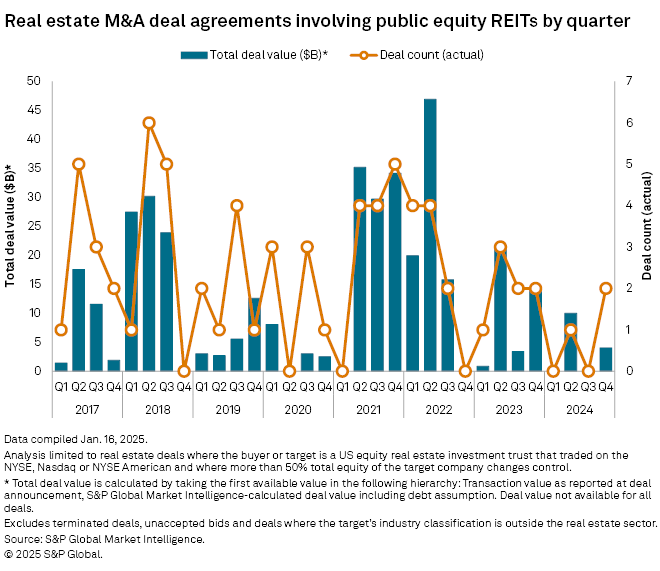

M&A activity involving publicly traded equity real estate investment trusts plunged in 2024, with only three announced deals.

Elevated interest rates and an associated higher cost of debt have largely slowed transactions in the REIT sector.

The analysis included real estate deals where either the buyer or target is an equity REIT that trades on the Nasdaq, NYSE or NYSE American.

Blackstone takes two REITs private

Blackstone Inc.'s privatization of multifamily REIT Apartment Income REIT Corp. marked the largest REIT deal of the year, an all-cash transaction valued at about $10 billion.

Blackstone also agreed to acquire shopping center REIT Retail Opportunity Investments Corp. in early November in an all-cash transaction valued at about $4 billion. According to Blackstone's press release on the matter, the $17.50 per share purchase price represents a premium of 34% compared to Retail Opportunity Investments' closing share price on July 29, 2024, the last trading day prior to news reports of a potential sale.

The most recent deal came on Nov. 22 when NexPoint Diversified Real Estate Trust agreed to acquire NexPoint Hospitality Trust. Under the terms of the deal, NexPoint Hospitality Trust shareholders will receive either 36 cents in cash per unit held or the equivalent value of NexPoint Diversified Real Estate Trust common shares according to the volume-weighted-average price 10 trading days prior to the closing of the transaction.

For comparison, eight deals were announced in 2023, totaling $39.81 billion in transaction value.

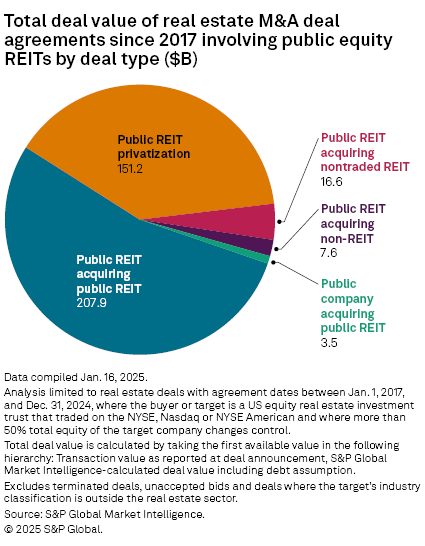

Private equity firms have been active acquirers of REITs over the years. Since 2017, privatizations of public REITs totaled $151.22 billion in transaction value or 39% of the aggregate transaction value of real estate deals involving public REITs over the time frame.

Public REITs merging or acquiring other public REITs was the most common transaction type, accounting for 54% of the total transaction value, which was $207.91 billion.

Deals in which public REITs acquired a nontraded REIT totaled $16.65 billion in transaction value, while $7.59 billion of deals involved a public REIT acquiring a non-REIT real estate company.

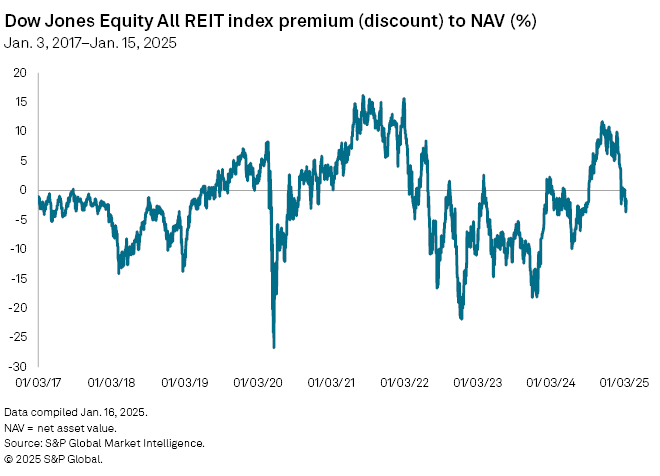

REITs overall trading at discounts to net asset value

REIT share prices plunged in December after the Federal Reserve cut interest rates but also signaled that it will be much more cautious with rate cuts in 2025.

REITs at lower valuations are oftentimes more attractive M&A targets. At the same time, higher interest rates have largely slowed transactions in the REIT sector.

As of Jan. 15, the Dow Jones Equity All REIT Index closed at a 1.6 market-cap-weighted discount to net asset estimates. Within the REIT sector, timber, industrial, farmland and hotel REITs trade at the largest discounts to NAV.