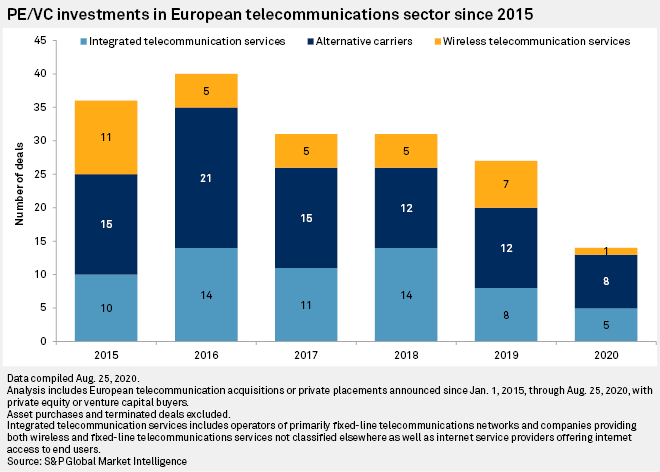

After a dip in transactions in 2019, the coronavirus pandemic could see private equity companies target European telecom operators, experts told S&P Global Market Intelligence.

As demand for telecom services increased during the pandemic, the industry offers cash flow visibility, as well as some potential bargains, the experts said.

"Fixed networks gained importance as a utility during COVID-19," Hendrik Wiersma, a senior credit analyst who covers tech, media and telecoms at ING, said. "Private equity tends to target sectors with predictable cash flow generation with high margins."

The rollout of fiber broadband in the region is also expected to encourage deals between carriers and private equity, they said. "These [fiber] deployment programs act as a lever for investment as they deploy a certain amount of capital with a relatively stable return — and if you get government funds that subsidize that, that is even better," Markus Muhs, a Clifford Chance partner specializing in cross-border M&A, said.

In April, the German government announced two low-interest loans from its state-owned bank to support private and municipal companies building out fiber internet.

Private equity-backed takeovers could occur in "mature" telecoms markets in Europe that are ripe for consolidation, where profit growth has slowed due to competition, Luis Alonso, a Clifford Chance partner, said.

A recent EU court order annulling a decision to block the merger of U.K. cell carriers Three and Telefónica UK Ltd., or O2, could spark consolidation between mobile carriers in Europe, analysts previously told this news service. But PE-carrier transactions could avoid merger control issues altogether, giving non-trade buyers an advantage. One example is the takeover of Spain's fourth-largest cell carrier MásMóvil Ibercom SA by a PE consortium including Cinven Ltd., KKR & Co. Inc. and Providence Equity Partners LLC, which faced some opposition from shareholders but otherwise went smoothly.

The U.K. could be next, according to the experts.

Incumbent BT Group recently began preparations to defend itself against a possible hostile takeover following a fall in its market valuation. After striking telecoms deals in Spain and Italy, New York-based private equity firm KKR is reportedly eyeing the U.K.-based telco, according to the Financial Times.

Though incumbents such as BT are not the typical PE targets, they will likely be drawn to its low market valuation and rich network assets, experts said. "Private equity has tended to be selective and gone for mid-cap [telcos]," Usman Ghazi, a telecoms equity analyst at German investment bank Berenberg said.

A strong incumbent does not tend to generate interest from infrastructure funds because it mixes in a legacy business that they may not want, Muhs, said.

"BT is an absolute bargain," former BT CTO Peter Cochrane said. "Its physical assets in terms of ducts, fiber in the ground, and its buildings are worth more than twice [its market value]."

The telco is not expected to give up its network assets without a fight, Cochrane said. "You would be protective if undervalued," Cochrane said. "You want the best price, and you are not going to just roll over without it."

BT's European peers, meanwhile, have suggested further deals could be on the way. Spain’s Telefónica SA in late July said there was opportunity for consolidation in its core operating regions including its domestic market and Germany. It is already in the process of merging its U.K. carrier O2 with Liberty Global PLC's broadband provider Virgin Media. German telco Deutsche Telekom AG in August said telecoms fragmentation in Europe was making it difficult to establish economies of scale.

"There is going to be a massive consolidation at some point," Cochrane said, pointing to the fact that virtual mobile network providers outnumber network infrastructure operators. "Europe can support no more than three telephone companies in total to make it viable in this modern world," he said. "To have dozens of little players makes no sense."