Singapore banks posted substantial increases in their capital equity Tier 1 ratios as the final Basel III reforms came into effect.

Most of the 41 Asia-Pacific banks with assets of more than $300 billion logged improvements in their capital equity Tier 1 (CET1) ratios for the 12 months ended Sept. 30, compared to the same period in the previous year, according to data from S&P Market Intelligence. All three major Singapore banks saw significant increases in their CET1 ratios.

DBS Group Holdings Ltd.'s CET1 ratio climbed 3.06 percentage points year over year to 17.17% during the 12 months ended Sept. 30, while United Overseas Bank Ltd.'s CET1 ratio increased by 2.47 percentage points to 15.49% and Oversea-Chinese Banking Corp. Ltd.'s rose by 2.38 percentage points to 17.17%.

The Monetary Authority of Singapore noted that the local banking groups' CET1 capital adequacy ratios rose from 14.0% in the third quarter of 2023. The phased adoption of the final Basel III reforms came into effect July 1.

CET1 ratio indicates how well a bank can withstand stress. The ratio measures the proportion of most-liquid capital that banks hold against their risk-weighted assets, in which the value of their loan portfolios and other assets, such as bonds, are adjusted for credit and market risks. An increase in a bank's risk-weighted assets pushes its CET1 ratio down.

The three Singapore-based banks saw a combined S$105 billion reduction in risk-weighted assets in the third quarter as the final Basel III rules took effect, according to a Nov. 19 report from Risk Quantum. DBS Bank posted the largest drop, down by 12.5% to S$338 billion, followed by United Overseas Bank, down by 11.2% to S$252.2 billion, and OCBC, down by 9.8% to S$227.2 billion, according to the report.

The final implementation of Basel III reforms raised capital between 1.5% to 2% from July 1 at Singapore banks, according to a S&P Global Ratings report. "We believe the uplift will gradually erode as the capital output floors are phased in over five years, resulting in no net uplift to regulatory capital adequacy ratios by 2029," Ratings said in its report dated Nov. 14.

Two Japanese banks recorded some of the largest year-over-year jumps in their CET1 ratios. The Norinchukin Bank's CET1 ratio rose by 6.15 percentage points year over year as of the end Sept. 30 to 20.17%, while that of Mitsubishi UFJ Financial Group Inc. (MUFG) rose by 3.74 percentage points to 14.35%.

Two Japanese banks recorded some of the largest year-over-year jumps in their CET1 ratios. The Norinchukin Bank's CET1 ratio rose by 6.15 percentage points year over year as of the end Sept. 30 to 20.17%, while that of Mitsubishi UFJ Financial Group Inc. (MUFG) rose by 3.74 percentage points to 14.35%.

MUFG said in May that to raise its CET1 ratio by the fiscal year ending in March 2027, it wanted to increase high-profitability risk-weighted assets by ¥12 trillion and shed ¥5 trillion worth of low-profitability assets.

On the other extreme, Japanese megabank Sumitomo Mitsui Financial Group Inc. posted a 76-basis-point decline in its CET1 ratio to 13.18% over the same period.

The implementation of the final Basel III standards by internationally active banks in Japan began from March, while the rules are expected to be implemented by Hong Kong and Malaysian banks from January 2025.

