The proposed combination of two of the world's largest advertising agency holding companies is expected to speed up change in an already rapidly shifting competitive landscape.

Ad agency holding company Omnicom Group Inc. on Dec. 9 agreed to acquire rival Interpublic Group of Cos. Inc. (IPG) in an all-stock deal worth $13.25 billion. Interpublic shareholders will receive 0.344 of an Omnicom share for every Interpublic common share held.

The deal comes as traditional players in the ad market are dealing with multiple challenges to their business model: Brands are increasingly relying on in-house agencies for advertising, and there is a greater demand for data analytics. In the first quarter of 2024, agency holding companies controlled 29.6% of total US ad spending, down from 44.6% five years ago, according to ad research firm Advertiser Perceptions. A shift toward artificial intelligence technologies could accelerate market share declines as more companies turn to AI to manage marketing and advertising.

"We have been very worried that modern day agency holding company models will be negatively disintermediated by the development of generative AI and the accelerating growth of programmatic media buying," wrote MoffettNathanson research analyst Michael Nathanson in a research note. "It feels like we are on the precipice of significant secular changes."

New leader board

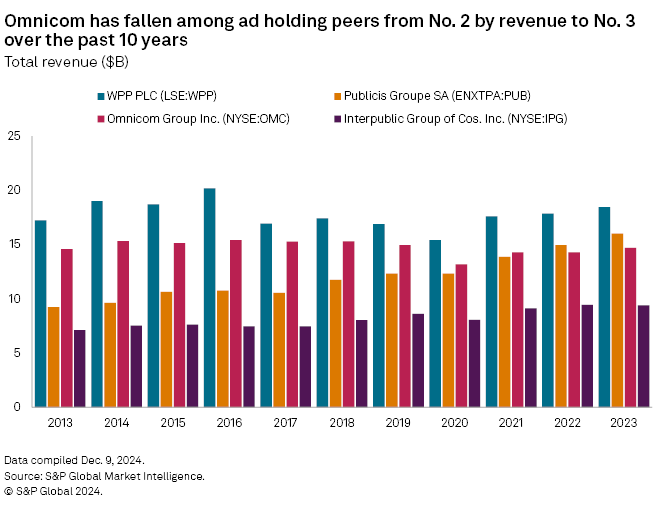

Omnicom has struggled to grow in recent years. Among the big four holding companies — Omnicom, Interpublic, France's Publicis Groupe SA and UK-based WPP PLC — Omnicom has fallen from second to third place in annual revenue over the past decade, surpassed by the more acquisitive Publicis.

Interpublic has faced challenges this year, including some major client losses. In September, Amazon.com Inc. said it was moving its global media account from Interpublic to Omnicom and WPP. And in March, Pfizer Ltd. shifted its global creative duties from Interpublic to Publicis. Other recent losses include Verizon Communications Inc., Spotify Technology SA and BMW.

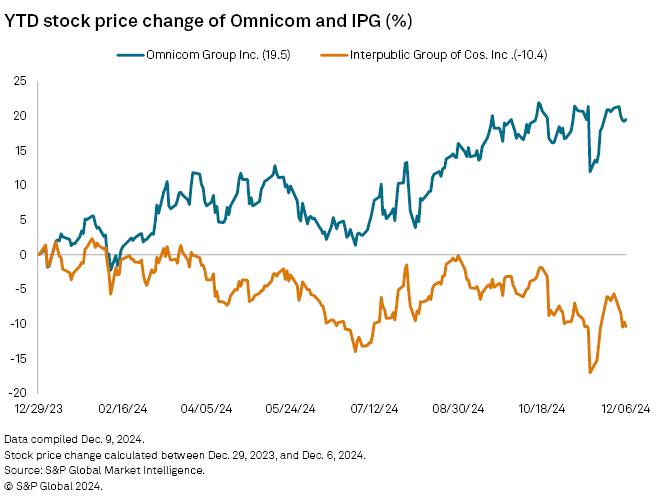

Shares in IPG have fallen throughout 2024. The stock was down more than 10% for the year prior to the deal announcement.

Stronger together

Company executives said that a combined Omnicom and IPG will be better able to compete in the evolving advertising market.

