Click here to participate in the 2025 Private Equity and Venture Capital Outlook Survey

_______________________________________________________

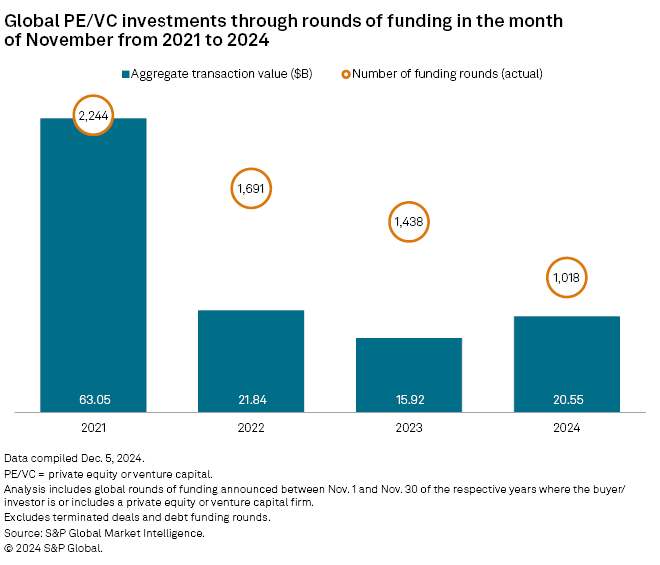

Global private equity-backed funding activity slowed in November, S&P Global Market Intelligence data shows.

Global venture capital deal count declined 29.2% year over year to 1,018. Deal value totaled $20.55 billion, up 29.1% from $15.92 billion a year ago.

Deal value dropped from $21.95 billion in October, while the number of transactions also declined from 1,413.

– Download a spreadsheet with data in this story.

– Read about global venture capital activity in October.

– Explore more private equity coverage.

At 62.2%, the technology, media and telecommunications (TMT) industry once again received the bulk of global venture capital investments in November. The healthcare sector followed with 12.7% of the total.

Within the TMT sector, application software companies attracted the largest number of private equity-backed funding rounds in November at 202, although that figure was lower year over year. Systems software companies came second with 39 funding rounds.

Largest deals

Seven of the 10 largest venture capital rounds in November were for TMT companies.

The largest private equity-backed round in the month was for X.AI Corp., which raised $5 billion in a funding round valuing Elon Musk's artificial intelligence startup at $50 billion, The Wall Street Journal reported. Firms including CoreNest Capital, Sequoia Capital Operations LLC, Valor Management LLC and Andreessen Horowitz LLC participated in the round.

The second-largest round was GTCR LLC's $1.33 billion investment in testing and quality engineering company Tricentis GmbH.

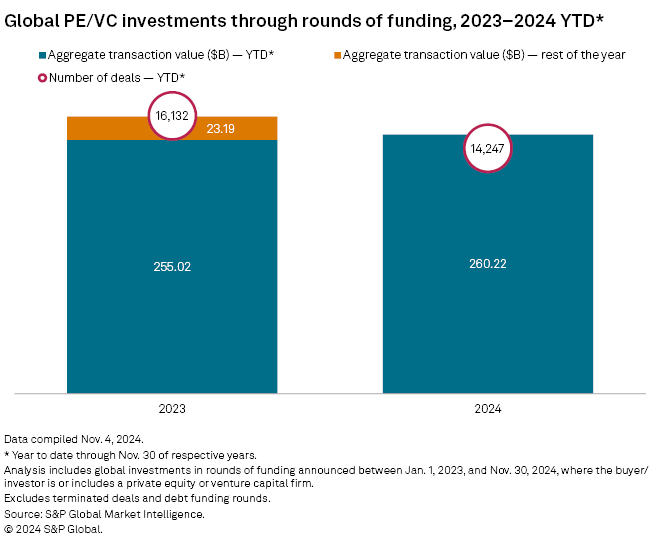

Through Nov. 30, the aggregate value of global venture capital funding rounds grew 2% from a year earlier to $260.22 billion.

The number of deals over the same period declined to 14,247 from 16,132.

Outlook

Venture capital is expected to rebound in 2025 due to opportunities spurred by developments in AI, an anticipated increase in venture capital deployment and valuations remaining in line with historical activity, investment manager Wellington Management Co. LLP said in a report.

Wellington expects a rebound in IPO market and exit environment next year.

"Historically, the longest observed period between peaks in US IPO activity over the past 40 years has been three years, and the end of 2024 will mark the end of the third year. Second, US IPO activity tends to be 39% higher in post-election years compared to election years and 24% higher than in other years. Both historical trends suggest 2025 may be primed for the market to reopen."