| Sberbank was forced by the ECB to close European branches after a run on deposits following Russia's invasion of Ukraine. Source: Sean Gallup/Getty Images via Getty Images News. |

|

The war in Ukraine has prompted a rupture between the Russian and European banking systems, heightening risks for lenders on both sides of the divide.

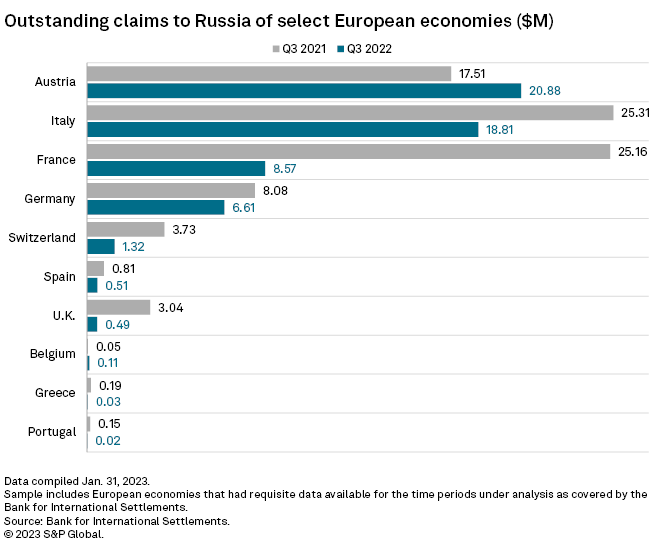

Western banks' exposures to Russia are at their lowest level in nearly 20 years, while big Russian lenders have had to abandon other European markets amid a slew of western sanctions.

Russian banks have taken big financial hits since the invasion of Ukraine 12 months ago, and many western banks have withdrawn from the Russian market, often booking heavy losses in the process. The few western lenders that retain a significant presence in the country — most notably Austria's Raiffeisen Bank International AG and Italy's UniCredit SpA — are attracting increased regulatory scrutiny and facing criticism that their operations are indirectly supporting the war effort.

Given increasing pressure on the banks, it is hard to imagine RBI or UniCredit having operations in Russia a year from now, said Sam Theodore, senior consultant at Scope Insights. "At some point, you have to realize that the bottom line of your income statement is not everything," he said.

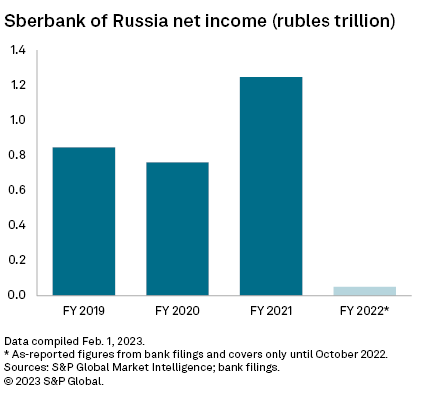

Meanwhile, Russia's weakening economy and ostracization on the global stage has negatively impacted domestic banks' profits and diminished their regional presence. Sberbank of Russia and VTB Bank PJSC, once two of Europe's largest banks by assets, have been forced to withdraw from neighboring European markets such as Hungary, Croatia and Serbia amid an increasing package of global sanctions.

"In many ways, Russia has been pushed to the side of the financial system," said Elisabeth Rudman, global head of financial institutions at DBRS Morningstar.

Pressure ramping up

Subsidiaries of foreign banks remain one of Russia's last links to the Western financial system given that more than 80% of Russian bank assets are affected by sanctions and nearly 64% of total sector assets have been excluded from SWIFT, said Ruslan Gadeev, senior financial analyst at RBI's research department.

The ECB increased UniCredit's minimum capital requirement late last year, in part due to concerns over the bank's remaining operations in Russia, Reuters reported. ECB board chair Andrea Enria said in February the supervisor is putting pressure on Russia-exposed banks to de-risk their local business and would favor banks' efforts to exit the market, the Financial Times reported.

Most recently, a Russian government program introducing loan payment holidays for soldiers fighting in Ukraine has triggered criticism from institutional investors holding stakes in RBI and UniCredit, such as Norwegian pension fund KLP, Reuters reported.

A prolonged exit

A recent ban on foreign-bank stake sales without prior permission by Russian President Vladimir Putin has complicated exit options. Yet, the pitfalls of staying in Russia are starting to outweigh the benefits, even for banks dependent on revenues from the region such as RBI, said Theodore. Banks are risking their reputation and relationships with investors and clients in the west who are bound to wonder whether the lenders' business and the taxes they pay locally are supporting Russia's war effort, he said.

RBI and UniCredit are still undecided on a potential pullout and reluctant to accept major losses. Russia was a significant source of profit for both banks in 2022, according to their latest earnings reports.

UniCredit's strategy is to reduce the exposure to Russia "without leaving too much money on the table," CEO Andrea Orcel said during an earnings call Jan. 31.

RBI CEO Johann Strobl said on a Feb. 1 earnings call the discount on a sale of the Russian unit from a current standpoint would be at least 50%. The bank "needs an improvement" before it chooses that option, he said.

The clock for both banks is ticking, as upcoming sanctions will heighten compliance and reputational risks, while the banks struggle to keep their Russian subsidiaries profitable in an increasingly difficult and uncertain environment, according to a consultancy covering the situation, which agreed to speak on the condition of anonymity.

An RBI spokesperson did not comment on plans for the Russian business in 2023, but said the bank is "confident that the information provided to OFAC will satisfy their request." UniCredit did not respond to a request for comment at the time of publication.

While the impact of the war on Western banks is considered broadly manageable by both the market and regulators, Russian banks have taken a heavy financial blow from sanctions and lost presence in neighboring countries.

The fire-sale of Sberbank units in Central and Eastern Europe has shifted market share to domestic players in the region, particularly in Croatia, Slovenia, Bosnia and Herzegovina, Gadeev said.

The sector managed to reverse a collective loss of 1.5 trillion rubles from the first half of 2022, but many banks ended the year with significant losses, the central bank said. The number of loss-making Russian banks in December 2022 was 104, up from 77 in January that year, the data shows.

Any future recovery in profits will depend on how well the Russian economy adjusts to the more challenging environment, according to Gadeev.

With no indication that the war will end soon, the economic environment in 2023 and 2024 "promises to be weak and likely volatile," said Stephan Barisitz, a research economist at the Austrian central bank. Against this background, credit and exchange rate risks "will remain pronounced for Russian banks," said Barisitz, who specializes in Russia, Ukraine and other former Soviet economies.

Russian authorities have the means to support domestic banks, at least in the short term, thanks to large energy revenues accumulated in 2022, Barisitz noted.

Yet banks must brace for more international sanctions that would isolate them further from the Western financial system.

In its latest package of measures against Russia, the EU is taking aim at four big credit institutions, including the country's largest private bank, JSC Alfa-Bank, Politico reported Feb. 13. The new package is scheduled to launch at the one-year anniversary of the Ukraine war on Feb. 24, Deutsche Welle reported.

As of Feb. 21, US$1 was equivalent to 74.83 Russian rubles.

To learn more about how the war has affected different markets and sectors sign up for a demo of S&P Capital IQ Pro