"Omnicom will have the deepest bench of marketing talent with over 100,000 practitioners," said Omnicom CEO John Wren on a Dec. 9 call with analysts. "You will have the most complete offering across media, precision marketing, [customer relationship management], data, digital commerce, advertising, health care, public relations and branding."

Upon completion of the deal, the combined company will keep the Omnicom name, and Wren will retain his roles as CEO and chairman.

Philippe Krakowsky, CEO of Interpublic, emphasized the complementary nature of Omnicom's and Interpublic's digital holdings. Omnicom in January 2024 acquired digital market analytics agency Flywheel Digital LLC for $910.0 million, while Interpublic in 2018 bought Acxiom Holdings Inc.'s marketing solutions business unit in a cash deal worth about $2.3 billion.

The Flywheel acquisition enabled Omnicom to track transactional data in real time, while Acxiom gave Interpublic capabilities in identity, analytics and first-party data management. "Those are skill sets which have never been more relevant than in an era of GenAI and mass personalization," said Krakowsky, who will stay on at the combined company as a co-president and COO.

Challenges ahead

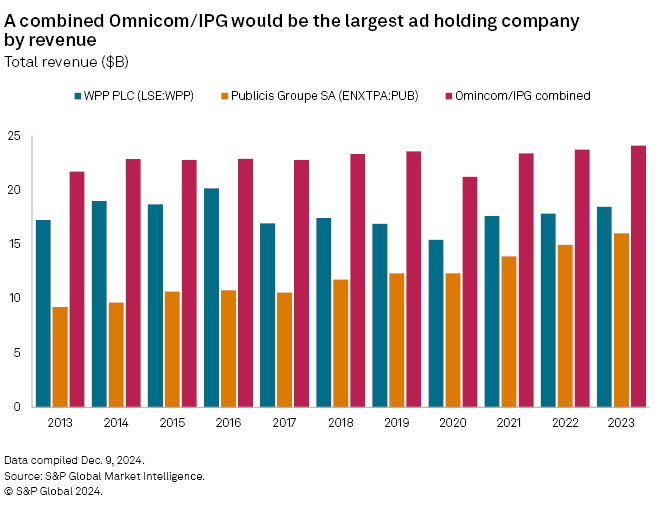

Omnicom and Interpublic are currently the world's third- and fourth-biggest advertising companies. The merged entity will become the biggest player in the sector.

In terms of agencies, Omnicom is the holding company for TBWA, FleishmanHillard and BBDO, and ad-buying firm Omnicom Media Group. Interpublic owns FCB, Weber Shandwick and McCann, together with ad buyer Mediabrands. Combining two such big organizations, both with extensive footprints, poses a challenge, according to Madison and Wall, an advertising-focused advisory and consulting firm.

"The process of simplifying a larger company is incredibly disruptive to the people who work at the agencies going through a process like this one, and to the extent that competitors seize on this disruption, clients may be more likely to choose to work with other agency groups in the near-term," Madison and Wall said in a note.

Nathanson said that while the deal offers long-term benefits, included expected annual cost synergies of $750 million within two years of closing, it also poses near-term risks.

"An integration of this size would be unprecedented and likely challenging," the analyst said. "The winners in this kind of transaction could end up being the newco's biggest rivals who would use the deal to try to steal clients and talent."

Wren said that the companies set to merge have already made a "great deal of progress" in terms of streamlining their back-office functions and "taking action on our overheads."

Path to closing

While analysts do not expect significant regulatory challenges to the deal, transactions of this scope can encounter myriad complexities.

For instance, Omnicom tried to combine with Publicis in 2013 in a deal with a gross value of $21.14 billion. That deal broke down after disagreements emerged on a number of key fronts, including the technicality of who was going to be the acquirer as required by US law. Despite a desire to present a united front and complete a merger of equals, the two sides ultimately backed away amid the disagreements and difficulties related to proposed tax structures.

Before any other considerations, the new Omnicom-Interpublic deal must attain the approval of shareholders and regulators.

President-elect Donald Trump has not nominated a replacement for Federal Trade Commission Chair Lina Khan, though he recently appointed Gail Slater, economic advisor to Vice President-elect JD Vance, as his nominee to lead the Justice Department's antitrust division.

"We are pretty confident that this is not going to create any regulatory issues," Wren said.

Omnicom and Interpublic expect the deal to close in the second half of 2025.