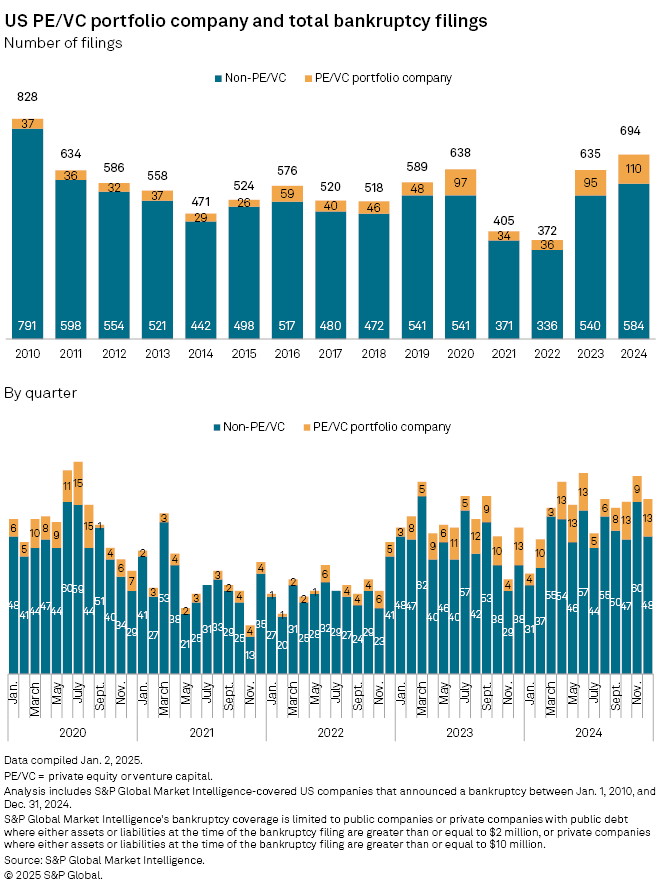

Bankruptcy filings made by US companies backed by private equity and venture capital climbed more than 15% to 110 in 2024, the highest annual total on record, according to S&P Global Market Intelligence data.

Overall bankruptcies in the US, which includes non-portfolio companies, came in at 694, up 9.3% year over year.

– Download a spreadsheet with data in this story.

– Read about US corporate bankruptcies in November 2024.

– Explore more private equity coverage.

Bankruptcy filings accelerated last year as issues that drove restructuring activity after the pandemic lingered, Jacob Adlerstein, partner at corporate law firm Paul, Weiss, Rifkind, Wharton & Garrison, told S&P Global Market Intelligence.

"There are issues in terms of consumer spending," Adlerstein said. "While interest rates started to get cut in the second half of the year, you certainly have a higher interest rate environment through 2024 than we experienced previously. That had a meaningful impact on certain companies."

The increasing cost of debt financing also contributed to the rise in bankruptcy filings, according to Anthony Arnold, a partner Barnes & Thornburg.

"There are additional sources of debt that have become available over the last decade that weren't available previously. I'm thinking mostly about private credit funds. They are aggressively trying to match or better the terms that folks get from the banks, but they also are more aggressive in terms of pursuing their remedies when it comes to potential defaults and failure to meet covenants," Arnold said.

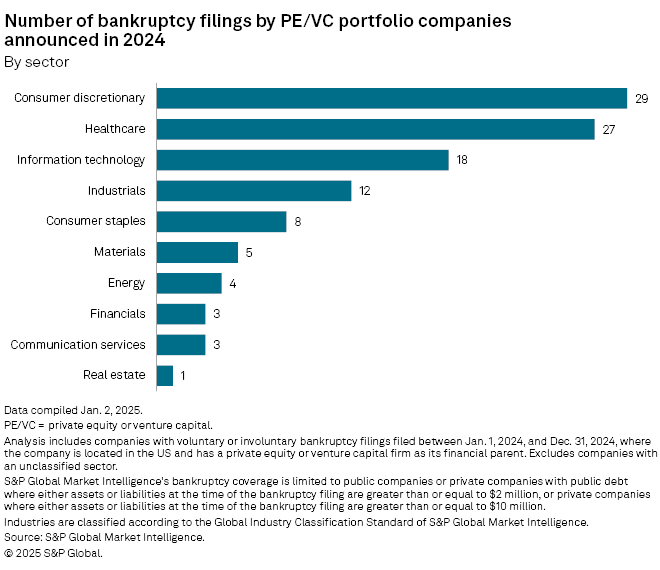

Consumer discretionary, healthcare dominate bankruptcy list

Of the 110 bankruptcy filings made by private equity and venture capital-backed companies in 2024, more than half were in the consumer discretionary and healthcare sectors.

