Green bond sales in the US, one of the biggest markets for the instrument, may slow under Donald Trump, analysts said after the president gave notice of the US' withdrawal from the Paris Agreement on climate change on his first day in office.

Instead, Trump vowed Jan. 20 that the US will boost oil and gas production, saying: "We will drill, baby, drill." The president's comments raised concerns that environmental issues might lose the significance that the previous Biden administration placed on them. This shift could, in turn, slow the issuance of green bonds in the US.

"The new US administration will serve as a headwind for sustainable finance," Mana Nakazora, chief environment, social and governance analyst at BNP Paribas Japan, said in a report on Jan. 16. "We're afraid that the US ESG bond market will shrink further."

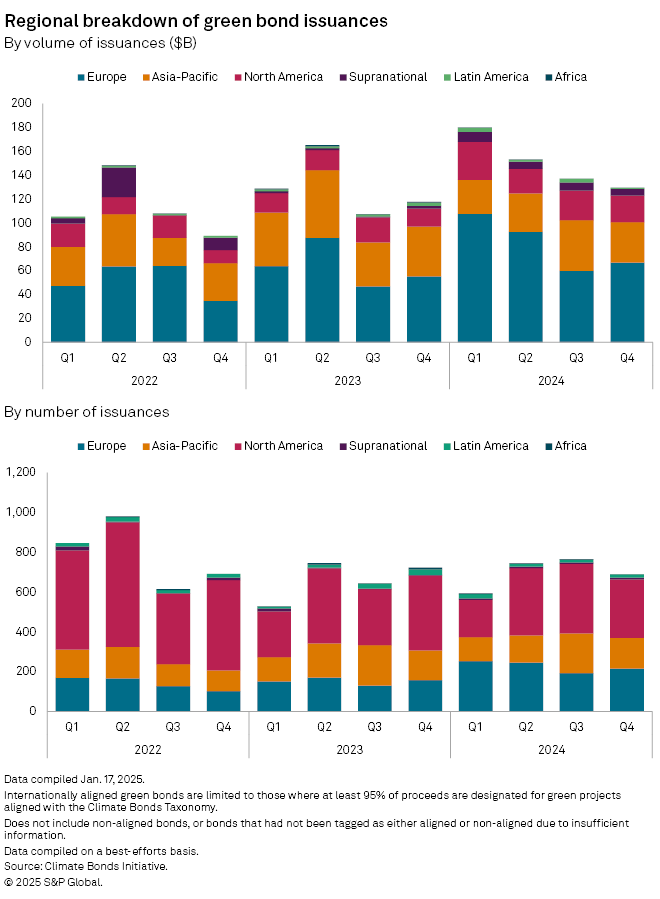

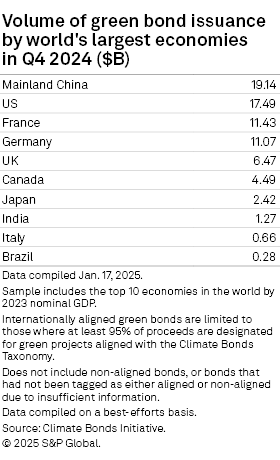

The US was the second-largest issuer of green bonds by country in the fourth quarter of 2024, according to the Climate Bonds Initiative (CBI), an international organization that seeks to mobilize global capital for climate action. From October to December 2024, the US issued $17.49 billion of green bonds, following China's $19.14 billion. France ranked third with $11.43 billion and Germany fourth with $11.07 billion, according to CBI data.

Stagnation fears

"Overall, the green bond issuance for this year [globally] could be at a similar level to last year's," said Yasunobu Katsuki, senior sustainability strategist at Mizuho Securities Co. "The Trump administration will likely dampen [US] market momentum."

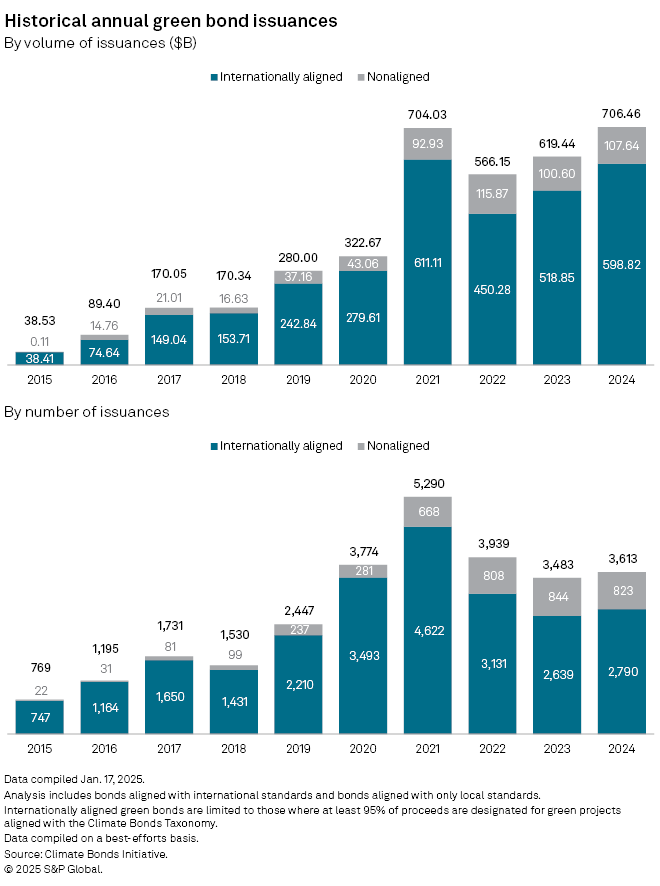

The global issuance of internationally aligned green bonds grew to $598.82 billion in 2024 from $518.85 billion in the previous year, according to CBI data. The aggregate number of transactions rose to 2,790 from 2,639.

Including the so-called nonaligned green bonds, global issuance rose to a record $706.46 billion in 2024 from $619.44 billion the previous year. Several countries, including China, sell green bonds aligned to local definitions that CBI counts as nonaligned green bonds.

China's green bond sales may sustain their momentum in 2025 after a 61.8% increase in issuances in the second half of 2024 compared to the first six months of the year.

Trump tariffs

Another cornerstone of Trump's policy, potential tariff hikes, could pose a separate threat to the global green bonds market. Higher tariffs on US imports could stoke inflation in the world's largest economy, slowing interest rate reductions. The US Federal Reserve has already indicated that it will be less aggressive with policy easing after three rate cuts in 2024. Higher interest rates could make it costly for issuers to sell green bonds, Katsuki said.

Meanwhile, Europe's green bond market may benefit from lower interest rates, which would make it less costly for issuers to sell green bonds, Katsuki said.

The European Central Bank, which entered a rate-cut cycle in June 2024, will likely maintain its loosening policy in 2025, according to a report from NLI Research Institute.

Europe's new green bond regulations may also favor the green bond market by providing a clear definition of green bonds for issuers and investors, BNP Paribas' Nakazora said.

The new European green bond regulations took effect Dec. 21, 2024, requiring deals to align at least 85% with the EU's green taxonomy.