S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

US real estate investment trusts are expected to moderately grow their funds from operations to about 5% in 2025 from 3% to 4% in 2024, Mizuho said in its 2025 REIT Outlook report.

According to Mizuho, many REIT managers and investors foresee a slowdown in the near term but remain hopeful for an improvement in the latter half of the year.

"We think this view is likely to change through the year and that supply remains a key risk into [the second half] for several sectors, including industrial and life sciences. On the positive side, strips, senior housing and datacenters have clear pricing power and are poised to see superior earnings growth vs REIT sector."

In a separate report, Nareit said REIT portfolio managers see continued growth in 2025. They expect REITs "to become net acquirers and provide liquidity to the broader commercial real estate market."

Nareit is the US-based trade association for real estate investment trusts and publicly traded real estate companies.

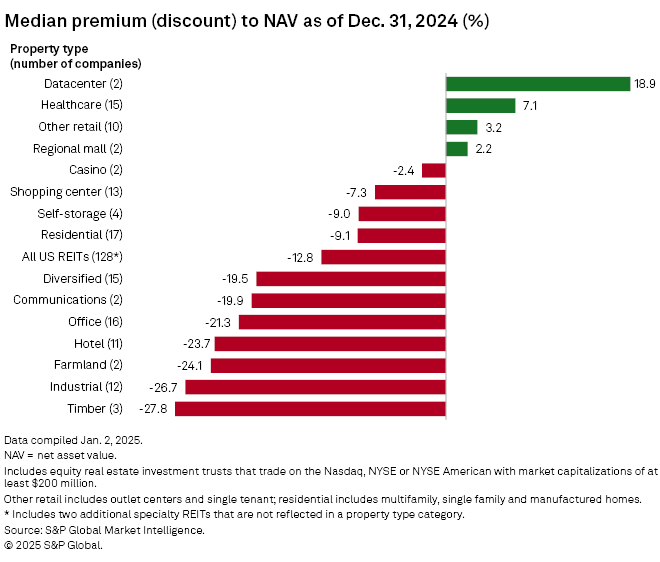

CHART OF THE WEEK: US REITs trade at 12.8% median discount to NAV as of end-December

⮞ Publicly-traded US equity REITs closed 2024 at a 12.8% median discount to their consensus net asset value per share estimates, up from the median 6.5% discount as of Nov. 29, according to S&P Global Market Intelligence data.

⮞ The timber sector traded at the largest median discount to net asset value.

⮞ The datacenter sector traded at the largest median premium to net asset value, with Digital Realty Trust Inc. and Equinix Inc. logging premiums of 21.1% and 16.8%, respectively.

TOP DEALS

– Brookfield Properties LLC sold its stake in the multifamily property at 3333 Broadway in New York City in a deal worth $323.5 million, the Commercial Observer reported, citing sources. Its investment partner, Urban American, along with MSquared and a group of investors now own the building consisting of 1,193 units.

– Pembroke acquired 267 multifamily units at Fitzroy, at 3275 Washington Boulevard in Arlington, Virginia, for $158.3 million, the Commercial Observer reported, citing property records. The developers, Trammell Crow Residential Co. and The Shooshan Co. LLC, sold the units.

– Williams Equities paid $147.5 million for the 300,000-square-foot office property at 470 Park Ave. in Manhattan, New York City. The property was sold by SJP Properties and PGIM Real Estate, Bisnow reported.

– Rexford Industrial Realty Inc. paid $137.2 million to acquire a 300,000-square-foot warehouse at 2501 West Rosecrans Avenue in Compton, California, the Commercial Observer reported. JP Morgan Chase sold the fully leased property.

US HOTEL PERFORMANCE

Key performance indicators for US hotels are up during the week ended Jan. 4, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Revenue per available room (RevPAR) was $81.53, a gain of 14.9% versus the comparable week in 2023 and 2024. Average daily rate (ADR) was $168.90, up 11.7% and occupancy was 48.3%, an increase of 2.9%.

Among the top 25 markets, Tampa, Florida, saw the largest year-over-year occupancy increase. New York City had the highest increase in ADR and RevPAR.

Explore key people moves in North American real estate.

Data Dispatch: US housing market: Home prices reached new highs in October 2024