S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Real estate investment trusts are expected to record a modest 9% total return in 2025 as stubbornly high interest rates remain a headwind, Janney said in a report.

"While we expect operating fundamentals to improve in several sectors as supply continues to dissipate in 2025, stubbornly high interest rates are likely to impede both earnings and REIT share-price growth," Janney said.

It added that REITs will remain challenged as long as the US 10-year Treasury yield remains high.

Industrial REITs are expected to outperform in 2025 driven by less supply, still solid fundamentals and cheaper valuations. Residential REITs will also perform relatively well in the year as the wave of new supply dwindles.

Janney expects office REITs to continue to underperform as refinancing assets remain a challenge, as well as hotels, on the back of higher capital expenditures.

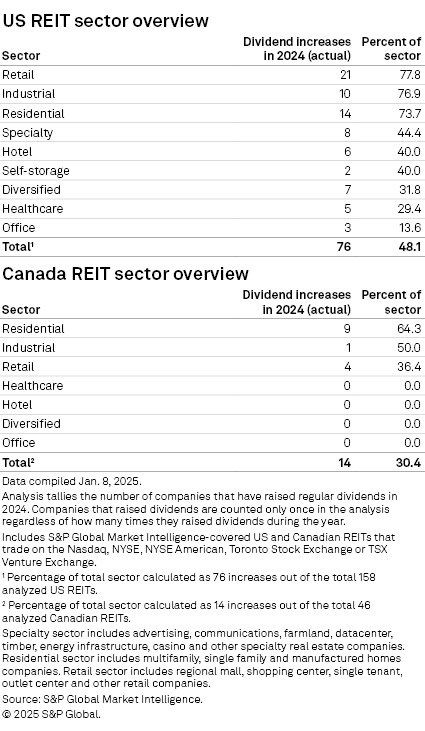

CHART OF THE WEEK: Almost half of US public REITs hike dividends in 2024

⮞ A total of 76, or nearly half of all US-based publicly traded REITs, declared increases to their regular dividends in 2024.

⮞ Almost 78% of all US retail REITs hiked their dividend payouts in 2024, the highest rate among the property sectors.

⮞ In Canada, 14 of 46 REITs declared higher dividends in 2024.

M&A

–

PROPERTY TRADE

– Canyon Partners Real Estate LLC sold the Broadway 101 Commerce Park industrial park in Mesa, Arizona, for $168.3 million to CIP Real Estate, REBusiness Online reported. The 98%-leased property comprises 809,230 square feet across 11 buildings.

– Ashford Hospitality Trust Inc. completed the $123 million sale of the 315-room Courtyard Boston Downtown hotel in Boston.

– Alexandria Real Estate Equities Inc. sold the Esplanade life science campus in San Diego to King Street Properties LLC for $120 million, Commercial Property Executive reported, citing public records. The sale comprises the buildings at 4755 Nexus Center Drive, 4757 Nexus Center Drive and 4796 Executive Drive, along with a fourth building expected to be finished in late 2025, according to the report.

US HOTEL PERFORMANCE

US hotels performance was down across three key metrics during the week ended Jan. 11, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Revenue per available room (RevPAR) was $70.92, dropping 13.2% from the comparable week in 2024. Occupancy was 49.2%, down 7.7% annually. Average daily rate (ADR) during the week was $144.03, down 5.9% year over year.

Tampa, Florida, was the best performing market, reporting the largest gains in each of the criteria.

Explore key people moves in North American real estate.

REIT Replay: US REIT share prices dive during week ended Jan. 10

US REIT net asset value chart book for Q4 2024