S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Bankruptcy filings by US private equity (PE) portfolio companies hit a record high in 2024, led by the consumer discretionary and healthcare sectors, according to S&P Global Market Intelligence data.

Consumer discretionary companies backed by PE or venture capital filed 29 bankruptcies in 2024, while healthcare companies filed 27. Combined, the two sectors accounted for over half of the 110 filings by US-based PE portfolio companies.

The surge in restructurings reflects lingering effects of pandemic-era economic disruptions, including shifts in consumer spending and labor shortages. Interest rate hikes in 2022 and 2023 further strained financially troubled companies by increasing refinancing costs.

PE-backed firms appeared more vulnerable than other US businesses. While overall bankruptcy filings rose 9.3% in 2024, portfolio company filings jumped 15.8%.

Read more about the record number of US bankruptcy filings by private equity portfolio companies in 2024.

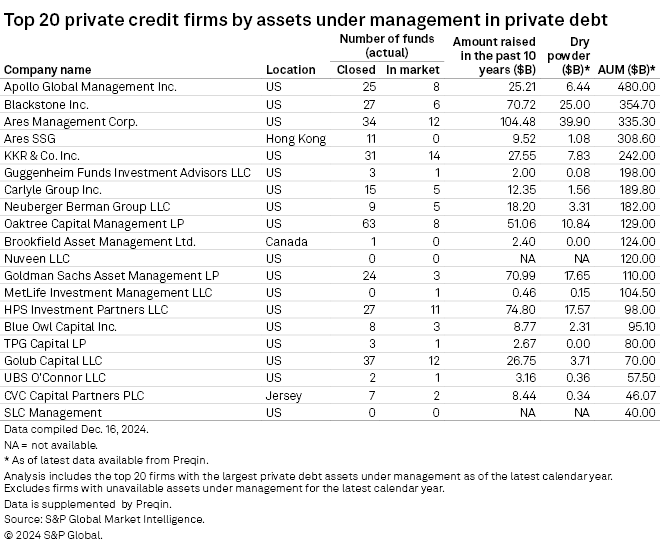

CHART OF THE WEEK: The largest private credit managers

⮞ More than one-third of global private credit dry powder was held by the 20 largest private credit managers as of mid-December 2024, according to S&P Global Market Intelligence and Preqin data.

⮞ Apollo Global Management Inc. was the largest private credit manager globally, with $480 billion in private credit assets under management.

⮞ Seventeen of the 20 largest private credit managers by AUM were based in the US.

TOP DEALS AND FUNDRAISING

– Apollo Global Management Inc. and BC Partners LLP agreed to buy the environmental services business of GFL Environmental Inc. for an enterprise value of C$8 billion. Brown Gibbons Lang & Co. Securities Inc. and JP Morgan Securities LLC served as financial advisers and Latham & Watkins LLP and Stikeman Elliott LLP were legal advisers to GFL. Sidley Austin LLP was legal counsel to Apollo. Kirkland & Ellis LLP served as legal counsel to BC Partners. Osler Hoskin & Harcourt LLP provided Apollo and BC Partners legal advice.

– Blackstone Inc. invested $300 million in AI and data intelligence solutions company DataDirect Networks Inc. The investment values the company at $5 billion. BofA Securities served as DDN's financial adviser in the transaction.

– CC Capital Management LLC made a nonbinding offer to buy wealth manager Insignia Financial Ltd. for A$4.30 per share in cash. The offer represents a 7.5% premium to Bain Capital LP A$4.00 nonbinding proposal to Insignia in December 2024.

– Advent International LP agreed to buy condiments and seasonings maker Sauer Brands Inc. from Falfurrias Management Partners LP. Terms of the deal were not disclosed. Morgan Stanley & Co. LLC, William Blair & Co. LLC and McGuireWoods LLP serve as Sauer Brands' advisers on the transaction. Centerview Partners LLC and Weil Gotshal & Manges LLP serve as advisers to Advent. McGuireWoods LLP is serving as legal adviser to Falfurrias.

– FTV Management Co. LP raised $4.05 billion in capital commitments at the close of its two funds that will invest in enterprise and financial technology companies. The flagship FTV VIII Fund raised $3.4 billion, while FTV Ascend I, dedicated to smaller investments, secured $651 million.

– Bonaccord Capital Partners raised $1.6 billion in capital commitments at the close of Bonaccord Capital Partners II, a vehicle providing growth capital to middle market companies.

– Alphi Capital Inc. secured C$295 million in limited partner commitments at the final close of its debut fund, Alphi Capital I LP. The fund invests in business-to-business services and value-added distribution companies. Metric Point Capital served as placement agent, while Torys served as counsel.

MIDDLE-MARKET HIGHLIGHTS

– Kinderhook Industries LLC acquired specialized equipment lessor and distributor Jack Doheny Cos. Inc. Terms of the deal were not disclosed. Kirkland & Ellis LLP served as legal counsel to Kinderhook. Schwartz Advisors LLC and Taft Stettinius & Hollister LLP served as financial and legal advisers to Jack Doheny, respectively.

– Waud Capital Partners LLC acquired anatomic pathology equipment maker Mopec Group from Blackford Capital Associates II Inc. Terms of the deal were not disclosed. Stout Capital and Kirkland & Ellis LLP advised Waud on the deal. Piper Sandler & Co. and Varnum LLP were Blackford and Mopec's advisers.

– Wynnchurch Capital LP sold compressors and generators maker Boss Industries LLC to Graycliff Partners LP. Terms of the deal were not disclosed. Wynnchurch was advised by Paul Hastings, D.A. Davidson and Deloitte Corporate Finance.

FOCUS ON: CONSTRUCTION AND ENGINEERING

– Trinity Hunt Partners LP sold forensic expertise and litigation dispute support services provider Aperture LLC to Genstar Capital LLC. Terms of the deal were not disclosed. Katten Muchin Rosenman LLP and Deloitte Corporate Finance served as advisers to Aperture.

– Sun Capital Partners Inc. acquired roofing services provider Latite Roofing and Sheet Metal Co. Inc. Terms of the deal were not disclosed.

– Berkshire Partners LLC made a significant strategic growth investment in Electric Power Engineers LLC. Terms of the investment were not disclosed. AEC Advisors advised Electric Power on the transaction, and Houlihan Lokey acted as Berkshire's adviser.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter