The global race to build generative AI capabilities has intensified with the inauguration of US President Donald Trump, who made AI a top priority.

The race is happening on multiple levels. On an international level, the competitive landscape is marked by a strategic rivalry between nations, with the US and China emerging as the leading contenders for AI dominance. At the same time, within the US, companies are competing for resources — both in terms of chips from NVIDIA Corp. and capital.

"AI lies at the heart of US-China geopolitical competition, with both countries recognizing its transformative potential for economic growth and military dominance," wrote Sarah Kreps, a nonresident senior fellow at the Brookings Institution, whose research focuses on the intersection of technology and international relations.

The amazing race

In the US, Trump last week announced the creation of the Stargate Project, a venture that brings together Sam Altman's OpenAI LLC, Masayoshi Son's SoftBank Corp., MGX Fund Management Ltd. and Oracle Corp. The partners said the project will begin with an initial investment of $100 billion in AI infrastructure, with plans to invest an additional $400 billion over the next four years.

The government involvement in accelerating AI development in the US is similar to the support provided by the Biden administration for semiconductors.

"Stargate could be viewed as a private money (and a more datacenter-focused) equivalent of the government-led US CHIPS Act, which pledged 'only' $53 billion but, according to the Semiconductor Industry Association, has also sparked dozens of private investments in the US, totaling nearly $450 billion," John Abbott, principal research analyst at S&P Global Market Intelligence 451 Research, said in a recent note.

However, instead of contributing cash, Trump indicated that the White House would offer expedited access to power and assist in clearing bureaucratic procedures.

"I'm going to help a lot through emergency declarations, because we have an emergency, we have to get this stuff built," Trump said Jan. 21 in announcing the Stargate Project.

The US announcement came days after China launched a new AI investment fund with an initial capital of $8.20 billion. The National AI Industry Investment fund is set to focus on general equity investment and asset management. It is a joint venture between state-backed Guozhi Investment (Shanghai) Pvt. Equity Fund Management and China Integrated Circuit Industry Investment Fund III.

Moreover, China-based Hangzhou DeepSeek Artificial Intelligence Co. Ltd. launched an open-source reasoning foundation model at a much lower price than US alternatives, with pundits noting its competitive performance. This launch threatens to upend the current business models of companies such as OpenAI, which sells its reasoning model for $200 per month.

"Deepseek R1 is one of the most amazing and impressive breakthroughs I've ever seen — and as open source, a profound gift to the world," Marc Andreessen, general partner of Silicon Valley venture capital firm Andreessen Horowitz, posted Jan. 24 on social media platform X.

Inside borders

While countries rush to establish dominance in AI, a concurrent race is underway to develop the next-generation supermodel, with hyperscalers and privately held companies engaged in both competition and collaboration.

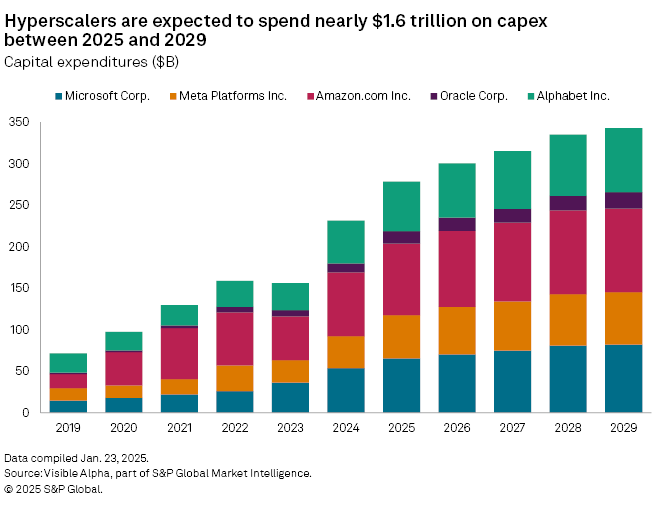

The five hyperscalers — Microsoft Corp., Amazon.com Inc., Alphabet Inc., Meta Platforms Inc. and Oracle — increased their capital expenditures by 48% in 2024, collectively spending over $231 billion, according to Visible Alpha, a part of S&P Global Market Intelligence. Most of that spend is directed toward AI. According to Visible Alpha estimates, capital expenditure at the five hyperscalers is expected to increase 20% again in 2025. Visible Alpha consensus estimates suggest these companies will spend nearly $1.6 trillion on capex in the next five years.

The competition has led to fractured relationships — most notably among OpenAI's Altman and Elon Musk, who in 2015 were both among the 11 co-founders of OpenAI.

After the Stargate announcement, Musk questioned Stargate's ability to deploy $100 billion, much less $500 billion. "They don't actually have the money," Musk wrote on X, the social media app he owns that was formerly known as Twitter. "SoftBank has well under [$10 billion] secured. I have that on good authority."

As CEO of X.AI Corp., Musk is building his own competing frontier foundation model and has an active lawsuit against OpenAI and Altman. Altman, meanwhile, said on X that Musk was wrong about Stargate's funding.

Reports also suggest that the partnership between OpenAI and Microsoft, which epitomized collaboration between AI startups and Big Tech, is becoming strained, as OpenAI seeks to establish its own datacenters instead of relying on Microsoft's cloud. Meanwhile, Microsoft has been building its own frontier AI model.

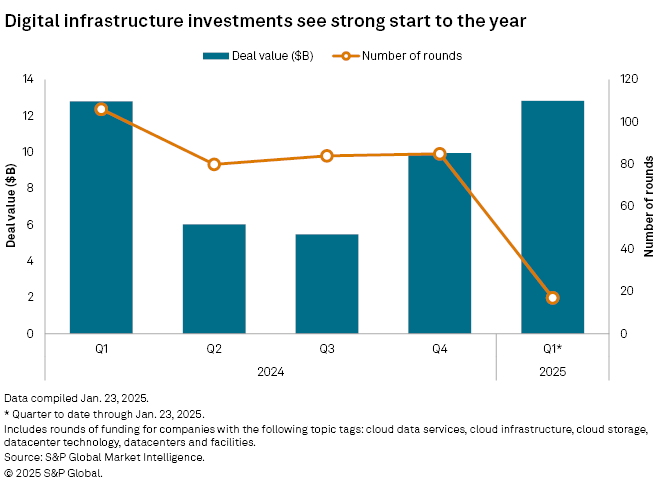

Amid the heated competition, institutional investors are looking for opportunities to participate. Investments in digital infrastructure geared toward AI could surpass last year's record levels. After a strong 2024, 2025 has started off even better. Investments in datacenters since the beginning of the year have already outpaced the same quarter last year. More partnerships are likely, similar to the one announced in 2024 by Microsoft, BlackRock Inc., Global Infrastructure Fund and MGX, which plan to invest up to $130 billion in AI infrastructure.