French President Emmanuel Macron faces a massive challenge to form a government that can win the support of a majority of the French parliament. |

The long-awaited upturn in French banks' fortunes faces headwinds from mounting political uncertainty following the fall of the country's government.

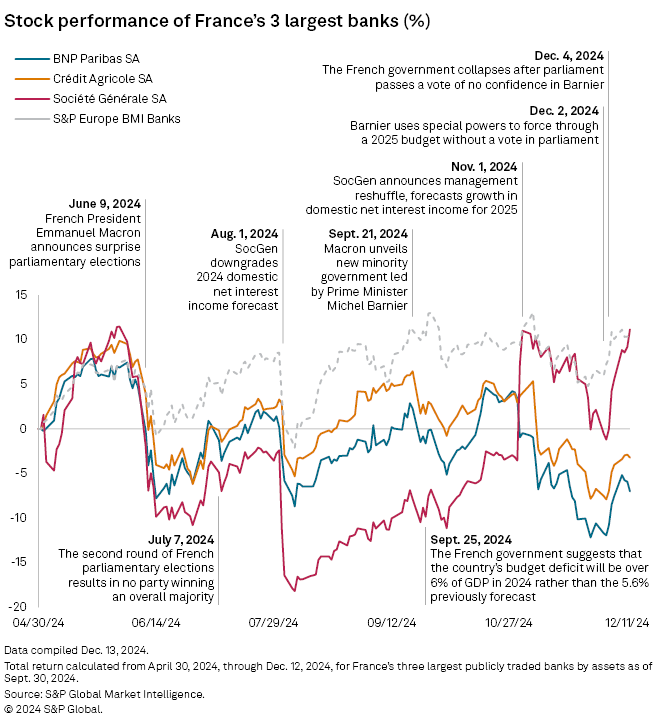

France was plunged into political chaos on Dec. 4 when the country's parliament voted to oust Prime Minister Michel Barnier after he attempted to force through an unpopular 2025 budget. French President Emmanuel Macron is now working to cobble together enough support from across the deeply divided French parliament for a new administration that can avoid a similar fate.

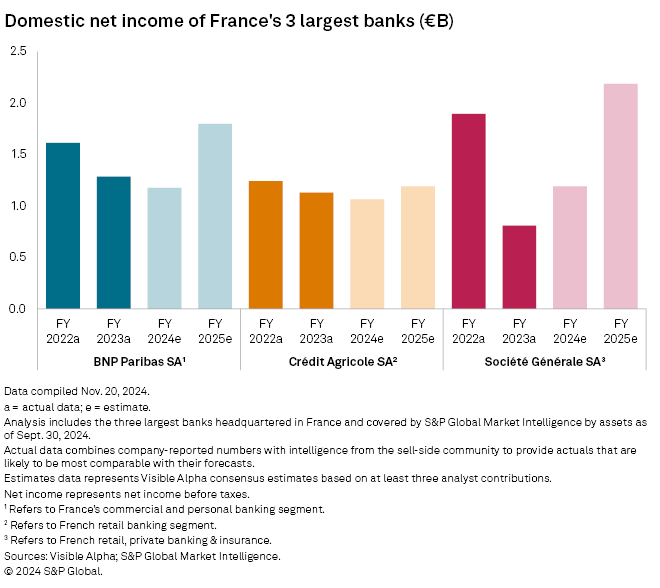

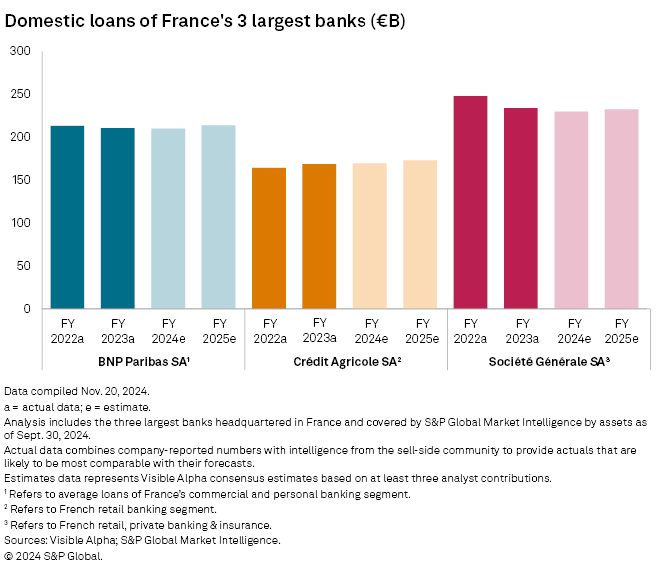

The political instability comes as France's three largest banks — BNP Paribas SA, Crédit Agricole SA (CASA) and Société Générale SA — forecast a turnaround in the performance of their domestic retail banks. Unlike most other European lenders, the recent rise in interest rates squeezed French banks' domestic lending income due to the peculiar features of their home market.

"The political instability is not translating into an economic crisis or recession yet," said Sam Theodore, independent bank analyst, in an interview with S&P Global Market Intelligence. "But if it does, the banks will suffer."

The three lenders' stocks have largely trailed that of the S&P Europe BMI Banks index since Macron announced snap parliamentary elections in June, Market Intelligence data shows. Downward revisions to forecasts for domestic lending income have also spooked equity investors.

Higher costs

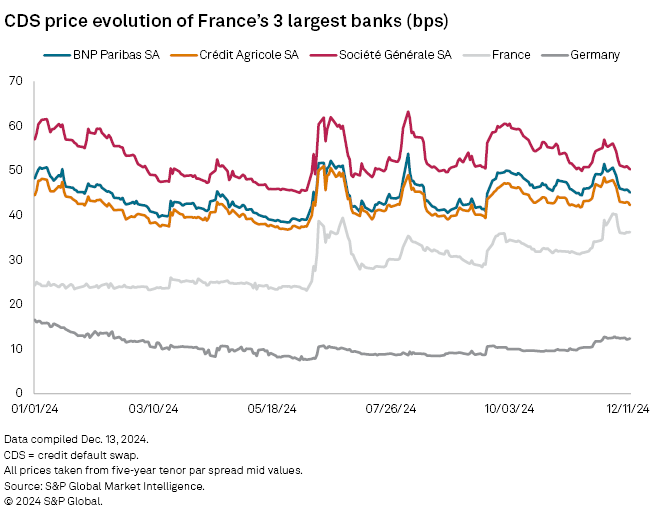

The escalating political instability in the country threatens the French lenders' domestic businesses on several fronts. Borrowing costs are likely to increase as they are more reliant on wholesale funding than most other European lenders,

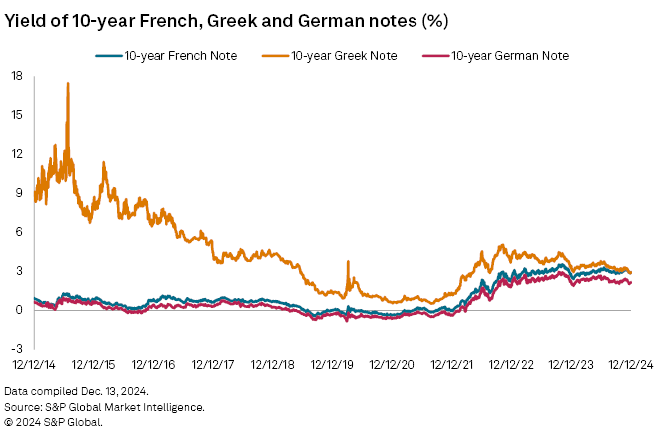

The French government's inability to tackle the country's deficit has unnerved investors in its debt, recently causing yields on French 10-year bonds to surpass those of Greece — long seen as the eurozone's most fragile economy.

S&P Global Ratings, which projects France's deficit to reach 6.2% in 2024, downgraded its credit rating on French debt in May, and Moody's followed on Dec. 14. These downgrades typically raise borrowing costs for the rated entity.

"Wholesale funding is very important for the French banks," said Johann Scholtz, senior equity analyst at Morningstar, in an interview. "Wholesale rates track French government bonds closely so that's probably the biggest political and fiscal risk for the banks."

The passing of any revised budget that reduces the deficit would also likely weigh on the banks' domestic loan growth.

"The government plans to become more restrictive with its 2025 budget," said Sonja Forster, senior vice president for European financial institutions at Morningstar DBRS, in an interview. "That has a direct negative impact on the economy — if you lower the deficit, it's less expansionary."

The politically febrile atmosphere in France could factor into a key decision on the rate of the country's hugely popular regulated savings scheme, Livret A, which has kept banks' interest expenses elevated in recent years. A decision on the new rate, which was frozen at 3% in July 2023 and is expected to fall to 2.5% in February 2025, is due next month.

