S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The senior living market is set to expand by $130.9 billion between 2025 and 2029, with North America expected to account for 44% of that growth, according to research and advisory group Technavio.

The estimated compounded annual growth rate of 5.8% during the period is driven by aging baby boomer population and technological advances in long-term healthcare.

US real estate investment trust Welltower Inc., in its third-quarter 2024 earnings report, said its senior housing portfolio drove the growth in its total portfolio same-store net operating income.

"The business continues to deliver exceptional results. Demand for needs-based product is clearly on the rise," Executive Vice President and COO John Burkart said during a call with analysts.

"The strength in our senior housing business was broad based with solid occupancy gains experienced across all our geographies and property types," he added. "While the summer months typically represent the most active period of leasing during the year, our sequential same-store occupancy gain of 120 basis points and spot-to-spot gain of 160 basis points are well above typical seasonal trends."

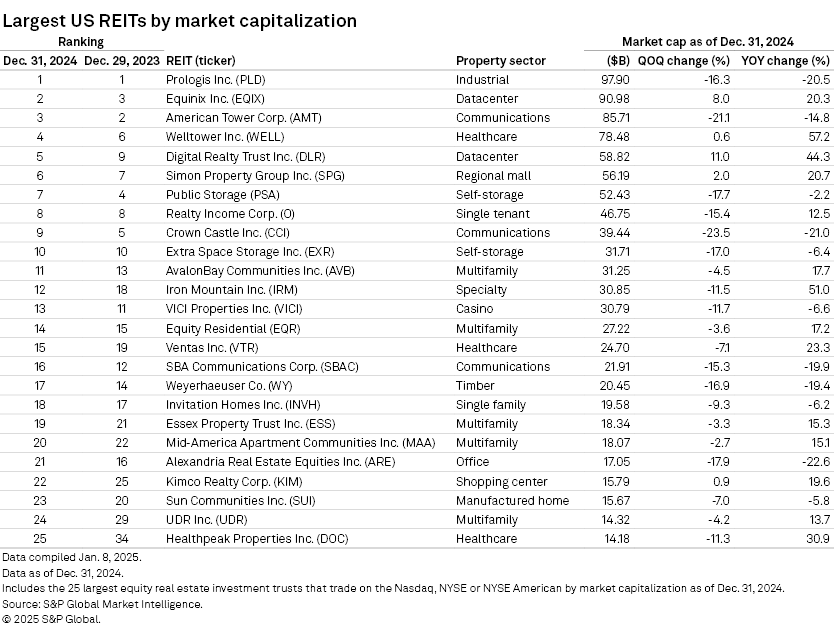

CHART OF THE WEEK: Largest US equity REITs by market capitalization

⮞ Logistics real estate-focused Prologis Inc. emerged as the largest US equity REIT by market capitalization in 2024. Prologis' market cap was $97.90 billion as of Dec. 31, 2024, data from S&P Global Market Intelligence shows. The company's market cap dropped 20.5% year over year.

⮞ Datacenter REIT Equinix Inc. followed with a market cap of $90.98 billion, a 20.3% improvement from a year ago.

⮞ Welltower saw the largest annual increase in market cap among the top REITs at 57.2%, ending the past year as a $78.48 billion enterprise.

TOP DEALS

– Ontario-based Primaris REIT agreed to acquire a 50% interest in Southgate Centre in Edmonton, Alberta, and 100% ownership interest in Oshawa Centre in Oshawa, Ontario, for a total consideration of C$585.0 million in cash and equity, subject to certain conditions.

The REIT is also selling Sherwood Park Mall in Sherwood Park, Alberta, for C$107.0 million. The sale is expected to close Feb. 13, subject to customary conditions. Primaris completed its C$31.5 million sale of Edinburgh Market Place in Guelph, Ontario.

– Private equity giant Blackstone Inc. agreed to pay $175 million to acquire the 292-key Kimpton Hotel Eventi at 851 Avenue of the Americas in Chelsea, New York, from DLJ Real Estate Capital Partners LLC, Commercial Observer reported.

DATACENTER FOCUS

– Blue Owl Capital, Crusoe Energy Systems and Primary Digital Infrastructure secured a $2.3 billion loan from JP Morgan for their build-to-suit datacenter project in Abilene, Texas, according to Newmark Group Inc., which brokered the loan. The 206-megawatt project is leased to Oracle, Bloomberg News reported, citing people familiar with the matter.

– Goldman Sachs provided a $130 million loan for HMC Capital and its subsidiary StratCap's acquisition of two datacenter assets in Texas and Kansas, Commercial Observer reported.

US HOTEL PERFORMANCE

US hotels saw average daily rate (ADR) and revenue per available room (RevPAR) soar to record highs in 2024, STR reported, citing data from CoStar, which provides information and analytics on property markets.

ADR in 2024 was $158.67, up 1.7% from 2023. RevPAR rose 1.8% on an annual basis to $99.94.

Occupancy was flat at 63%.

Among the top 25 markets, New York City logged the highest occupancy level.

Explore key people moves in North American real estate.

REIT earnings estimates expect FFO per share to be largely flat YOY for Q4 2024

REIT M&A activity muted in 2024

US REIT average short interest ticks up in December 2024