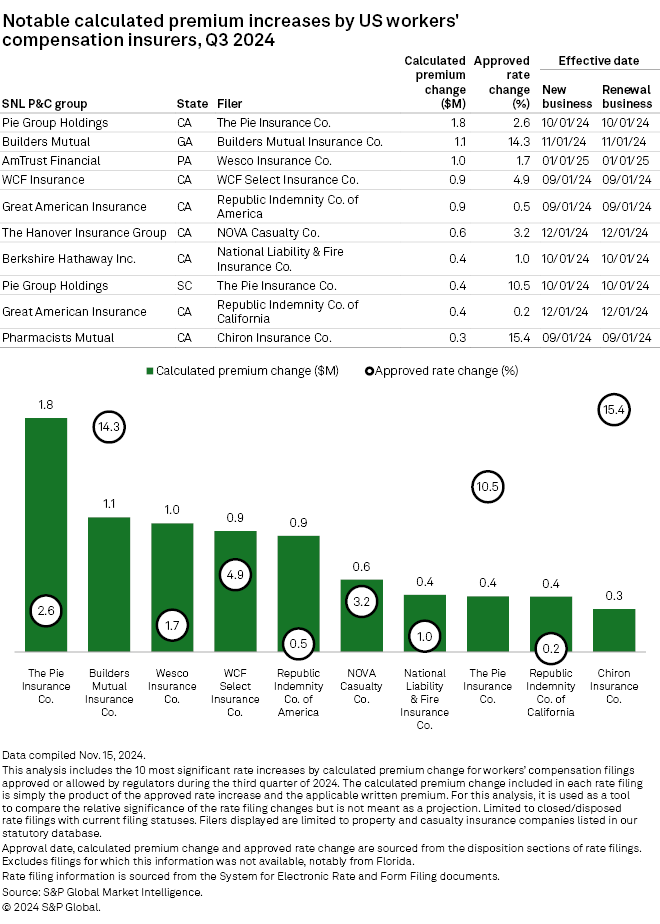

California regulators approved several of the most significant worker's compensation insurance rate changes across the US in the third quarter.

The Golden State approved eight of the 10 most notable calculated premium increases, according to an S&P Global Market Intelligence analysis. In total, 13 filings in the quarter approved increases and another 40 decreased rates in California.

Pie gets rate hikes in California

The Pie Insurance Co., a subsidiary of the Pie Group Holdings Inc., received approval for the most significant rate increase in California. The $1.8 million calculated premium change corresponded with a 2.6% rate increase, impacting about 7,000 policyholders. The other rate hike among the 10 most impactful changes for Pie Insurance was for a $400,000 calculated premium increase and a 10.5% rate change in South Carolina. Both these rate changes became effective at the start of October for new and renewal business.

The second-most-notable calculated premium increase was secured by Builders Mutual Insurance Co. The corresponding calculated premium change was $1.1 million, with a rate increase of 14.3% in Georgia.

All figures in this analysis are based on as-reported numbers filed in the rate filings of each subsidiary in each state. The calculated premium change is not a final projection of the additional premium the insurer may receive in the upcoming year. The calculated premium change is reported by each insurer to reflect the most impactful premium changes based on the combined impact of the percentage change and the amount of business it affects. Changes to the insurer's policy mix or policies in force are not factored into the analysis.

US states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use as well as use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.

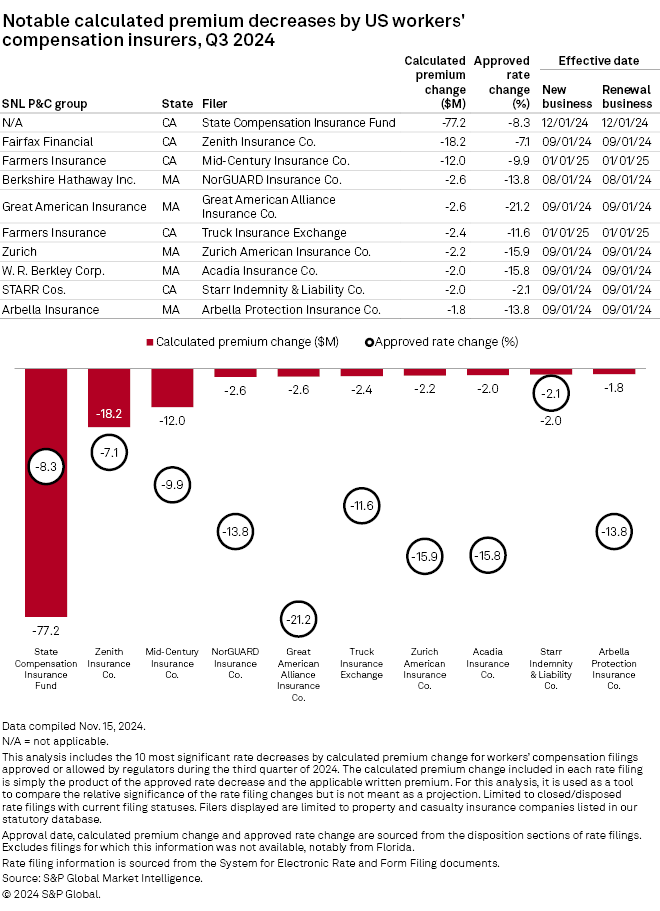

California, Massachusetts dominate rate decline chart

California and Massachusetts accounted for all the most significant movement in workers' compensation rates from a premiums perspective, with California reporting three of the top five reductions.

The most significant rate decrease was secured by California's public enterprise fund, State Compensation Insurance Fund, corresponding with a calculated premium change of $77.2 million relating to an 8.3% rate change. The change will become effective at the start of December for new and renewal business, impacting close to 83,000 policyholders.

California also approved rate reductions of 7.1% for Zenith Insurance Co., 9.9% for Mid-Century Insurance Co. and 11.6% for Truck Insurance Exchange. Mid-Century Insurance and Truck Insurance Exchange are subsidiaries of Farmers Insurance Group of Cos.

NorGUARD Insurance Co., a subsidiary of Berkshire Hathaway Inc., posted the third-highest calculated premium change at $2.6 million thanks to a 13.8% rate decrease in Massachusetts. This rate reduction will impact about 5,000 policyholders and has been in effect for new and renewal business since the start of August.

Great American Alliance Insurance Co. secured a rate cut of 21.2% from Massachusetts regulators, which will lower its premiums by $2.6 million.