Bank of England Governor Andrew Bailey attends the central bank's Monetary Policy Report press conference at the BOE in London on Nov. 7, 2024. The BOE and European Central Bank could be two of the major economy central banks to issue more interest rate cuts than the US Federal Reserve this year

|

Economic strength in the US relative to other major economies is likely to drive contrasting paths for interest rates across the globe.

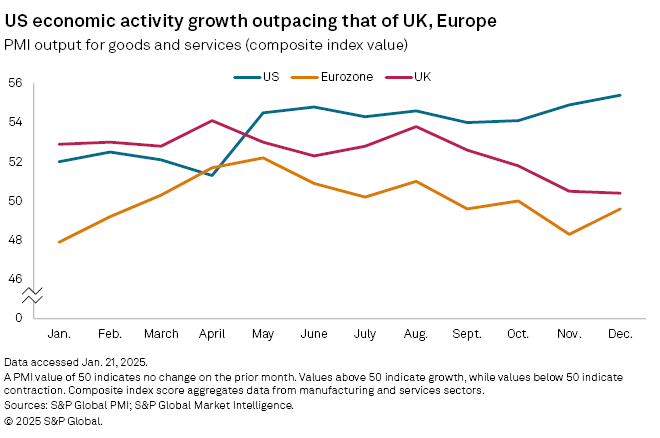

S&P Global's latest Purchasing Managers Index surveys recorded the fastest rate of business activity growth for the US in more than two years, with a headline composite index reading of 55.4 for December 2024. Any value higher than 50 represents expansion. The UK, meanwhile, recorded an index reading of 50.4, a slowdown from prior months, and the Eurozone registered contracting activity at 49.6.

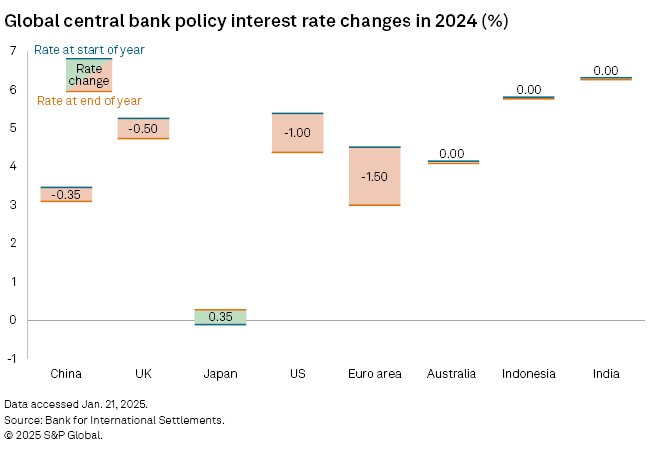

With varying rates of growth and inflation, the European Central Bank and Bank of England are likely to cut benchmark interest rates steadily this year, while the US Federal Reserve looks to take a more cautious approach. This would represent a major shift from the near-tandem moves by major central banks to lower rates to near-zero in response to the effects of the COVID-19 pandemic and subsequently raise them to tamp down rising prices.

"I expect to see some cuts coming from the UK and Europe because their growth trajectories are not as strong," Steve Dean, chief investment officer at Compound Planning, said in an interview. "Other developed countries will continue on this lowering path more than the Fed will at this point ... with a few exceptions."

Moving targets

Futures market bets indicate nearly 65% odds that the Fed will reduce benchmark interest rates between 25 basis points and 50 basis points by the end of 2025 from the current range of 4.25% to 4.50%, compared to 15.6% odds that rate policy will stall at the current level, according to data at market close Jan. 21 from the CME FedWatch Tool.

That expectation aligns with the median view among Fed officials, as of December 2024, that the federal funds rate will end 2025 at 3.9%. Projections released in September 2024 showed a median expectation that rates would finish 2025 at 3.4%.

