US consumer spending in November performed better than economists' expectations, boosted by a year-over-year surge in ecommerce and other nonstore sales during the end-of-year holiday shopping season.

Total retail and food services sales rose 0.7% month over month and 3.8% year over year in November, according to US Census Bureau data. The sales growth on the month outperformed consensus estimates of a 0.5% rise, according to data compiled by Econoday. Meanwhile, October sales were revised up from initial government estimates of a 0.4% month-over-month increase, with the latest Census Bureau data now showing a 0.5% gain from September.

"November retail activity was solid as consumers have plenty of spending power from higher incomes, rising portfolio values and stable financial footing," LPL Financial Chief Economist Jeffrey Roach said in an email. "This report will likely add to the [US Federal Reserve]'s debate about the policy path for 2025."

S&P Global Market Intelligence recorded three new retail bankruptcy filings from Nov. 15 to Dec. 17. Default risk for publicly traded retail companies eased during the same period.

Sales

Retail and food services sales hit a combined $724.61 billion in November, according to seasonally adjusted advance estimates by the Census Bureau. In the first 11 months of the year, consumers retail spending reached $7.746 trillion, up 2.9% from the same period in 2023.

Within retail categories, motor vehicle and parts dealers recorded the highest monthly sales increase at 2.6%, followed by nonstore retailers — ecommerce and other retailers without a physical store — with a 1.8% rise. These two sectors also recorded the most significant year-over-year sales increases with nonstore retailers climbing 9.8% and automotive dealers gaining 6.5%.

The drive up in automotive sales was likely due to promotional activity from sellers to liquidate a buildup of excess supply and match consumer value-hunting, a trend that may also have been evident for online retail sales, according to Jeff Wilson, portfolio manager at Jensen Investment Management.

"You probably had some willing customers that wanted to get ahead of potential tariff price increases," Wilson said in an interview. "You also had some pull forward from retailers trying to get ahead of tariffs and getting supply onshore. In general, e-commerce was a mechanism for this, but the consumer at large is looking for value and reasons to buy and ways to save."

– Set email alerts for future Data Dispatch articles.

– For more bankruptcy analysis, check out the monthly bankruptcy series.

Overall, consumer spending dipped in only five of the 13 retail and food service categories tracked by the Census Bureau sales data. The largest monthly sales drop among retail sectors was the 3.5% fall within the miscellaneous store retailers category, which includes specialty shops and auctions.

