulus measures have been strong in the housing sector, which has experienced a multiyear slowdown. The Shanghai Stock Exchange Composite Index gained nearly 13% year over year in 2024. The government recently relaxed house purchase and construction rules, while the central bank lowered interest rates. China's economy grew 5.0% in 2024, matching the government's goal.

Economists widely expect authorities in mainland China to maintain a supportive stance for the economy. In mid-January, the International Monetary Fund raised China's 2025 GDP growth forecast to 4.6% from 4.5%, citing the effects of the stimulus measures.

As of Jan. 27, US$1 was equivalent to 7.25 Chinese yuan.