|

Rusal's aluminum plant in Sayanogorsk in Eastern Siberia, Russia. The country sold a record amount of primary aluminum to China in 2022, but analysts expect Chinese demand for Russian metal to cool this year. |

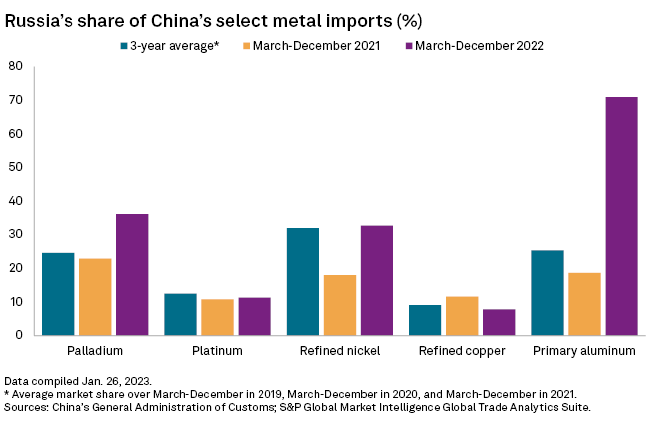

China stepped up as a willing trade partner to Russia when some major world economies turned away from the latter's products after the invasion of Ukraine, but Russia's ability to continue to move metals out of its borders will heavily depend on economic conditions in China through 2023.

|

China's overall metals imports, including those from Russia, fell as COVID-19 lockdowns and a downturn in the property sector hampered demand from the world's biggest metals consumer. Analysts expect China's demand for Russian metals to continue to cool as the Asian giant's slow economic recovery and domestic surpluses are expected to limit imports in 2023.

The value of China's imports of Russian primary aluminum, refined nickel, refined copper, palladium and platinum fell 4.4% year over year from March to December 2022, compared with an 11.6% dip in total imports of the five metals fell during the same period, data from China's General Administration of Customs showed.

The war's impact on metal trades has eased but remains a risk in 2023, said Liu Xiaolei, chief aluminum analyst at Shanghai Metals Market, or SMM. More sanctions could be imposed, and Russian metals buyers might need to regularly change their procurement process.

Gloomy outlook for aluminum, nickel

Russia's primary aluminum exports to China surged 58.8% year on year in 2022 and accounted for 70% of China's primary aluminum imports that year, a sharp rise from a share of just 18% in 2021, customs data showed. Meanwhile, China's primary aluminum purchases from other countries shrank sharply. Overseas aluminum smelters cut production due to surging energy prices triggered by the war, pushing import prices much higher than domestic prices, Liu said.

Liu expects Russia to remain significant in China's primary aluminum imports portfolio, but overall demand growth from China is limited due to a projected small surplus in domestic supplies in 2023. While China's exit from zero-COVID-19 policies and a booming renewable energy sector might lift domestic consumption, export orders are likely to shrink, given the high inflation rate outside China..

China's import of Russian nickel is likely to decrease in 2023, because domestic companies have begun producing Class 1 nickel that could replace Russian supplies, said Zhang Lingying, SMM's nickel analyst.

Russia primarily produces refined nickel, which Chinese companies use to produce stainless steel and high-temperature alloys, but China's demand for the product has been declining due to high prices following the historic short squeeze on the London Metal Exchange. It has become uneconomical to produce nickel sulfates — the key material for batteries — from refined nickel, and Chinese companies have shifted to abundant and cheaper nickel intermediates, including mixed hydroxide precipitate and nickel matte, from Indonesia.

In contrast, China's alumina exports to Russia have been skyrocketing, hitting the highest since at least 2003. Shortly after the war began, UC Rusal IPJS shut down its Nikolaev alumina refinery in Ukraine, given "unavoidable logistical transport challenges," while Australia announced a ban on aluminum ore exports to Russia. Moscow has since turned to China for alumina, the raw material for aluminum, after losing more than 60% of imports from Australia and Ukraine.

China will likely continue selling alumina to Russia in 2023 due to low prices and high domestic capacity, Liu said.

Uncertainties, demand weakness ahead

The flow of Russian palladium into China from March to December 2022 increased year over year by 81.3%, customs data showed, as demand for palladium for use in catalytic converters, which can lower emissions in conventional vehicles, drove the trend.

During the same period, China's platinum purchases from Russia fell 17.6%, which Ji Changzheng, senior precious metals analyst at consultancy Antaike, attributed to a surplus in previous years and recent rising prices.

Ji expects China's imports of platinum group metals to remain stable in 2023. But uncertainties surround palladium demand, which will ultimately be determined by prices and the penetration rate of electric vehicles that don't carry catalytic converters.

Eleni Joannides, copper research director at consultancy group Wood Mackenzie, saw no shift in Russian copper exports to China after the war broke out. "While volumes may be down year on year [in 2022], the share of total refined copper imports from Russia has reverted to a more usual range of between 7% and 9%," Joannides said, noting that 2022 has been "a weaker year for demand given the weakness in the construction sector." Still, it is possible that China will import more refined copper from Russia in 2023 after the zero-COVID policy was lifted, Joannides said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.