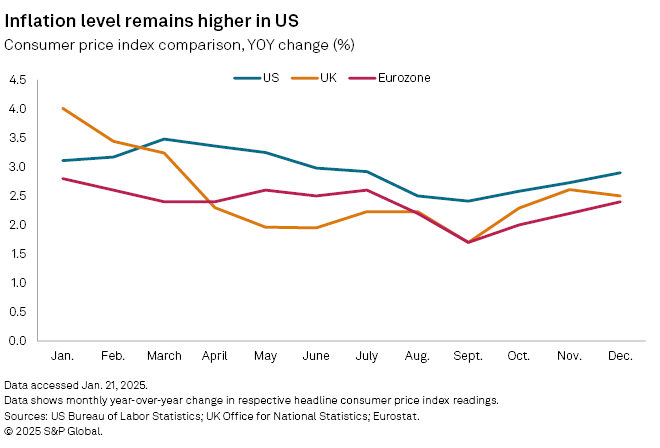

The ECB suggested it would continue to pursue a gradual unwinding of its deposit facility interest rate this year from the current 3% amid an expected slowdown in inflation. Consumer prices rose 2.4% year over year in December in the euro area, slower than the 2.5% growth in the UK and 2.9% growth in the US.

"We got accustomed to those relationships being very synchronized, and now you're starting to see imbalances in the global economies due to the pandemic get filtered out," John Sidawi, vice president and senior fixed income portfolio manager at Federated Hermes, said in an interview. "It's very easy to present an argument in Europe to cut rates further, but it's more delicate right now in the US."

Bank of England Monetary Policy Committee member Alan Taylor said in a Jan. 15 speech that the central bank could consider an aggressive rate decline of up to 150 basis points throughout 2025 from the current 4.75% if inflation cools significantly, though he personally favors 100 basis points of rate cuts given current conditions.

Unique scenarios

Other central banks in developed economies, such as the Bank of Japan (BOJ), are working in the opposite direction. The Bank of Japan pushed its benchmark rate up to 0.25% in 2024 after more than a decade of near-zero and negative rates. Rates in Japan have been below 1% for nearly 30 years as the country's economy has experienced multiple periods of deflation, rather than inflation.

"There's some structural improvements taking place affecting the Japanese economy," TIAA Wealth Management Chief Investment Officer Niladri Mukherjee said in an interview. "They are trying to induce higher inflation, leading to better consumer confidence and income spending".

After three years of price increases, the BOJ is now hoping that further increases in underlying inflation will achieve domestic price stability. The uptick would allow the bank to implement policy that would promote wage growth and investment, according to the summary of opinions of the BOJ's December policy meeting.

The Reserve Bank of Australia (RBA) has also sought tighter monetary policy since 2022, but to a more significant degree. The bank raised its cash rate target from 0.10% in 2022 to 4.35% in 2023 and held it steady through 2024. Following its December monetary policy decision, RBA Governor Michele Bullock said the central bank would "need to be careful" with monetary policy decisions to preserve gains in the domestic labor market as inflation continued to slowly trend downward.

The RBA has also been monitoring uncertainty over the effect of Australia's recent tax cuts, implemented in July 2024, on household income growth and consumer consumption in the coming years.

Emerging economies

While developed economies are increasingly pursuing independent and insular monetary policy paths, many emerging economies with external debt denominated in US dollars have had to monitor US monetary policy and stronger currency more closely. This has led some central banks to make moves in anticipation of the Fed's rate decisions.

"A good example of that is Indonesia, where there was a decline in the rupiah late in 2023 and early 2024," Mukherjee said. "That prompted the Bank of Indonesia to hike rates to stem further currency weakness. So what the Fed is doing is much more pertinent to those emerging markets where they have a lot of dollar debt."

However, interest rate trends have diverged in two of the world's largest emerging economies: China and India.

"India is growing strongly and raising rates, whereas China is worried about keeping their growth numbers up because of imbalances that they're trying to deal with," Compound Planning's Dean said.

From 2020 through 2024, India raised its policy interest rate to 6.5% from 4%, while China has lowered its respective rate to 3.10% from 4.15%.