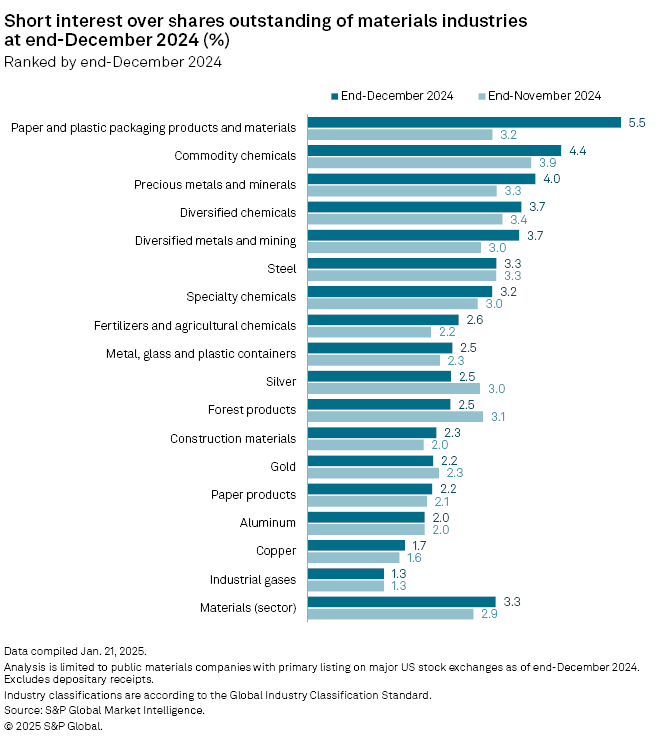

Short sellers increasingly targeted materials stocks toward the end of 2024, with the sector recording one of the highest run-ups in short interest on major US exchanges during December.

Short interest in the materials sector, which includes metal and chemical producers and makers of construction materials, jumped to 3.3% at the end of December, up 40 basis points from the end of November, according to the latest data from S&P Global Market Intelligence.

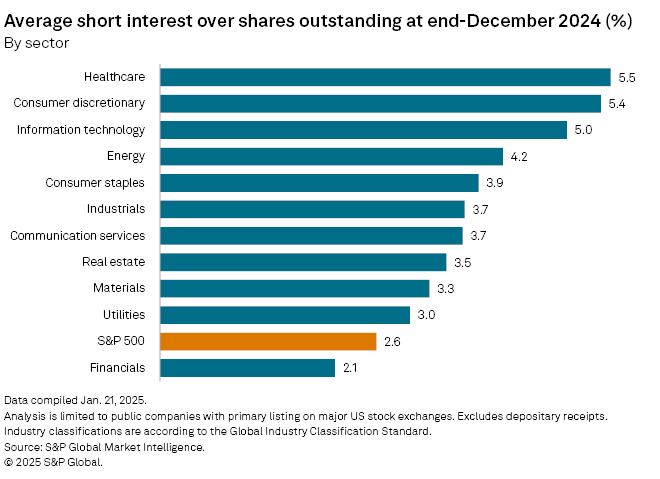

Healthcare stocks recorded a slightly higher jump at the end of December, up 41 bps from a month earlier. The sector has been consistently one of the most-shorted on major US exchanges throughout 2024, reaching 5.5% at the end of December, higher than other sectors. Consumer discretionary stocks — the most shorted stocks throughout much of 2024 — had short interest of 5.4%, up 24 basis points from the end of November.

