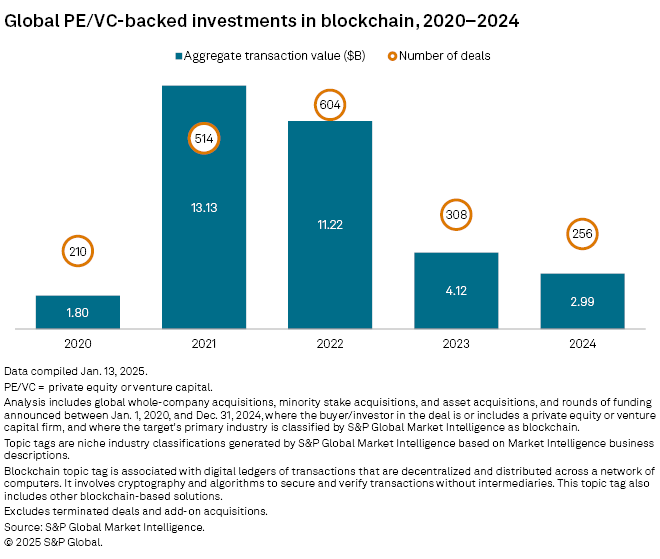

Global private equity and venture capital investments in blockchain continued a multiyear decline in 2024.

Transactions targeting blockchain amounted to $2.99 billion, down 27% annually, while the number of deals was down close to 17%, according to S&P Global Market Intelligence data.

Blockchain is an information storage technology using a decentralized ledger system to record transactions across computers, ensuring data security and transparency.

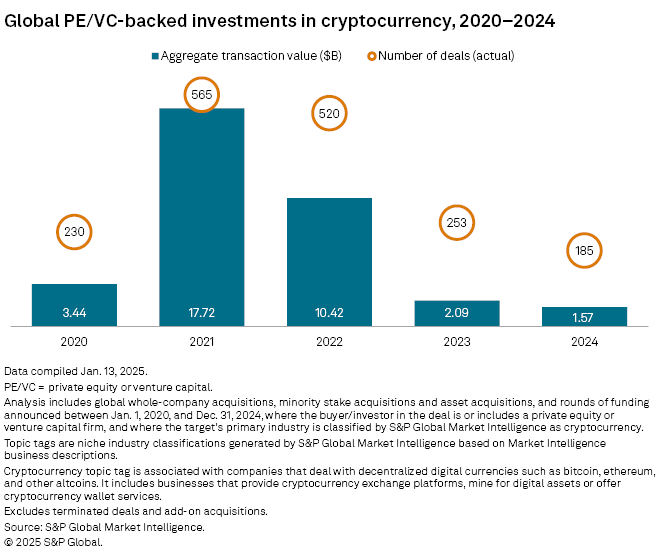

Private investments in cryptocurrency — a digital alternative to traditional assets and fiat money that runs on blockchain technology — were down about 25% to $1.57 billion, reflecting investor caution.

The AI factor

Blockchain has found applications outside the cryptocurrency industry, such as healthcare and supply chain management. The new US administration's pro-crypto stance drove bitcoin's recent price upward. Investors in the cryptocurrency anticipate favorable regulatory policies, but it remains a speculative bet compared with blockchain.

"Many of the large [venture capital]-backed cryptocurrency projects haven't done as successfully as they've hoped," Cambridge Blockchain Society President Kisso Selvan said, citing unsatisfied retail investors in alternative cryptocurrencies.

"On the complete contrary, we've seen massive pushes for blockchain technologies in a regulatory scope. Most countries have moved to blockchain and encouraged its adoption for things like supply chain management and beyond because of the increased transparency."

The surging generative AI industry, however, has overshadowed blockchain and crypto as investors flock to bet on the next technological breakthrough.

451 Research, a technology research group within Market Intelligence, expects blockchain technology to benefit. The decentralized ledger system and GenAI could complement each other to provide applications across industries.

"[B]lockchain's role as a tamper-proof shared data repository makes it particularly valuable in areas where auditability and trust are critical concerns. AI appears to stand out in this regard," a 451 Research report said.

– Download a spreadsheet with data featured in this article.

– Read up on rising private equity investments in Japan.

– Learn more about US pension funds' private debt allocation.

