S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The availability of retail space in US downtown markets was 88 basis points higher than its suburban counterpart in the third quarter, the largest gap on record, CBRE said in a report.

The real estate services firm attributed the large spread to the impact of remote work, which implies that consumers are spending their income closer to home.

CBRE began collecting retail data in the early 2000s.

Within the downtown districts, those with retail properties that coexist with prime office buildings showed the strongest rent growth compared with their overall market, CBRE said.

The non-prime business districts — those that have no prime office space and are usually adjacent to suburban office parks — also outperformed their market average as limited space availability supports higher rents.

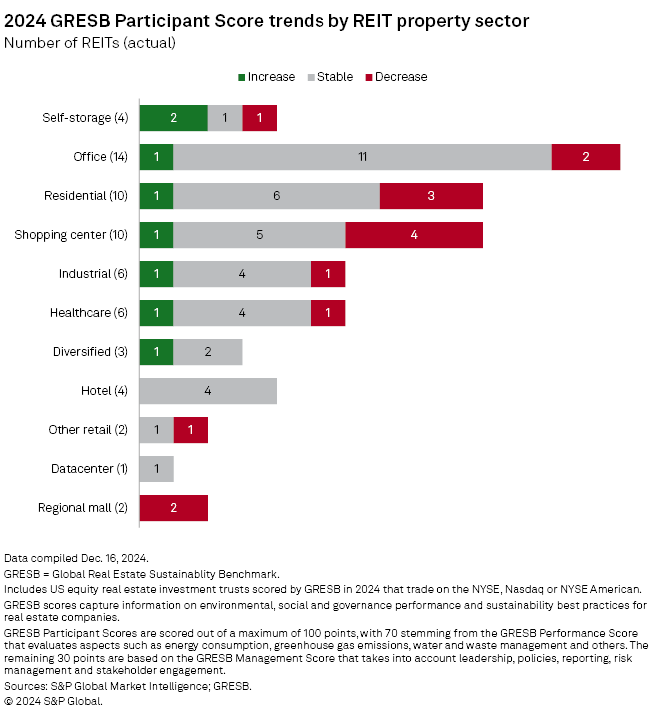

CHART OF THE WEEK: Sustainability benchmark scores mostly stable for US REITs

⮞ Most US equity real estate investment trusts recorded stable Global Real Estate Sustainability Benchmark (GRESB) scores in 2024, with 39 of the 62 companies that were also scored in 2023 seeing little change.

⮞ Fifteen REITs posted decreases, while eight recorded improvement in their scores.

⮞ Office REITs tallied a median GRESB Participant Score of 90, the highest overall.

TOP DEALS

– Lodging company Marriott International Inc. acquired Postcard Cabins, formerly known as Getaway House Inc., a provider of outdoor accommodations.

– Canadian Apartment Properties Real Estate Investment Trust completed the sale of 11,605 residential lots for a gross purchase price of C$715 million, excluding transaction costs and other customary adjustments. The company is selling 533 other lots for a gross price of C$25 million in cash. The deals are part of the REIT's sale of its manufactured home community portfolio.

– Casino REIT Gaming & Leisure Properties Inc. completed the $395 million acquisition of the land and real estate assets of Bally's Kansas City Casino and Bally's Shreveport Casino & Hotel from Bally's Corp. The assets will be leased back to the seller.

– Canada-based Minto Apartment Real Estate Investment Trust and a national Canadian life insurance company agreed to acquire the Lonsdale Square property in North Vancouver for an undiscounted price of C$111.5 million. Minto will acquire a 50% managing interest, while the partner will acquire the remaining 50% nonmanaging interest. Lonsdale Square is a purpose-built rental building with 113 suites and ground floor retail.

US HOTEL PERFORMANCE

US hotels' performance across three key metrics were up year over year during the week ended Dec. 14, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Revenue per available room was $92.32, up 18.2% from the comparable week in 2023. Average daily rate (ADR) improved 8.9% during the week to $155.21. Occupancy was 8.5% higher from the year-ago level, at 59.5%.

Among the top 25 markets, Tampa, Florida, reported the biggest year-over-year occupancy growth and New York City logged the highest gain in ADR.

Explore key people moves in North American real estate.

Chart book for US commercial real estate, December 2024: Weathering the storm

US equity REIT capital offerings more than tripled in November

Average short interest in US REITs up 17 basis points in November

10 US REITs, 4 Canadian REITs boost dividend payments in November

REIT Replay: REIT share prices drop during week ended Dec. 13