Bankruptcies

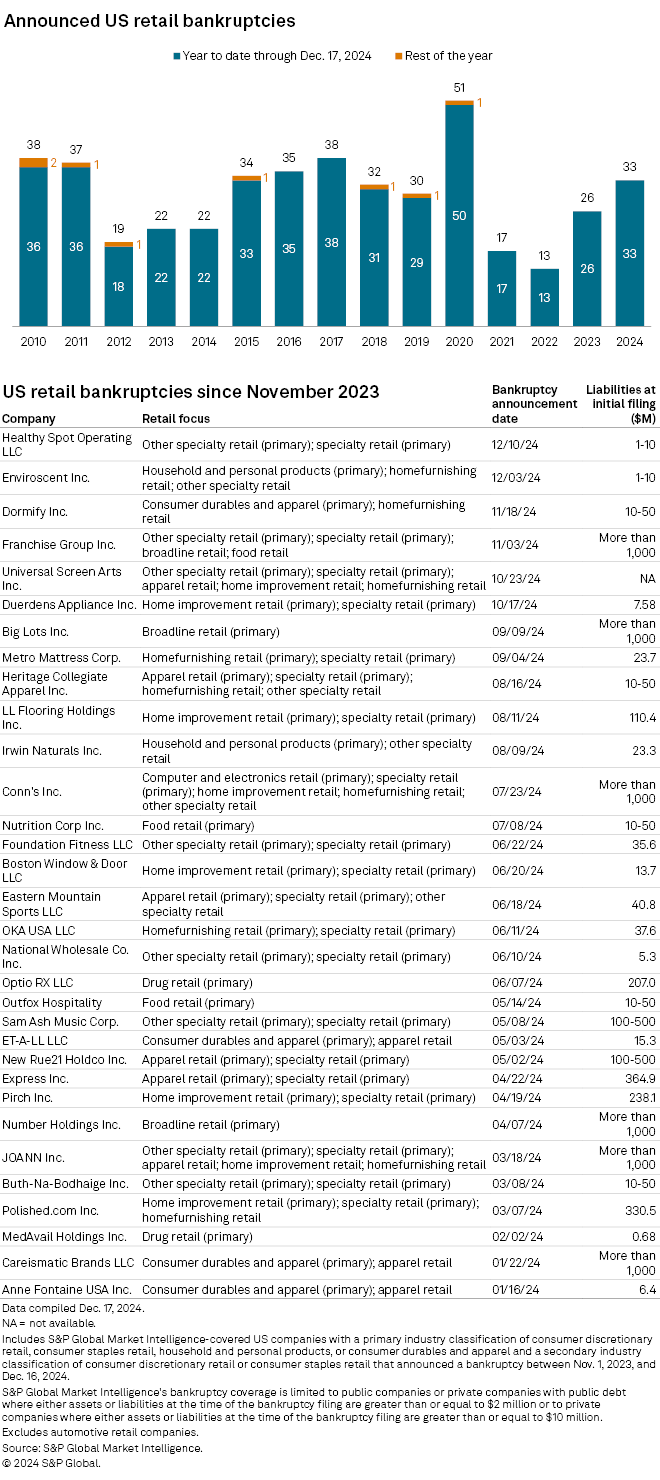

The three retail sector bankruptcies recorded from Nov. 15 to Dec. 17 were all among companies with liabilities of $50 million or less at the time of filing.

Home furnishings manufacturer and retailer Dormify Inc. had the largest volume of liabilities among the three bankruptcies and is seeking to reorganize.

The other two retail bankruptcies in the period from fragrance producer Enviroscent Inc. and pet retail chain Healthy Spot Operating LLC were also filed as reorganizations.

Market Intelligence has recorded 33 bankruptcy filings of public and certain private retail companies in 2024 through Dec. 17. Compared with the same period in previous years, this is the highest total since 2020 and second-highest total since 2017.

Default risk

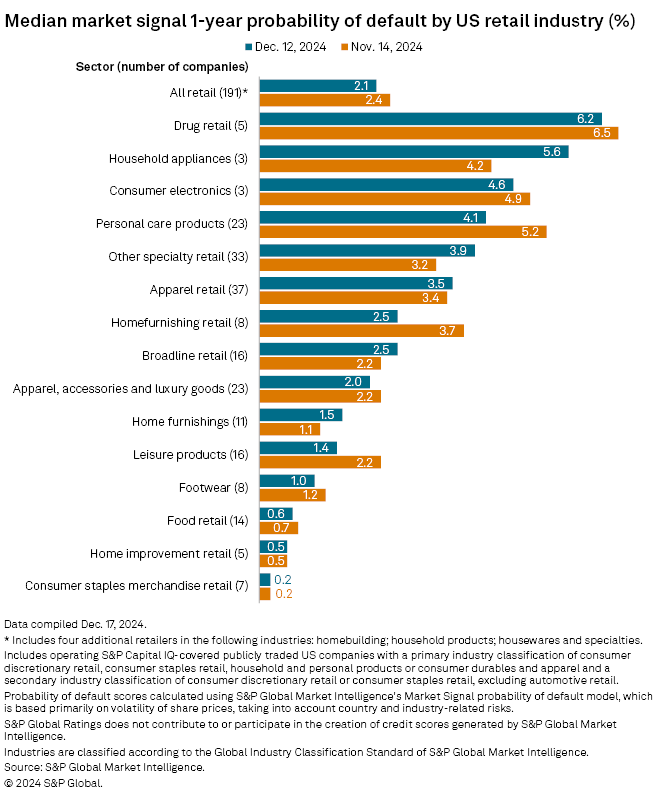

The odds of default for publicly traded retailers lowered in mid-December from a month earlier. Among all retail categories, median default risk was down to 2.1% on Dec. 12 from 2.4% on Nov. 14, according to Market Intelligence's Market Signals Probability of Default model.

The scores represent the median odds of default on debt within a year and are based primarily on the volatility of share prices for public companies on major US exchanges, accounting for country- and industry-related risks and other macroeconomic factors.

Median probability of default scores dropped for eight of the 15 retail industries tracked by Market Intelligence. Home furnishings retail recorded the largest decrease in default risk score during the period with a 1.2-percentage-point drop. The default risk score for the household appliance sector rose the most from 4.2% to 5.6%.