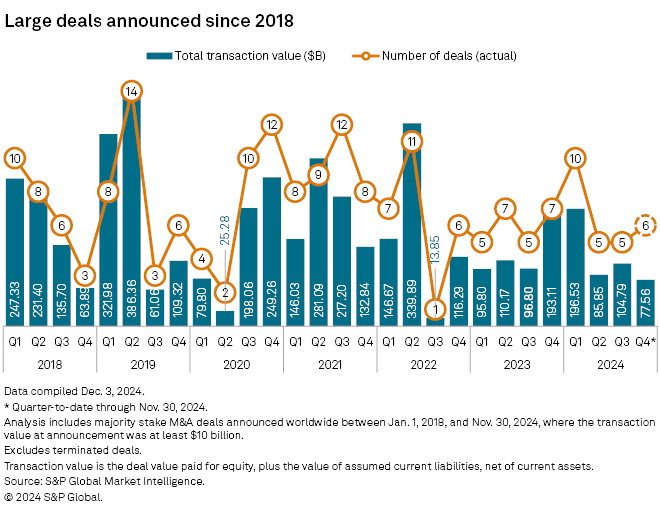

Headed into the final month, the fourth quarter is already the second-most active period in 2024 for $10 billion-plus M&A announcements.

Three M&A deals with transaction values of more than $10 billion were announced during November, matching the total from October. The first quarter set 2024's high-water mark with 10 M&A deals with transaction values higher than $10 billion, and the following two quarters each had five.

While the fourth quarter has recorded more $10 billion deals than the previous two periods, it lags in terms of total transaction value. The six deals announced in October and November have a combined transaction value of $77.56 billion, down from $104.79 billion in the third quarter and $85.85 billion in the second quarter.

Optimism has been growing for M&A with dealmakers expecting an uptick in US M&A in the coming year due to the incoming presidential administration favoring a looser regulatory environment. President-elect Donald Trump has promised a more business-friendly environment after President Joe Biden's administration increased antitrust scrutiny that inhibited some large-scale M&A.

November activity

Two of November's three deals involved targets from the materials sector. Zurich-based packaging manufacturer Amcor PLC announced Nov. 19 that it plans to acquire Indiana-based packaging manufacturer Berry Global Group Inc. in an all-stock transaction valued at $16.90 billion. This deal is among the top 20 largest global M&A transactions in the past 12 months.

The deal is expected to close in mid-2025, according to the deal announcement. However, in a research report, Barclays analyst Michael Leithead said the regulatory review process might be more rigorous than company executives seem to expect. Both companies list one another as key competitors in their respective Form 10-K filings, and they share overlaps in flexible and rigid plastic packaging, according to the research report. Gaining regulatory approval could require an antitrust review or divestiture, the analyst said.

In the other materials deal, Georgia-based privately owned family business Quikrete Holdings Inc. announced Nov. 25 that it plans to acquire Colorado-based construction materials company Summit Materials Inc. for $11.49 billion, including debt. Quikrete Holdings owns several construction materials and textiles companies throughout the US but has not made an acquisition since 2021, according to S&P Global Market Intelligence data.

Since 2018, materials is the sector with the fewest number of $10 billion-plus deals globally with 11, according to S&P Global Market Intelligence data.

– View

– Read the M&A and equity offerings research paper.

– Read more about

The third M&A deal to top $10 billion in the month was announced Nov. 24, when Oklahoma-based natural gas transmission company ONEOK Inc. disclosed it plans to acquire a majority stake in Texas-based energy company EnLink Midstream LLC in a transaction valued at $10.16 billion. The deal is the first over $10 billion in the energy and utilities sector since Marathon Oil Corp. was acquired for $20.76 billion by ConocoPhillips in May.