S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

The flywheel is one of private equity's favorite metaphors, evoking an investment cycle continually building on its own momentum. Raise money from investors, buy businesses, improve those businesses, sell, distribute the profits and repeat.

That flywheel has gone a bit wobbly in recent years, knocked off its axis by macroeconomic turbulence and slowed by friction in M&A markets. After hitting a record high in 2021, aggregate private equity exit value fell dramatically in 2022 and stayed there through 2023.

We now know private equity's long wait for a rebound in exits will extend into another year. Although the volume of exits increased slightly in 2024, the aggregate value fell to a five-year low of $392.48 billion, according to S&P Global Market Intelligence data.

When exits slack off, less cash flows back to investors. When less cash flows back to investors, fundraising slows. The flywheel groans.

Read more about private equity exit value falling to a five-year low in 2024.

CHART OF THE WEEK: Entry deals expand in 2024

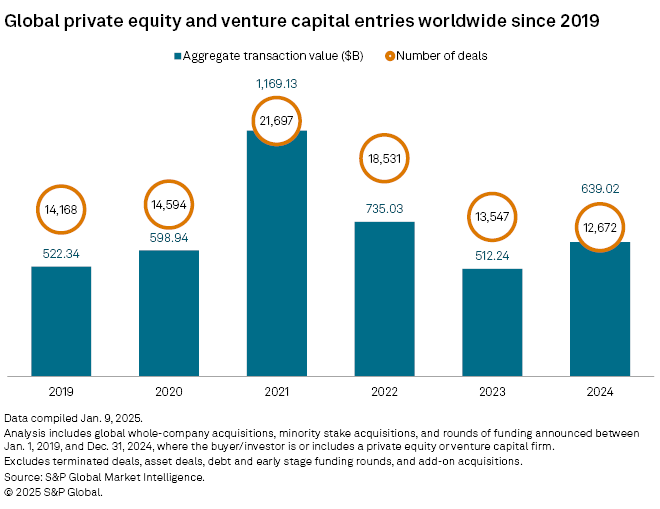

⮞ The value of global private equity and venture capital entries climbed nearly 25% year over year to $639.02 billion in 2024 after declining for two consecutive years, according to Market Intelligence data.

⮞ Even as deal value increased, deal volume fell to its lowest level since at least 2019.

⮞ The trend of more private equity capital being deployed into fewer deals was exemplified by the surge in private equity-backed megadeals.

TOP DEALS AND FUNDRAISING

– Renewable energy company Origis Energy USA Inc. secured more than $1 billion in new strategic investment from Brookfield Asset Management Ltd. and Antin Infrastructure Partners.

– Apollo Global Management Inc. agreed to buy midmarket asset manager Argo Infrastructure Partners LP. The deal is expected to close in the second quarter.

– An investor group, including KKR & Co. Inc. and Highland Europe (UK) LLP, made a growth investment in Austrian dairy farming company Smaxtec Animal Care GmbH.

– Ardian brought in $30 billion for its ninth secondaries platform. The ASF IX vehicle seeks to acquire stakes in best-in-class private equity assets.

– French private equity firm Omnes Capital SAS raised €2.05 billion for Capenergie 5 FPCI, its fifth-generation renewable energy fund. The vehicle has already made seven investments in European renewable energy developers since its launch in December 2022.

– Hildred Capital Management LLC raised more than $800 million in capital commitments for its third fund at final close. The Hildred Equity Partners III LP fund exceeded its $600 million target and seeks to invest in middle-market healthcare companies.

– Mountaingate Capital Management LP raised $570 million in capital commitments at the close of Mountaingate Capital Fund III LP. The vehicle will invest in digital, data, technology-driven marketing and business services, specialty manufacturing and distribution companies.

– Bertram Capital Management LLC raised $260 million in capital commitments at the close of its debut small-cap fund. The Bertram Ignite I LP fund seeks to make lower-middle-market and noncontrol investments.

MIDDLE-MARKET HIGHLIGHTS

– Cohere Capital Partners LP raised more than $215 million in commitments at the close of Cohere Capital Fund II LP. The lower-middle-market firm also received a strategic investment from TPG Capital LP's TPG Next strategy.

– Gainline Capital Partners LP invested in IMS Technology Services LLC, an audiovisual event staging services provider.

– Stellex Capital Management LP added electrical services provider ICS Holding LLC to its portfolio.

FOCUS ON: MEDICAL EQUIPMENT

– Montagu Private Equity LLP agreed to buy medical device supplier Tyber Medical LLC. As part of the deal, Tyber will combine with Montagu portfolio companies Resolve Surgical Technologies and In'Tech Medical SAS.

– Medical device company Alleviant Medical Inc. secured $90 million in a round of funding led by Gilde Healthcare Partners US Inc.

– Surgical robotics company Cornerstone Robotics raised $70 million in a series C financing round led by EQT Partners AB.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter