Global private equity and venture capital deal value in the software and IT services sector of the Southeast Asian regional bloc has recovered from a sharp drop in 2023 levels with Singapore as the top investment destination, far ahead of its neighbors.

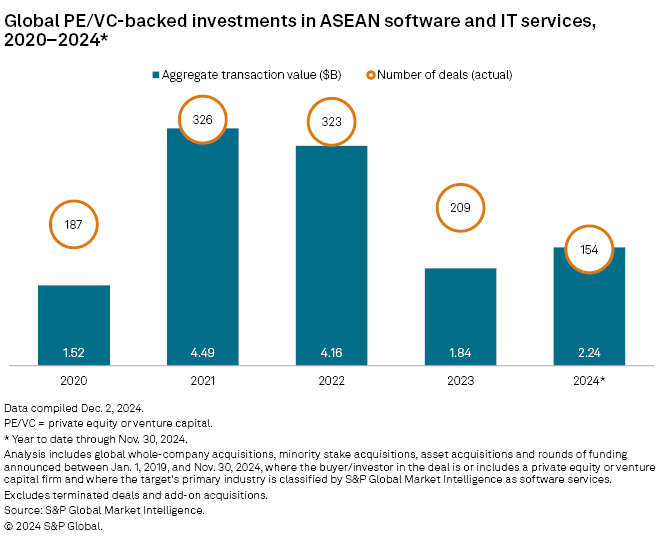

From Jan. 1 to Nov. 30, private equity investment in the sector across the 10 Southeast Asian countries that comprise the Association of Southeast Asian Nations reached $2.24 billion, about 22% higher than the $1.84 billion recorded for full year 2023, according to S&P Global Market Intelligence data.

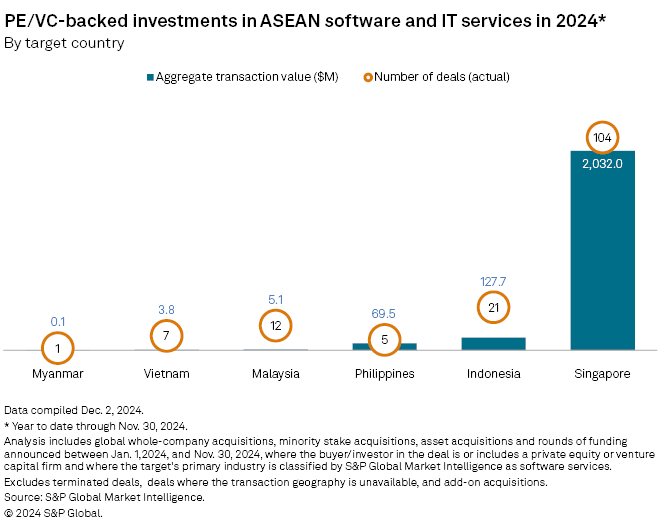

Singapore, known as a startup hub for its favorable regulatory and financial environment for IT entrepreneurs and venture capital, accounted for 90% of the deal value.

However, deal value in 2024 so far is only about half of 2021 and 2022 levels, impacted by high interest rates and inflation worldwide.

Scaling opportunities

The rising private equity interest in the sector — defined as companies that specialize in mobile apps, online financial services, cloud technology, digital data analytics and internet infrastructure management — bucks the declining trend in overall private equity investments in the region this year.

The sector has received more than $14 billion in private equity funding since 2020 as Southeast Asia's digital economy evolves. Opportunity for scaling the operations of software and IT services companies is driven by the region's gross merchandise value — the total value of goods and services sold through e-commerce platforms — which surpassed $200 billion in 2022.

It is forecast to grow to at least $1 trillion by 2030, according to a research paper from the Economic Research Institute for ASEAN and East Asia.

Gross merchandise value, which includes online shopping, travel bookings and ride-sharing services, requires reliable cloud technology and internet connections as more people in ASEAN countries transact online, the report said.

Singapore-headquartered companies have captured nearly all private equity inflows into the region's software and services industry from Jan. 1 to Nov. 30 with 104 transactions amounting to about $2 billion. Indonesia ranked second with 21 deals totaling $127.7 million, and the Philippines came in third with five deals amounting to $69.5 million.

Malaysia, Vietnam and Myanmar together had 20 deals totaling $9 million.

– Download a spreadsheet with data featured in this story.

– Read up on family offices with the largest private equity allocations.

– Learn more about private equity trends in fintech.

US investors fund Singapore-based companies in largest deals

The largest private equity-backed deal was KKR & Co. Inc. and Singapore Telecommunications Ltd.'s $1.3 billion investment in datacenter and internet infrastructure manager STT GDC Pte. Ltd., which does business as ST Telemedia Global Data Centres.

The second-largest deal was a $105 million series C round involving Salesforce Ventures LLC and GIC Pte. Ltd. for data and AI management platform developer Peeply Private Ltd., which does business as Atlan. The company will use the proceeds to expand its research and development infrastructure.

Private investors to focus on nascent sectors, exit strategies

Private investors anticipating the next wave of growth in Southeast Asia's digital economy have invested heavily into nascent sectors such as software as a service, enterprise IT solutions and Web3 companies, according to a November report by Bain & Co., Temasek Holdings (Pvt.) Ltd. and Google LLC.

Investor confidence in exit strategies in Southeast Asia is still subdued, though measures are being taken to improve the exit environment in the region, including increased regional cooperation and capital market enhancements.

Southeast Asia's digital economy is expected to hit $263 billion in gross merchandise value by the end of 2024, the report added.