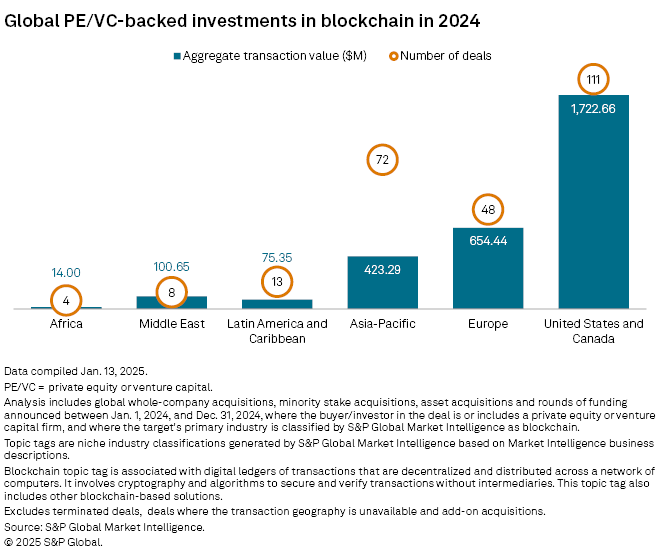

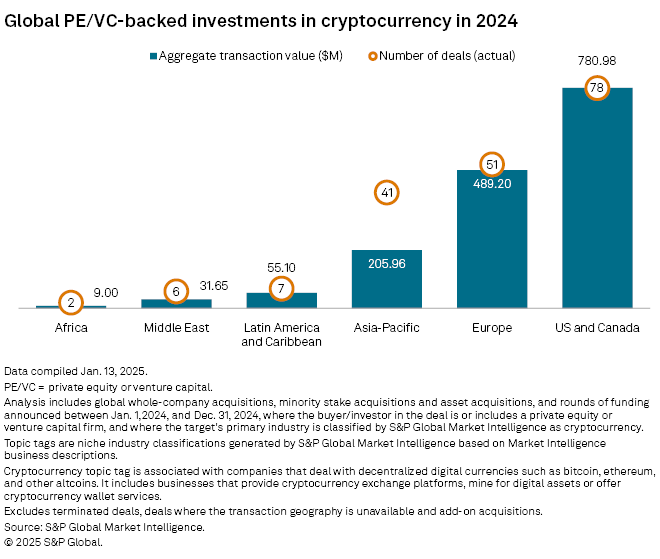

North America deals dominate

Blockchain and cryptocurrency companies in the US and Canada had the most private equity-backed investments. Blockchain companies in these countries had 111 deals totaling $1.72 billion, while cryptocurrency companies in the region received about $781 million with 78 deals.

Europe, including the UK, ranked second for private equity-backed investments in both technologies, with 48 blockchain deals totaling $654.4 million and 51 cryptocurrency deals reaching $489.2 million.

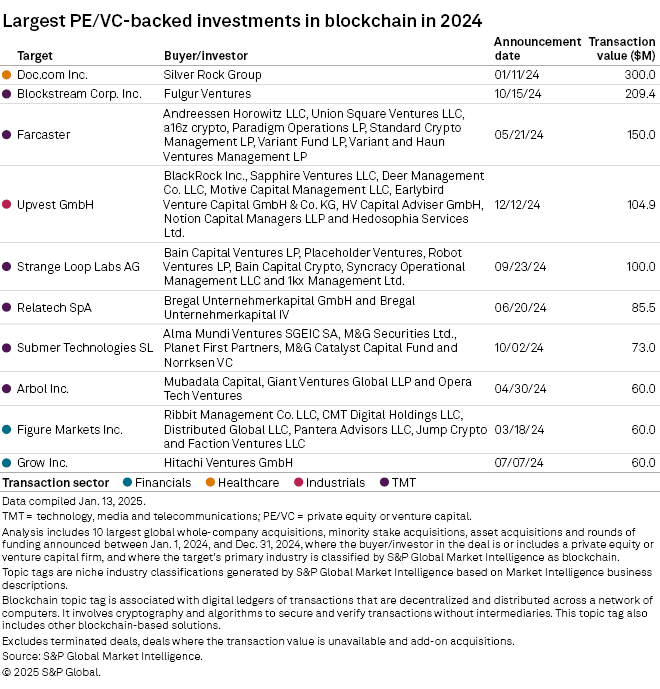

The largest private equity-backed investment in blockchain was healthcare-focused Doc.com Inc.'s $300 million round from investor Silver Rock Group.

The second-largest deal was Fulgur Ventures' $209 million investment in Canadian company Blockstream Corp. Inc.

The largest private equity-backed deal in cryptocurrency was a $100 million investment in UK-headquartered Crypto Technology Ltd., with participation from Nomad Capital and No Limit Holdings.

The second-largest transaction was a $60 million investment in blockchain and cryptocurrency company Figure Markets Inc., led by new backers including Faction Ventures LLC and Pantera Advisors LLC.

Enterprise blockchain adoption

"As soon as bitcoin runs up, other projects gain interest, and institutional investors are getting more comfortable with the prospect of investing in things outside of bitcoin," Interchain Foundation President Josh Cincinnati told Market Intelligence.

Cincinnati cited a Toyota Motor Corp. project using blockchain technology for intercar communication as one of the ongoing innovations in the space. He also expects enterprises to use blockchain systems to prove transactions without revealing customer information.

"That kind of proving system is going to be tremendously powerful because it means these companies that need to collect this information won't have a degree of data liability around holding all of this customer information," Cincinnati said.