Poland-based Bank Polska Kasa Opieki SA is likely to merge with Alior Bank SA after acquiring the latter's stake from Polish insurer Powszechny Zakład Ubezpieczeń SA, analysts told S&P Global Market Intelligence.

Powszechny Zakład Ubezpieczeń (PZU), Poland's largest insurer and the top shareholder in both banks, signed a letter of intent with Bank Polska Kasa Opieki (Bank Pekao) to reorganize its banking assets. PZU holds a 31.9% stake in Alior Bank and a 20% stake in Bank Pekao. One scenario involves Bank Pekao purchasing PZU's shares in Alior Bank.

"The transaction is highly likely because it is in the interest of the leading shareholder, PZU, and will streamline [the group's] structure, which may also be viewed positively by regulators," said Tomasz Bursa, banking sector analyst and vice president at Polish investment fund manager OPTI TFI.

DM BOŚ Senior Equity Analyst Michał Sobolewski agreed, noting the sale would allow PZU to realize a profit and optimize capital. Based on current valuations, the deal could generate over 1 billion zlotys in stand-alone profit for PZU, though the impact would be neutral on a consolidated basis, executives said.

"Although different scenarios are being considered, we believe a merger of both banks is more likely," Sobolewski said. The analyst added that without shareholder approval for a merger, an alternative would be to maintain two separate banks with distinct strategies while sharing some functions to achieve cost efficiencies.

Bursa said Bank Pekao should fully acquire Alior Bank as soon as possible after purchasing PZU's shares. "Otherwise, the acquired shares will burden Pekao's capital and solvency ratios, and synergies will not be realized," Bursa said.

No binding decisions have been made, a Pekao spokesperson told Market Intelligence. Any acquisition will depend on achieving financial and managerial synergies that create value for both PZU and Pekao shareholders. In its 2027 strategy presentation, PZU said a potential agreement for the sale of Alior Bank's stake could be signed in the first half of 2025.

While Pekao and PZU executives have not specified Pekao's plans for Alior Bank's stake, PZU CEO Artur Olech said in December that collaboration options between the banks would be explored over the next year.

Market positioning

A merger with Alior Bank would strengthen Bank Pekao's position as Poland's second-largest lender by assets, loans and deposits, narrowing the gap with sector leader PKO Bank Polski SA and widening its lead over the third-largest bank, Santander Bank Polska SA.

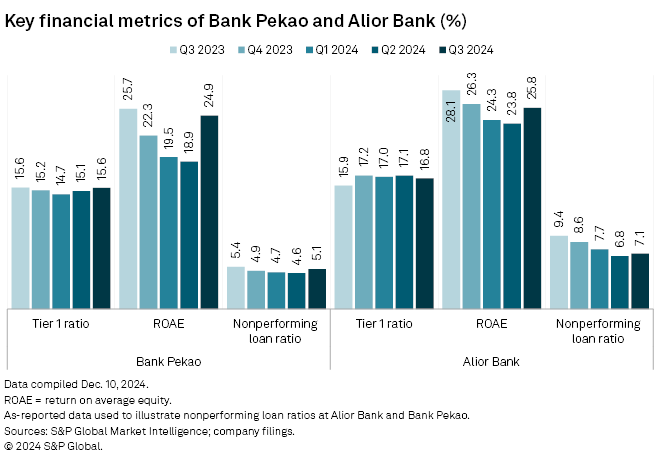

Both banks have delivered strong return on equity over the past five quarters, with Alior Bank's ratio consistently exceeding 20%, according to Market Intelligence data. But Alior's nonperforming loan ratio remains higher than Pekao's, though it has been trending downward.

A deal could reduce operating costs and improve efficiency for both banks, said Sobolewski, while expanding Bank Pekao's operations and creating economies of scale. "But we are skeptical about obtaining significant revenue synergies," Sobolewski added.

Pekao's extensive distribution network could integrate Alior's products, Bursa noted. "Additionally, both banks complement each other in their product offerings: Pekao excels in corporate banking and mortgages, while Alior specializes in cash products," Bursa said.

Dividend prospects

Pekao said the potential acquisition of PZU's stake in Alior would not affect its plan to distribute 50%-75% of its 2024 profit as dividends. The bank added it could issue Tier 1 or Tier 2 bonds to raise capital, if needed.

"I do not assume a significant risk of a lack of dividends from Pekao," Bursa said. "Perhaps in a transitional period of one to two years, the bank would reduce the dividend payout ratio to between 50% and 60%, but in the longer term, it should still pay out about 75% of profit as dividends."

Sobolewski said the purchase could limit Pekao's dividend potential in the medium term, particularly if the banks remain separate.

Pekao has the liquidity to fund the acquisition entirely in cash, Fitch Ratings said Dec. 11, though it warned the move could reduce the bank's capital buffers. "The bank has solid rating headroom, which could be depleted if the acquisition results in a durable decrease in Pekao's common equity Tier 1 ratio close to or below 13%," Fitch said. As of Sept. 30, Pekao's Tier 1 and core Tier 1 ratios stood at 15.6%, according to Market Intelligence data.

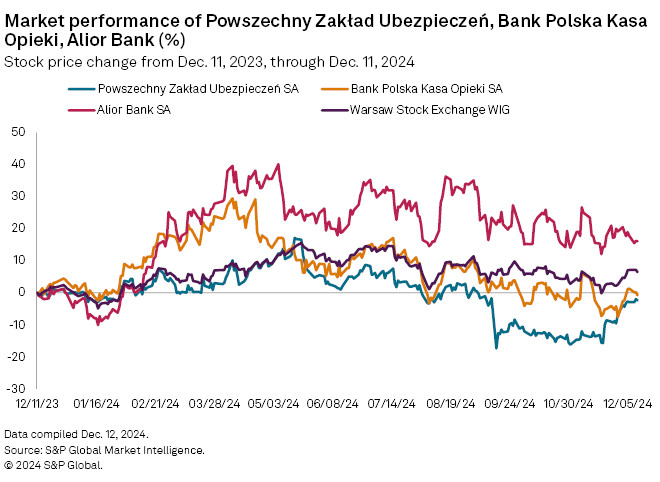

Pekao's stock initially fell on rumors of the deal but rebounded in subsequent days. Despite this, the bank's shares have underperformed Alior Bank and the Warsaw Stock Exchange's main index over the past 12 months.

DM BOŚ recently cut its 12-month target price for Pekao by 30% to 142.2 zlotys and downgraded its recommendation to "hold" from "buy." In contrast, the brokerage raised its target price for Alior Bank by 9% to 101.8 zlotys per share. Polish brokerage BM mBank identified Alior as one of its top stock picks for 2025.

As of Dec. 16, US$1 was equivalent to 4.05 Polish zlotys.