Donald Trump's trade policy is beset on all sides.

Not only are negotiations with China at risk of foundering, but the already agreed-upon United States-Mexico-Canada Agreement, or USMCA, is bound to face tests from both parties in Congress and looks unlikely to be ratified this year.

Despite the Trump administration's push to get a deal to replace the North American Free Trade Agreement, or NAFTA, across the finish line in 2019, Democrats have been hesitant to pass, or even consider, a deal that does not include provisions with strong enforcement and labor standards, particularly in Mexico.

On the other side of the aisle, Sen. Chuck Grassley, the Iowa Republican who chairs the Senate Finance Committee, said in an April 28 Wall Street Journal op-ed that without a lifting of U.S. tariffs on steel and aluminum imports from Canada and Mexico, the deal is "dead."

"The chances of passage this year are close to zero," said Inu Manak, a visiting scholar at the Cato Institute in Washington, who said that Mexico would object to the added negotiations that a new enforcement mechanism would require.

The USMCA, although agreed to in November 2018, has yet to be formally sent as draft legislation to the U.S. Congress as remaining issues are raised by lawmakers. The deal would also need to be ratified in Canada and Mexico before taking effect.

The risk for Trump is that he heads into the 2020 presidential election without a win on trade, having touted his skills as a negotiator. The pain felt by the electorate, particularly U.S. farmers, from retaliatory tariffs also has the potential to dent Trump's popularity among his base.

Democratic expediency

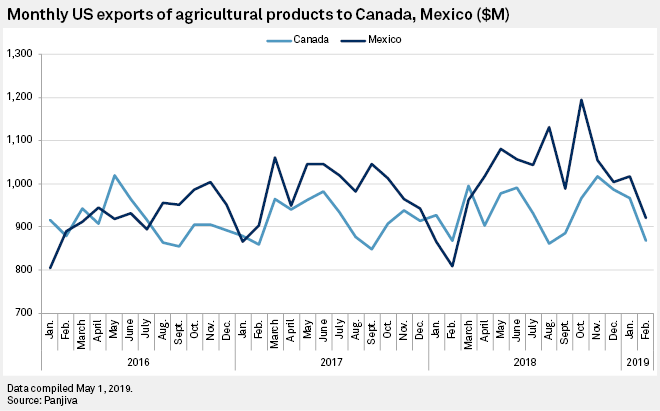

U.S. sugar exports to Mexico and Canada fell 80.4% year over year in the three months ended Feb. 28, while pork shipments fell 28.6% over that span, according to Panjiva, a division of S&P Global Inc.

Democrats may be trying to capitalize on that by ensuring that the USMCA does not get passed before the election in 2020. Even the April 29 passage of measures strengthening labor unions by the Mexican Senate, a move U.S. Democrats said was needed before they would consider the pending trade deal, is unlikely to be enough, according to Peter Allgeier, president of international trade at the consulting firm Nauset Global LLC and a former deputy U.S. trade representative under the George W. Bush administration.

"The Dems seem [that] they can only lose by having to vote on the USMCA over the next 18 months before the election," Allgeier said. "Enforcement is a nebulous enough thing that they will always have questions about it. I'd be amazed if the USMCA gets voted on by Congress between now and the election."

Republican opposition

Even before the agreement gets to the Democrats, it needs to pass muster with Republicans unhappy about tariffs on Canadian and Mexican exports to the U.S. Lawmakers have said the tariffs, outside the scope of USMCA, damage not only the trading relationship with Canada and Mexico — partners that represent $1.3 trillion in annual trade — but also domestic industries that rely on the imported metals for finished products.

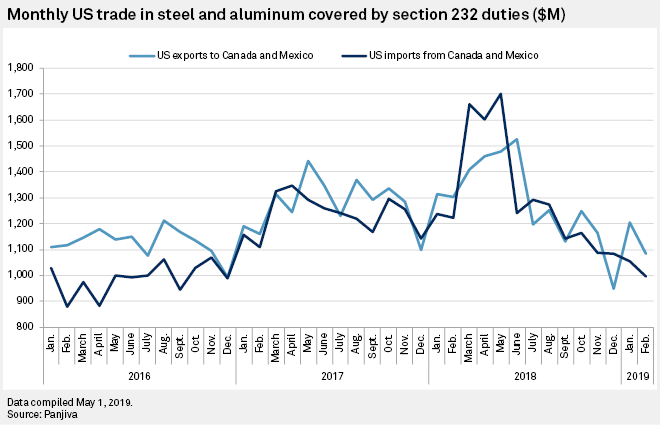

The metals tariffs caused imports of the metals from Mexico and Canada to fall by 23.9% year over year in the three months ended Feb. 28 and exports to fall by 20.6% over that span, Panjiva data shows. Trump has also floated imposing quotas on steel and aluminum from the United States' northern and southern neighbors in lieu of the tariffs, as opposed to lifting the tariffs outright, something he will not commit to.

"I think when you've got the Republican chair of the key committee saying that is a must in order for this thing to obtain support, that's pretty real, and that's even before it gets to the Democrats," Allgeier said.

House Speaker Nancy Pelosi, who will have to approve consideration of USMCA legislation in the House, would need a significant portion of her caucus to support a bill, said Douglas Bell, global trade policy leader at EY in Washington. Though it would not be an easy task, Bell said, the administration will have to negotiate with the Democrats amid pressure from the U.S. business community. "That's a political reality," Bell said.

Chris Hudgins contributed to this article.