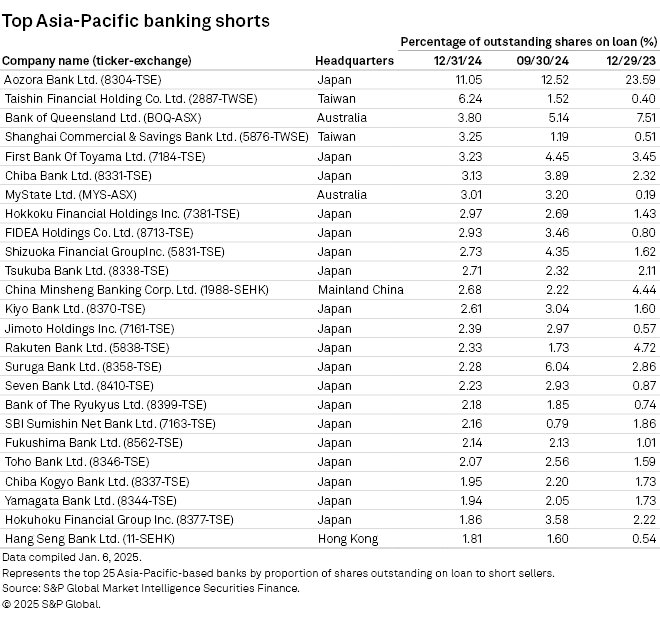

Smaller lenders from Japan dominated the list of the most shorted banks in Asia-Pacific in the quarter ended Dec. 31, 2024.

Among the 25 most shorted banks in the region, 19 were small and regional Japanese lenders, compared with 16 in the September quarter. Aozora Bank Ltd. was the most shorted bank in Asia-Pacific with 11.05% of its shares held by short sellers, a decrease of 1.47 percentage points from the previous quarter. Aozora was also the most shorted lender in the previous quarter quarter though short interest in its shares declined from 23.59% in the quarter ended 2023, according to S&P Global Market Intelligence data.

The second Japanese lender on the list is The First Bank of Toyama Ltd., with 3.23% of its shares held short, closely followed by The Chiba Bank Ltd., which has 3.13%.

Rising rates

While Japan's megabanks have gained from the end of the nation's experiment with negative interest rates, many small and regional banks have struggled to pass higher rates to their customers who typically have weaker financial profiles than clients of bigger lenders.

"It won't be easy for them [regional banks] to raise lending rates as they have to negotiate a raise in lending rates with borrowers that would [find it difficult to] shoulder growing borrowing costs," said Hideo Oshima, a senior economist at Japan Research Institute, in a report.

More than half of Japanese regional banks failed to improve the margin between lending and deposit rates in the first six months of the fiscal year ending March 31. "Given that, investors may have set short positions in some regional banks," Oshima told Market Intelligence in a phone interview.

Taiwan's Taishin Financial Holding Co. Ltd. was the second-most shorted bank stock in Asia-Pacific, with 6.24% of its shares held by short sellers, a jump from 0.40% a year earlier. Taishin Financial announced a merger deal with Shin Kong Financial Holding Co. Ltd. in September 2024, which is likely to weaken Taishin's credit profile, according to S&P Global Ratings.

Another Taiwanese bank on the list was The Shanghai Commercial & Savings Bank Ltd., with short positions rising to 3.25% of total shares from 0.51% in the prior-year quarter.

Australia's Bank of Queensland Ltd. was the third-most shorted among regional peers, though the outstanding shorts on its stock declined to 3.80% from 5.14% in the previous quarter. MyState Ltd. was the other Australian bank on the list, with 3.01% of its shares held by short sellers.

China Minsheng Banking Corp. Ltd. was the only mainland Chinese bank on the list, with 2.68% of its shares held by short sellers. Hang Seng Bank Ltd., with 1.81% of its shares shorted, was the only Hong Kong-based lender on the list.