Sector breakdown

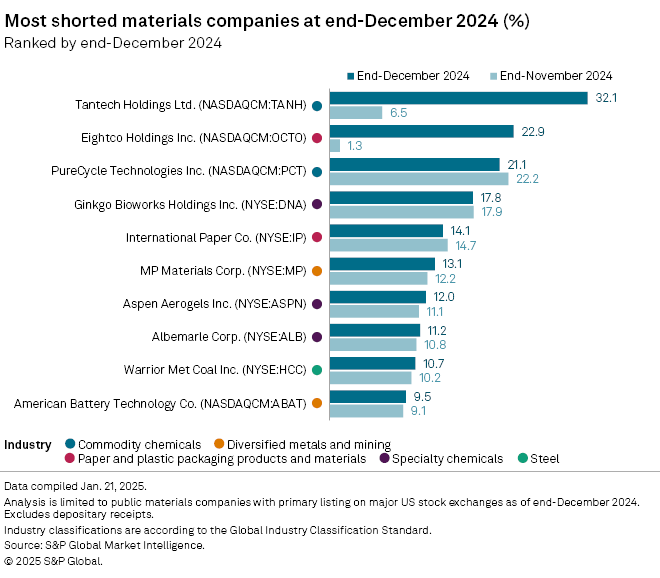

Within the materials sector, Tantech Holdings Ltd. was the most shorted stock at the end of December, jumping to 32.1% at the end of 2024 from just 6.5% a month earlier.

Tantech, a China-based bamboo product company with majority control of a specialized vehicle manufacturer, saw its stock crash to just 21 cents per share at the end of 2024 from a high of more than $871 per share in November 2020. The company is trying to regain compliance with Nasdaq's minimum bid price requirement.

At the end of 2024, the paper and plastic packaging products and materials industry was the most shorted within the materials sector, with short interest climbing to 5.5% at the end of December from 3.2% at the end of November.

S&P 500

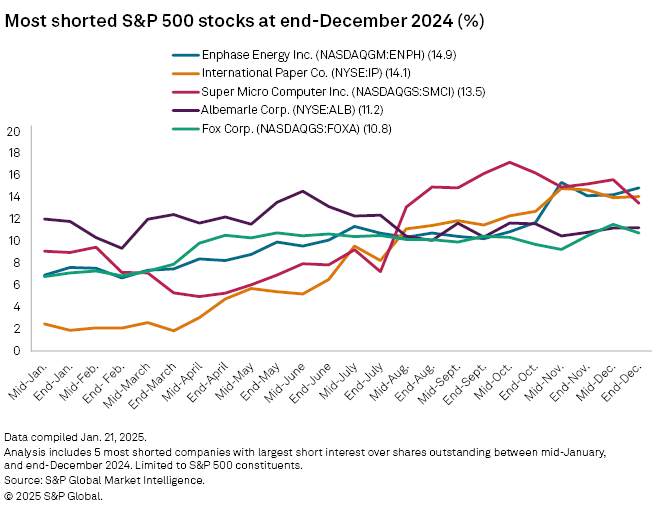

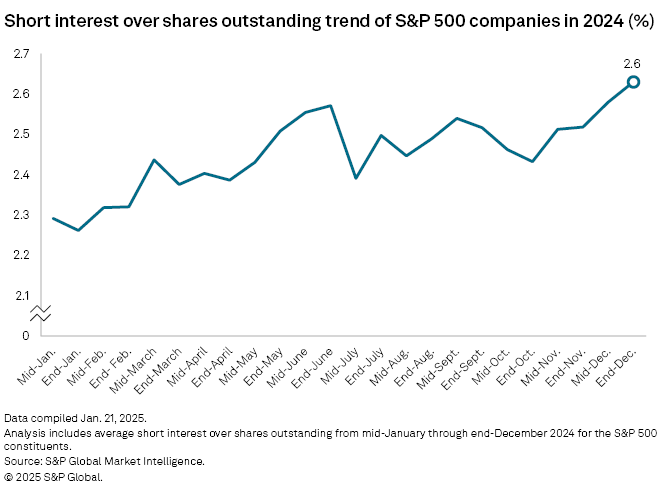

Short interest in the S&P 500 climbed throughout most of 2024, jumping to 2.6% at the end of December from a low of 2.3% at the end of January.

Enphase Energy Inc. was the most-shorted S&P 500 stock at the end of December, with 14.9% short interest, up from 14.2% a month earlier and 7.6% at the end of January. Over the course of the past year, Enphase shares have lost about a third of their value.