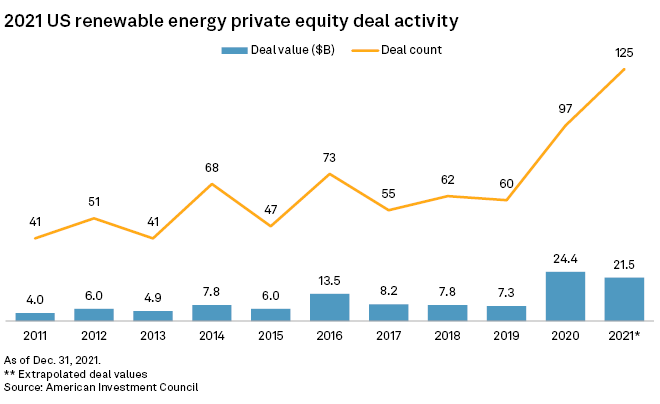

Private equity firms invested $21.5 billion in the U.S. renewable energy sector in 2021, with over $6 billion of capital flowing to wind and solar projects, according to a recent report by the American Investment Council.

Over the past decade, private capital has "sponsored more than 1,000 U.S. clean-tech companies, investing almost $150 billion," according to the American Investment Council, a lobbying and research organization representing the private equity and growth capital investment industry. Those investments include conventional renewables like wind and solar, along with agricultural technology such as sustainable food management, waste management and water management.

"I think you'll see everything from farmers getting smarter about how they irrigate to ... how do you make farming more efficient, how do you computerize farming?" American Investment Council President and CEO Drew Maloney said in an interview, citing innovations like vertical farming, which uses a significantly smaller agricultural land footprint.

Investments in wind and solar power were evenly distributed throughout the country, the report found.

Avangrid Inc. CEO Dennis Arriola said during the company's April 27 first-quarter earnings call that a February offshore wind lease sale totaling $4.37 billion for areas off the coast of New York and New Jersey was particularly fertile for private capital, as public companies like Avangrid, Public Service Enterprise Group Inc. and Ørsted A/S bowed out.

"There are a lot of players, whether they be operational companies, financial companies, institutions and pension funds that want to be in the renewable space," Arriola told analysts and investors.

But offshore wind can be a difficult investment for closed-end funds.

"It's really challenging because you've got a 10- or 12-year end-to-end and you've got an investment period of three to five years, and you have to put that capital to work and then find a way to monetize and sell it for more than you bought it for," Eamon Nolan, a partner at Vinson & Elkins LLP who specializes in financing infrastructure and energy projects, said in an interview.

With larger pools of private capital chasing the same investments, foreign and domestic funds are also looking at green ammonia, hydrogen, carbon capture and renewable natural gas targets. Those are the assets "we're seeing the most activity around," Nolan said, due in part to an overlap with fossil fuel infrastructure projects.

"It's almost the same players" who invest in big hydrocarbon transportation projects like LNG terminals, Nolan said.

A new $15 billion fund by Brookfield Asset Management Inc. is among those infrastructure-style vehicles, injecting cash into companies that already have the technology and intellectual property while allowing management teams to maintain control.

Deep industrial decarbonization is "not something that can be solved with a $50 million equity check," Natalie Adomait, a managing partner in Brookfield's renewable power and transition group, said during an April 20 panel at Bloomberg New Energy Finance's New York City summit.

Moving from blast furnaces to electric arc furnaces in the steel sector, for example, "is a $2 billion project, and steel players aren't just doing one of those, they're doing 10 to 20," Adomait said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.