Private equity activity in 2024 had mixed results, according to S&P Global Market Intelligence, suggesting to some industry sources that numbers for deals, fundraising and exits may rebound in 2025.

Deals improve

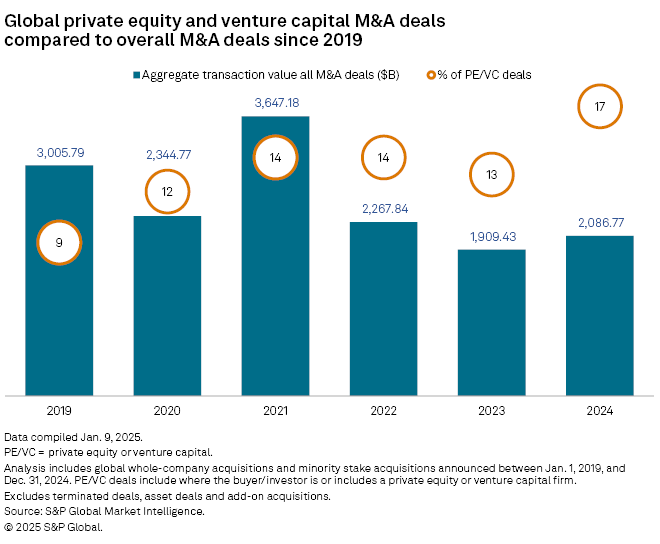

Global private equity and venture capital deals showed resilience in 2024, with aggregate deal value increasing for the first time since 2021.

Private equity and venture capital deal value accounted for 17% of all M&A transactions, the highest since at least 2019, according to S&P Global Market Intelligence data.

Among the megadeals driving private equity M&A is Novo Holdings A/S' buyout of US pharmaceutical products developer Catalent Inc. for $16.5 billion.

Regionally, the US and Canada led global private equity and venture capital M&A transactions, achieving a deal value of $188.72 billion. Europe recorded the most deal volume with 990 transactions in 2024, surpassing the US and Canada.

Fundraising continues slide

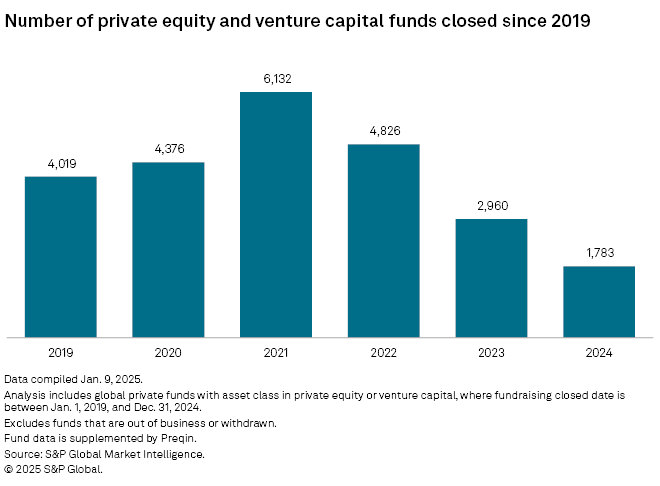

Despite increased deal activity in 2024, global private equity fundraising sank for the third straight year, largely due to a weak exit environment that constrained liquidity. Private equity funds worldwide secured $680.04 billion, down 30% from about $966.37 billion raised in 2023, Market Intelligence data shows.

The number of funds closed in 2024 continued a multiyear decline, with 1,783, a 40% year-over-year decrease. Fund closings began declining after peaking at 6,132 in 2021.

EQT AB (publ) closed the largest private equity fund in 2024, securing $22.67 billion for its EQT X fund. The flagship fund invests primarily in the healthcare technology and technology-enabled service sectors in Europe and North America.

Exits at 5-year low

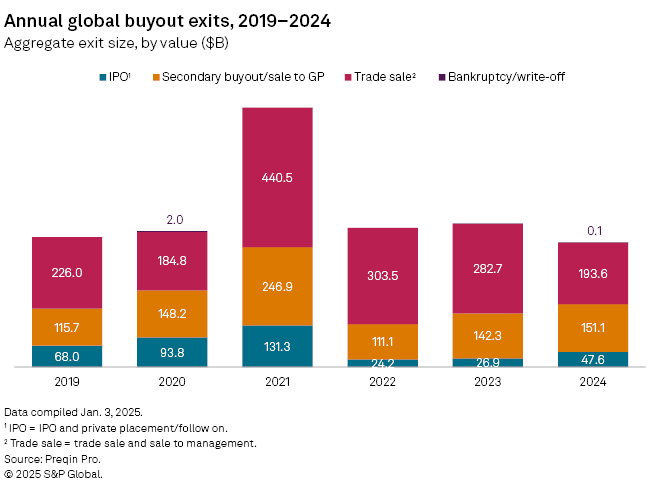

The value of global private equity exits — including IPOs, secondary buyouts, trade sales and bankruptcies — fell to a five-year low of $392.48 billion in 2024, Preqin data shows.

Trade sales, including sales to management, accounted for around half of this total, at $193.6 billion across 1,177 transactions. Secondary buyouts represented 38% of deal value, IPOs accounted for 12% and bankruptcies made up over 2%.

Insight Venture Management LLC and venture capital firm Y Combinator led firms in exits between Jan. 1, 2024, and Dec. 9, 2024. Each participated as a seller in 22 transactions during this period, Market Intelligence data shows.

Transactions, fundraising, and exits to rebound

For private equity deals, the expectation is that 2025 will see improvement "on all fronts," according to HarbourVest managing director Scott Voss.

"All relevant measures showed signs of a rebound in the second half of 2024," he said. "This was most obvious in investment activity, where we saw dry powder decline for the first time since 2021 and only the second time in the last ten years, as investment activity outpaced fundraising."

Pressure on both sellers and buyers is expected to drive transaction volumes. Extended hold periods and aging assets will compel sellers to exit despite concerns about not achieving optimal value in the bid-ask spread. "The clock is ticking" for committed capital that has not yet been deployed, Voss said.

Clifford Chance partner Jonathan Bray anticipates stronger private equity fundraising activity in 2025 compared to 2024 as signs of a more active M&A environment emerge.

"Pricing expectations are becoming just more consistent across the board, coupled with a slightly lower interest rate environment and expectations on that side. People are expecting to become more comfortable with the global macroeconomic and political environment, too," Bray said.

Exits are also expected to rebound in 2025, a positive outlook supported by Preqin data, which indicates that exit transaction values steadily increased each quarter of 2024.

Pent-up demand for exits is one driver of transactions, Arthur D. Little partner Jonas Fagerlund said, citing pressure to invest the record amount of private equity dry powder.

"[T]hat's a huge amount of money waiting to be spent," Fagerlund said.

Click on the links to our private equity data dispatches summing up 2024's activity: