US President-elect Donald Trump, former Mexican President Enrique Pena Nieto and Canadian Prime Minister Justin Trudeau signing the US-Mexico-Canada Agreement during Trump's previous presidency in Buenos Aires on November 30, 2018, on the sidelines of the G20 Leaders' Summit. Source: Martin Bernetti/AFP via Getty Images. |

President-elect Donald Trump's proposed 25% tariffs on all US imports from Canada and Mexico could reshape trade dynamics in North America and increase costs in key industries, potentially squeezing businesses and consumers.

As a result, the specific proposal to tax imports from the US' North American neighbors could discourage trade with its largest import sources and disrupt integrated supply chains for the automotive industry and other critical sectors. Mexico and Canada are two of the top automotive exporters to the US with nearly $160 billion of products shipped this year through October, according to S&P Global Market Intelligence data.

"The automotive industry has taken decades to build out its supply chain infrastructure across North America that has leveraged advantages offered by all three countries and has been supported and encouraged by provisions in [United States-Mexico-Canada Agreement] and [North American Free Trade Agreement] before it," said John Lash, group vice president of product strategy for connected supply chain platform e2open, in an interview. "This can't be undone quickly. Sometimes materials and components cross borders several times in North America before they end up into an assembled vehicle."

Juggling costs

Businesses exposed to targeted imports could face a balancing act between absorbing costs and passing them on to inflation-weary consumers.

"The challenge will be that a lot of these companies have slimmer profit margins, and they're really not going to be able to absorb that," said Rodney Lake, director of the GW Investment Institute at The George Washington University, in an interview. "When you talk about a 25% tariff and you look at the underlying net margins for the types of products that we're talking about, that's not a great match."

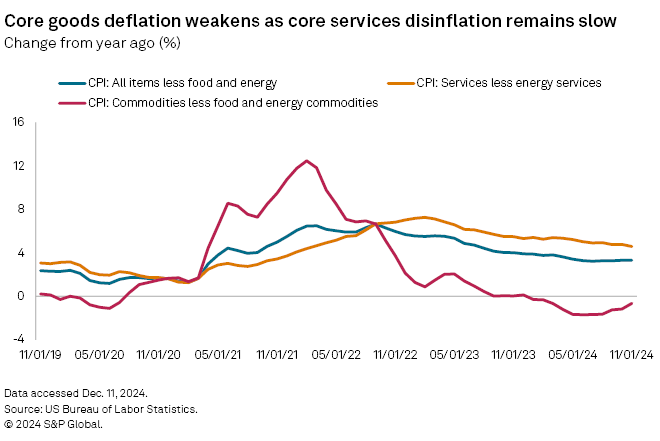

For consumers, higher costs were a critical issue in this year's presidential election, and inflation remains elevated. The latest consumer price index for November rose 2.7% year over year and 0.3% month over month, up from 2.6% and 0.2% in October.

"If prices start going up [from tariffs], it's going to create pressures all the way around, so it's hard to say how all these dynamics are going to go and play out," e2open's Lash said. "Eventually, the retailers are going to have to push back. Consumers are going to push back."

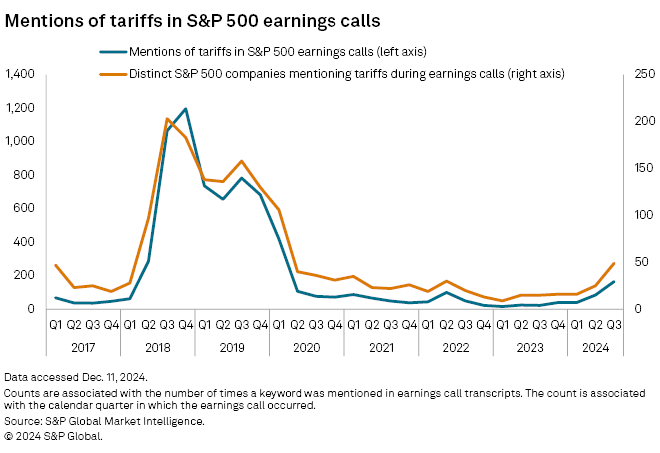

Tariffs during Trump's previous presidency were a major concern for US companies. In the fourth quarter of 2018, there were nearly 1,200 distinct mentions of tariffs among 183 S&P 500 companies during earnings calls, drastically up from the prior-year period, according to Market Intelligence data.

Though tariff discussions subsided during the Biden administration, they resurfaced ahead of the US presidential election in November. In the third quarter of 2024, there were 165 mentions of tariffs among 49 S&P 500 companies during earnings calls, the highest since the first quarter of 2020.

Tariff as threat vs. national protection

A 25% tariff on all imports could potentially violate the United States-Mexico-Canada Agreement (USMCA), but Trump could override the agreement by declaring a national emergency and issuing an executive order invoking the International Emergency Economic Powers Act, said Richard Mojica, head of the customs and import trade practice at Miller & Chevalier, in an interview.

The national emergency proclamation could be tied to immigration, illicit drug movement, domestic industry protection or other issues.

Trump used national security justifications for trade enforcement during his previous term. Still, observers agree that the proposed tariffs are a negotiation tactic to pressure foreign governments on trade and political issues.

"That's certainly one of the objectives of the Trump administration, to use this threat" Mojica said of the proposed tariff on Canada and Mexico. "It signals that he's going to want changes to the USMCA, and it may expedite those changes as a result."

The USMCA expires in 2036, but the three trade partners will review the agreement in 2026. Part of this review will consider extending the pact beyond 2036.

Meanwhile, US economic strength and consumer resilience may embolden the incoming Trump administration to use tariffs as a negotiation tool, despite cost pressures, according to George Washington University's Lake. Tariffs also align with reshoring trends supporting national security narratives, Lake said.

Despite inflationary pressures since 2020, US consumers have continued to prove resilient. Total retail and food services sales rose 0.4% month over month in October, according to US Census Bureau data, beating consensus estimates of a 0.3% increase, according to data compiled by Econoday.

"Given the backdrop that the consumer has been very resilient, they could use this and say that this is the time to possibly take some short-term pain for these long-term gains to make sure that the US reshores some of these supply chains," Lake said.