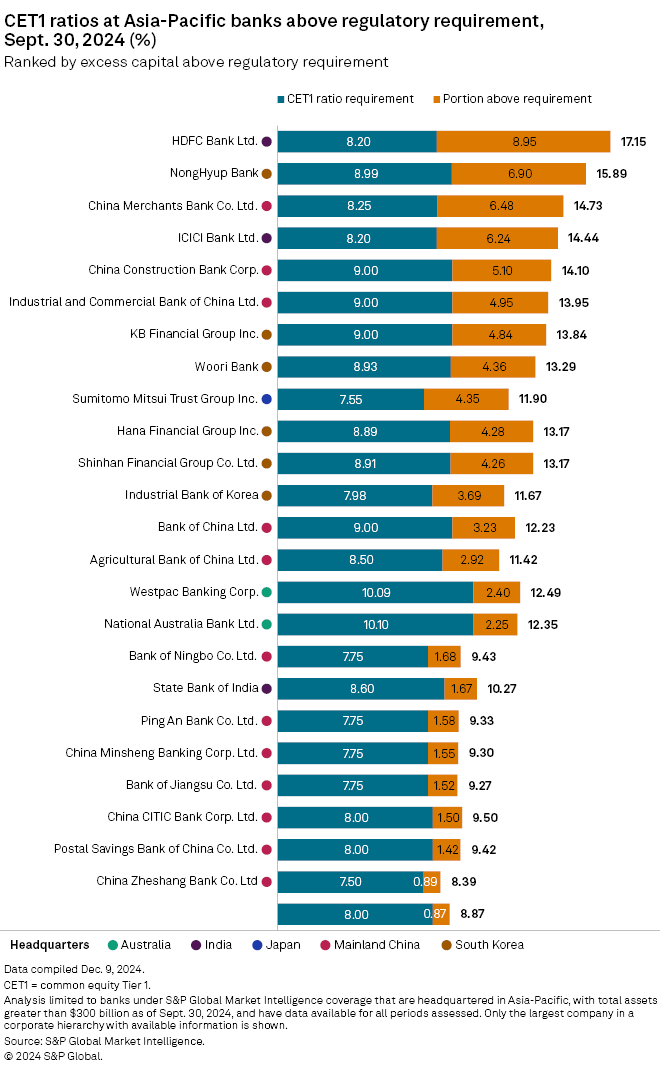

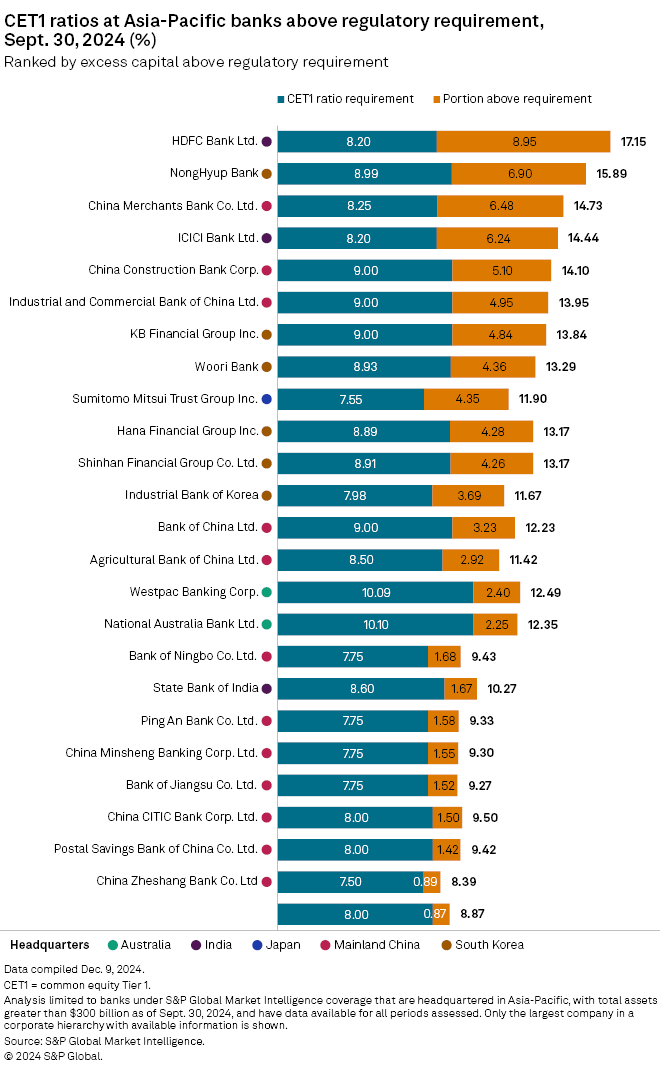

India-based HDFC Bank Ltd., South Korea-based NongHyup Bank and China-based China Merchants Bank Co. Ltd. were the top banks in the region with CET1 ratios well above regulatory requirements in the 12 months to Sept. 30, according to Market Intelligence data. HDFC Bank's CET1 ratio of 17.15% was more than double the minimum required ratio of 8.20%, according to the data.

As of Dec. 19, US$1 was equivalent to S$1.36.