Adlerstein said consumer discretionary companies were hit by changing spending patterns as consumers reeled from high inflation. "They're allocating their limited dollars in different ways. That has a meaningful impact on certain companies. In the retail space, in particular, there were a fair amount of big box retailers that went through restructuring transactions."

High operating costs related to labor, supply and regulations have weighed on healthcare companies, said Arnold.

Largest portfolio company bankruptcies

The Chapter 11 filing by H-Food Holdings LLC in November 2024 was among the largest private equity portfolio company bankruptcies during the year. The snack maker had liabilities of $2.83 billion at the time of filing and counts Blue Owl Credit Advisors LLC as one of its investors.

Correctional healthcare provider Wellpath Holdings Inc. also filed for Chapter 11 bankruptcy protection in November. The Prospect Capital Management LP-backed company intended to sell its recovery solutions business to some of its lenders and to initiate a separate reorganization of Wellpath Correctional Healthcare.

Big Lots Inc. had liabilities exceeding $1 billion at the time of its September 2024 filing and lists Mill Road Capital Management LLC among its investors. The discount retailer sought to sell its assets to Nexus Capital Management LP, but the deal collapsed in December 2024.

With inflation remaining somewhat stubborn, the Federal Reserve is not expected to lower interest rates aggressively this year, keeping the cost of borrowing high. That could spell trouble for more companies this year.

"There just aren't a lot of companies that can survive that sustained level of interest rate," Arnold said.

However, Adlerstein does believe the number of bankruptcies filings will decrease this year.

"You'll see a lot more out-of-court restructuring transactions and liability management transactions, which is a trend we saw in 2024 as well," he said.

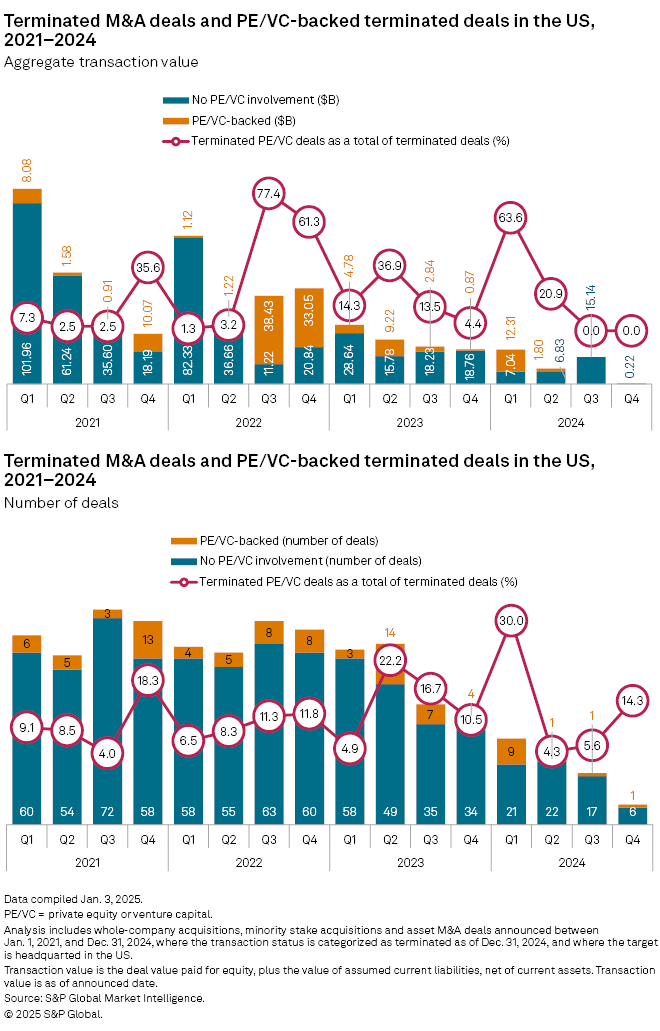

PE-backed terminated deals

The number of terminated private equity-backed deals in the US fell to 12 in 2024 from 28 cancelled deals in the same period a year ago. PE-backed deals accounted for 15.4% of all terminated deals in the US, which stood at 78.

The value of terminated private equity deals in 2024 totaled $14.11 billion, down from $17.70 billion in 2023. The value of all terminated M&A deals was $43.34 billion, down from the $99.11 billion in 2023.