The Trump administration's newly proposed tariffs on products imported from the European Union could curb shipments from vintners who send their products to the U.S., according to an April 10 report from Panjiva, a division of S&P Global Inc.

Wines and brandy are among the more than 300 products targeted by the tariffs proposed April 8 by the Office of the U.S. Trade Representative. The U.S. has requested authority to impose $11.2 billion in retaliatory tariffs after the World Trade Organization found that the EU subsidized Airbus SE, a business rival to Chicago-based Boeing Co.

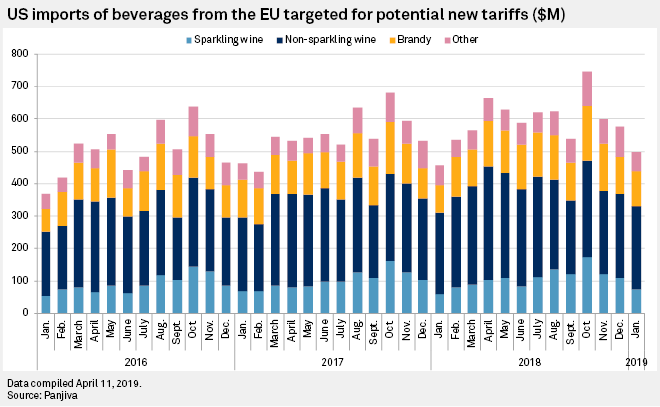

EU wine, brandy and spirits exports that would be subject to the new tariffs totaled $7.14 billion in 2018, up 8.7% from the previous year, Chris Rogers, research director for Panjiva, said in the report. Still wines represented 47.3% of the total, sparkling wines represented 18.1% and brandy represented 21.6%. Monthly shipments have grown in recent years, reaching a peak of $747 million in October 2018, according to Panjiva data.

In its announcement, the USTR did not set a proposed rate for the new tariffs, but Panjiva estimates that the U.S. would need to impose a duty of 14.7% on European products. Rogers said duties may need to be "much higher" than 15.5% to discourage consumers of high-end champagne and brandy.

"The U.S. is looking to apply $11.2 billion of retaliation against the EU. Assuming 100% tariffs on aerospace products — which were worth $9.03 billion in 2018 — that would require a 14.7% duty rate to be added to all non-aerospace products," Rogers wrote in the report.

Any restriction on trade could hit both shippers and wine producers if tariffs reach a level that affects consumer behavior, Rogers wrote.

Shipping firms led exports of wine and brandy from the EU to the U.S., with JF Hillebrand Group AG accounting for 14.3% of shipments in the 12 months ended Jan. 31, up 8% year over year, according to Panjiva. Specialist shipper Giorgio Gori, a Deutsche Post AG subsidiary, followed with 13.7% of shipments.

The companies did not return messages from S&P Global Market Intelligence seeking comment.

Beverage producers are also growing the amount of wine and brandy they ship to the U.S.

Dr. August Oetker KG brand Freixenet grew shipments by 19.4% in the 12 months ending March, while luxury goods company LVMH Moët Hennessy Louis Vuitton SE grew shipments at 3.3%, according to Panjiva. The companies did not return messages seeking comment from Market Intelligence.

The EU is reportedly seeking WTO arbitration on its own rights to retaliate against the U.S. EU member nations on April 11 also granted initial approval to start trade negotiations with the U.S.

But the EU could face difficulty retaliating against the new wine and brandy tariffs as they are tied into the aerospace case, Rogers said in an email.

"The most likely action should the US proceed would be for the EU to withdraw from the planned trade negotiations," Rogers said.

The U.S. sent $469 million worth of wine to the EU in 2018, said Michael Kaiser, vice president for WineAmerica, the national association for American wineries.

"We have not heard any specific rumors about the EU retaliating, but it's obviously a growing concern," Kaiser said in an email.