"If the past is anything to go by, and considering the political environment at the moment, we don't necessarily expect Livret A to come down commensurate with lower interest rates, which would then imply a bit of a margin squeeze for the banks," Scholtz said.

Any damage caused to the French economy from the political strife could also prompt an increase in bad loans, Theodore said. CASA already reported an increase in loan loss provisions in the third quarter at its French retail bank Crédit Lyonnais SA, with self-employed professionals and small to medium-sized enterprises particularly affected.

"France's political uncertainty and volatile domestic economic conditions remain key concerns that could impact the recovery in lending and limit profitability improvements in the near term," said Carola Saldias, senior director for financial institutions at Scope Ratings, in a Dec. 11 report.

Better prospects

The political upheaval is an unwelcome blight on what otherwise is an encouraging outlook for French lenders. Analyst consensus estimates compiled before the recent turmoil anticipate much stronger profits and an uptick in loan issuance for all three major banks, S&P Global Market Intelligence and Visible Alpha data shows.

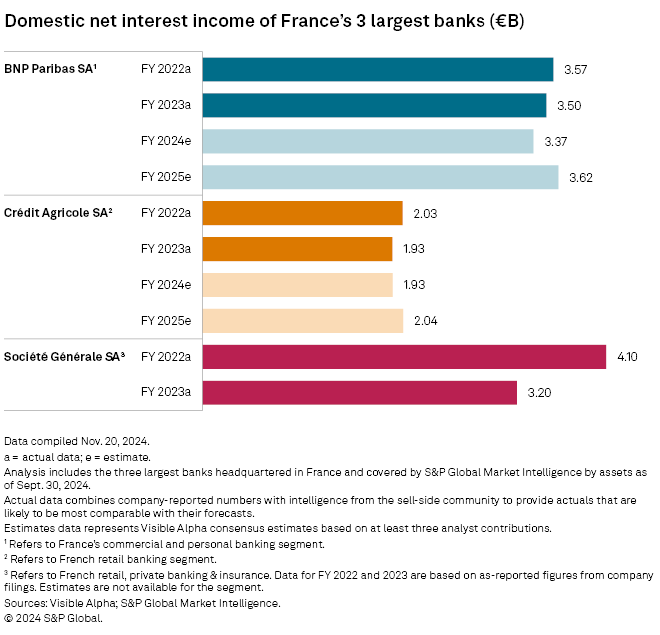

French banks' domestic retail businesses have struggled since eurozone interest rates began to rise in 2022. A surge in deposit costs and limited growth in interest income have weighed heavily on the lenders' domestic NII.

Deposit costs increased due to a rapid rise in rates on regulated savings schemes linked to inflation, such as Livret A. Largely fixed-rate, long-duration loan books and restrictions on the pace at which banks could pass on higher rates to borrowers prevented them from offsetting the explosion in interest expenses.

SocGen's and BNP's domestic NII was also impacted by hedges the banks placed against further falls in NII before the interest rate hiking cycle began in 2022.

Unlike in other eurozone countries, the ongoing fall in interest rates is seen as positive for both French banks' interest income and interest expenses.

"With lower rates, we do see some upside there," said Forster. "Definitely, mortgage lending and lending in certain other segments should certainly pick up."

"After two quarters in negative territory, the French bank is in positive evolution," CEO Jean-Laurent Bonnafé said during the bank's earnings call. "The internal target for next year is clearly above 3% for the French domestic bank."

CASA and SocGen also pointed to a recovery in the mortgage market as evidence of better times ahead.

"I don't know if optimism is really the right word, but I'm more positive, more constructive," CASA deputy CEO Jerôme Grivet said during his bank's call.

Playing politics

Uncertainty around French politics is likely to persist well into next year even after the Dec. 13 appointment of centrist François Bayrou as prime minister. Any government Macron forms will likely face the same resistance to its budgetary proposals as Barnier did. Macron is also unable to call new parliamentary elections in the hope of reshaping the National Assembly until June, one year after the last vote.

France's three largest banks are somewhat insulated from their country's political woes due to their extensive and largely profitable businesses beyond French retail banking. In 2023, BNP and CASA generated approximately 86% and 84% of their revenue from these businesses, respectively, while SocGen's other businesses accounted for over 70% of its revenue, according to Visible Alpha data.

Still, the lenders are inextricably tied to the fortunes of their home market, said Theodore.

"They can diversify all they want," he said. "They're still large French banks whose dominant market remains France."