Click here to participate in the 2025 Private Equity and Venture Capital Outlook Survey to gain insights into private market sentiment for the upcoming year from global private equity, venture capital and limited partner professionals.

________________________________________________________

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity investment in taxation, auditing and accounting services firms came roaring back in 2024 after going quiet for two years.

The announced value of global private equity and venture capital deals in that corner of the professional services sector totaled $6.31 billion between Jan. 1 and Nov. 30, according to S&P Global Market Intelligence data. This total is more than private equity has invested in tax, audit and accounting firms in any single year since at least 2015, and it follows a two-year stretch when investment amounted to just about $80 million.

Private equity firms are perusing a buy-and-build strategy to consolidate market share in the fragmented professional services space, according to law firm Ropes & Gray. Part of the attraction for private equity acquirers is the resilient revenue streams produced by taxation, auditing and accounting services firms through market cycles.

A single deal — Cinven Ltd.'s planned $5.3 billion acquisition of a majority stake in Alter Domus Participations S.à r.l. Société à responsabilité limitée — is responsible for most of this year's surge in private equity investment targeting the sector. But even without that one outsized deal, 2024 would have seen more private capital flow to the sector than in all but three of the past nine years.

Read more about surging private equity-backed investment in taxation, accounting and auditing services firms.

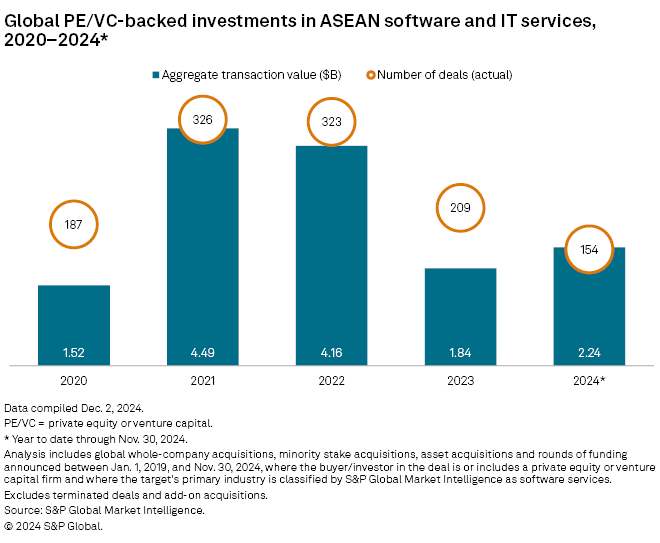

CHART OF THE WEEK: Private equity investment in ASEAN software and IT services firms picks up

⮞ Private equity- and venture capital-backed investment in the software and IT services sector of the 10 Southeast Asian countries that make up the Association of Southeast Asian Nations rebounded to $2.24 billion in 2024 as of Nov. 30, up 22% from the full-year 2023 total of $1.84 billion, according to S&P Global Market Intelligence data.

⮞ Deals targeting Singapore-based firms accounted for 90% of the total private equity investment in the software and IT services sector in ASEAN countries.

⮞ The year-over-year increase in investment targeting the sector, which includes specialists in mobile apps, online financial services, cloud technology, digital data analytics and internet infrastructure management, defies a broader decline in private equity-backed investments in Southeast Asia.

TOP DEALS AND FUNDRAISING

– BlackRock Inc. agreed to buy credit investment manager HPS Investment Partners LLC for about $12 billion. BlackRock said it seeks to become a partner of choice for private equity fund managers with the announced deal.

– General Atlantic Service Co. LP reached a deal to buy London-based learning and talent development company Learning Technologies Group PLC for about £802.4 million in cash.

– Property management software company Inhabit IQ secured preferred equity investment from Blackstone Inc.'s Blackstone Tactical Opportunities Advisors LLC and Greater Sum Ventures LLC.

– EQT AB (publ)'s EQT Active Core Infrastructure fund and GIC Pte. Ltd. agreed to buy a majority stake in smart metering company Calisen Group (Holdings) Ltd. from Global Infrastructure Partners, Goldman Sachs Alternatives' infrastructure business and Mubadala Investment Co. PJSC.

– Stellaris Venture Partners

MIDDLE-MARKET HIGHLIGHTS

– Vector Capital Management LP agreed to buy Australian sales enablement software company Bigtincan Holdings Ltd. for roughly A$183 million in cash.

– Ampersand Management LLC made a growth investment in Spanish contract development and manufacturing organization Vivebiotech SL, which specializes in lentiviral vectors for gene and cell therapy.

– Align Capital Partners LP added erosion control and pollution prevention company MKB Co. LLC to its portfolio.

FOCUS ON: RESEARCH AND CONSULTING SERVICES

– InfraVia Capital Partners agreed to buy a majority stake in Danish airport optimization company Copenhagen Optimization ApS. The deal is expected to close in early 2025.

– Summit Partners LP made a growth investment in accounting and tax services firm UHY LLP.

– Salesforce Ventures LLC led the latest funding round for consulting and implementation services firm Saltbox Mgmt Inc.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter