NET Power's pilot facility using Allam-Fetvedt carbon capture technology for natural gas plants delivered its first electricity to the Texas grid in 2021. |

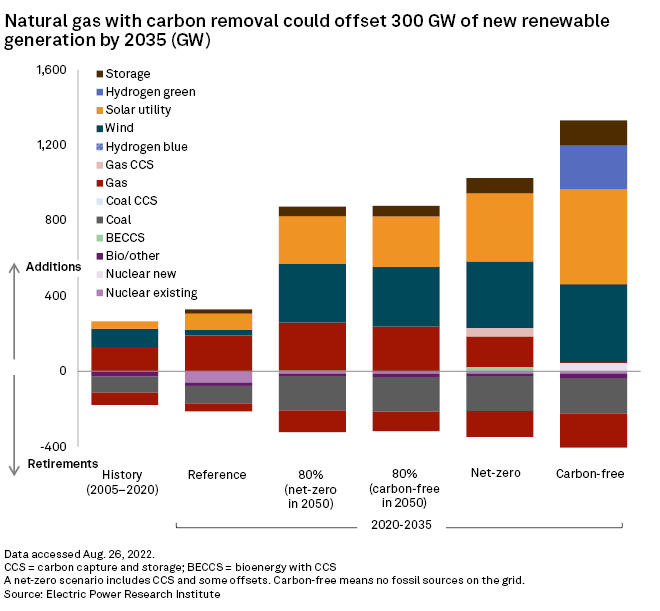

An estimated $1.6 trillion price tag for decarbonizing the U.S. power sector by 2035 could be reduced by $300 billion if some natural gas-fired plants paired with carbon capture technology remain in operation and offsets are available, a recent study by the Electric Power Research Institute found.

The paper from the think tank, known as EPRI, suggests that if about 200 GW of flexible natural gas capacity remains on the grid past 2035, the country would need to deploy about 1,000 GW of new renewable and nuclear generation over the next 13 years — down from 1,300 GW if all natural gas plants were idled. About 44 GW would come from plants equipped with carbon capture, the rest from unabated plants using offsets from direct air capture or carbon capture for blue hydrogen.

The study could bolster utility arguments that some natural gas, including new plants, will be needed as the sector pushes toward net-zero emissions.

But the EPRI scenario comes with a big caveat: Nascent investments in carbon capture on natural gas-fired power plants and geologic sequestration, known as CCS, would need to ramp up at a dizzying speed and advance beyond the early pilot stage where most such projects are today.

"There's no reason, technically, why it can't move quickly," said John Thompson, technology and markets director at Clean Air Task Force, a group supportive of the technology. "People have been doing gas capture for a long time, they just haven't done it at this scale."

The first few projects will be slow, with investments picking up after 2030 as the traditionally conservative utility industry watches for lessons learned, Thompson predicted. Lenders must become more familiar with the technology, permitting agencies will initially need more time to ensure pipeline and storage projects are safe, and developers may want to conduct extra studies.

"There are real-life constraints that slow things down that tend to disappear with time," Thompson said. "I'm optimistic."

The EPRI paper, published Aug. 12 in the journal Nature Communications, is one of the first peer-reviewed studies to assess what role natural gas-fired power generation could play in the decarbonization of the U.S. electricity sector. The analysis concluded that even if natural gas remained a part of the mix in a net-zero emissions economy, it would account for less than 20% of generation, depending on regional differences.

By comparison, solar and wind would make up between 52% and 66% of generation in the EPRI net-zero scenario.

Uncertainties associated with carbon capture and sequestration can make modeling difficult, said John Bistline, a co-author of the EPRI paper.

"Things like siting and permitting of first-of-a-kind projects, policy uncertainty, all those things could be impactful as we think about the role of gas," Bistline said in an interview. "The dynamics of technological change are obviously very, very complex."

Boosted 45Q tax credit a potential game-changer

The study coincided with Congress passing the Inflation Reduction Act, which lifted hopes for new investments in carbon capture technology.

The legislation boosted 45Q federal tax credits for carbon that is captured and stored from $50 per tonne to $85 and roughly doubled the credit for carbon that is captured and used in oil fields or other industrial processes to $60 per tonne. Capture, transportation and storage of carbon from natural gas plants would cost between $79 and $88 per tonne, according to estimates by the Clean Air Task Force, putting projects within reach with the new credits.

Only one commercial power-sector carbon capture and storage facility operates in the world today: the Boundary Dam 3 project in Canada, which launched in 2014.

Large-scale power-sector projects at coal plants have been dogged by financial and technical challenges. The Boundary Dam project at a Saskatchewan coal plant has struggled with unplanned outages and lower-than-expected results, but its CCS facility was available 96% of the time during the second quarter of 2022, according to a July status report.

More than 30 power-sector CCS projects are in early or advanced stages of development at commercial power plants worldwide, according to data from the Global CCS Institute. One-third of the projects would involve existing or new natural gas plants.

The U.S. accounts for at least eight of the proposed natural gas plant projects.

CCS proposals for gas plants multiply

In California, facilities with carbon capture proposals include California Resources Corp.'s 549-MW Elk Hills Power plant in Kern County and Calpine Corp.'s 880-MW Delta Energy Center LLC.

In Texas, projects are planned for the Golden Spread Electric Cooperative Inc.'s 464-MW Mustang Station and Calpine's 1,205-MW Deer Park Energy Center.

Also included are Southern Co.'s 1,000-MW Victor J. Daniel Jr. plant in Mississippi and installations at what would be three new natural gas plants in Colorado, Illinois and Louisiana using NET Power LLC's technology.

The U.S. also has NET Power's 50-MW demonstration facility in La Porte, Texas. In late 2021, it delivered its first electricity to the grid using the novel Allam-Fetvedt supercritical carbon dioxide power cycle. Unlike traditional amine-based systems, this technology would capture virtually all carbon from a plant, Bistline said.

More could be in the works. The U.S. Energy Department in October 2021 announced $45 million in research and development funds to jumpstart CCS at natural gas plants and industrial operations. Calpine's projects were among the eight natural gas-related recipients.

President Joe Biden has set a net-zero carbon emissions goal for the U.S. power sector by 2035. Analysts say that deadline is needed to meet the country's pledge under the Paris Agreement on climate change to decarbonize the whole economy by 2050. The Biden administration as well as the International Energy Agency say carbon removal must be part of the solution, an assumption some observers have criticized.

"Instead of spreading doubt about climate science, the industry now spreads false confidence about how we can continue to burn fossil fuels while efficiently cutting emissions," Massachusetts Institute of Technology professor Charles Harvey and metals exploration executive Kurt House wrote in an Aug. 16 opinion piece in The New York Times. "We need to ... stop burning billions in taxpayer money on white elephant projects."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.