| The potential €12 billion tie-up of Spanish lenders BBVA and Sabadell has spurred hopes for more M&A among big European banks. |

Mergers and acquisitions in Europe's banking sector are prepared for takeoff in 2025, as lenders plan to capitalize on strong profitability to significantly expand and transform their businesses.

Three possible megamergers — Banco Bilbao Vizcaya Argentaria SA's bid for Spanish rival Banco de Sabadell SA, and Italian bank UniCredit SpA's investment in Germany's Commerzbank AG and takeover offer for domestic peer Banco BPM SpA — signal a willingness for banks to pursue transactions of a size unseen since the global financial crisis.

Higher interest rates triggered a rebound in profits, filling banks' coffers. As the rate cycle turns, many lenders will look to M&A to offset lower lending income and maintain earnings momentum, and boost their competitiveness on the global stage.

M&A experts at law firm White & Case said in a report that they are "more bullish on bank M&A than we have been in the last five years."

"M&A in financial services is hot in 2024, but is expected to turn red hot in 2025," said Hyder Jumabhoy, partner in the law firm's global corporate M&A practice and co-author of the report.

Perfect storm

Scale is of ever-increasing importance in banking as regulatory costs and IT investments rise, while growing competition from low-cost providers erodes margins, according to a recent analysis by M&G Investments. The complexity of customers' needs, especially in corporate and institutional banking, is a further structural driver of M&A as banks look to expand the depth and breadth of their capabilities, they said.

These pressures are not necessarily new, but lenders are now in a better position to pursue acquisitions thanks to a sustained period of bumper profits and declining financing costs. Banks have "abundant capital," prompting management to choose between investing in growth, acquiring others or returning capital through buybacks. While buybacks are attractive, "they offer limited future growth potential," Man Group said in an Oct. 1 analysis.

Falling rates are a key cyclical driver for bank M&A, according to M&G, as lenders seek "to keep the positive earnings momentum through synergies."

"With a renewed currency, peak earnings and clean and strong balance sheets, this should be prime time for bank M&A," M&G said.

Pick and choose

Some banks have very clear strategies and know where they want to grow and where to pull back from, White & Case's Jumabhoy said.

For example, BBVA's move to take over domestic peer Sabadell aligns with its goal of being among the top three players in each of the markets where it operates. Similarly, UniCredit's acquisition of BPM would make it Italy's largest bank by assets and expand its footprint in the wealthier north of the country. A tie-up with Commerzbank would boost UniCredit's footprint across borders in a market where the bank already has a strong presence.

More banks are seeking to diversify their income streams by acquiring new asset management and fee income-boosting businesses, a strategy made all the more attractive by the so-called Danish Compromise, an EU rule allowing lenders to use their insurance units to acquire businesses at favorable capital terms. French banking group BNP Paribas SA agreed to acquire asset manager AXA Investment Managers SA via its insurance business for €5.4 billion in August this year. In November, Italy's Banco BPM SpA launched a €1.5 billion bid to take full control of asset manager Anima Holding SpA, also via its insurance business, saying the deal would be transformational.

The Danish Compromise, named after Denmark's EU presidency in 2012, was enacted temporarily but will become a permanent feature of European regulations from Jan. 1, 2025, with the introduction of the third leg of the Capital Requirements Regulation. This is expected to trigger "a revival of bancassurance," a recent EY report said.

In the crosshairs

The emergence of a wider range of possible takeover targets is aiding dealmaking momentum.

Several large banking groups that were bailed out during the global financial crisis are once more going private. As bank share prices rise thanks to surging profits, local governments have reduced their stakes in UK-based NatWest Group PLC, Germany's Commerzbank, Netherlands-based ABN AMRO Bank NV, Italy's Banca Monte dei Paschi di Siena SpA, Allied Irish Banks PLC and National Bank of Greece SA in 2024.

The removal of these stakes will give banks more flexibility to "pursue strategic shifts and growth opportunities" and boost confidence in the sector, "which can now operate independently following years of restructuring, de-risking and re-regulation," Scope credit analyst Marco Troiano said in an Oct. 16 report.

Challenger banks are also providing a stimulus for takeover activity. This is most evident in the UK, which led European financial sector consolidation through the first three quarters of the year with the three largest definitively agreed or completed deals.

The largest of these saw Nationwide Building Society take upstart lender Virgin Money UK PLC off the board, while Coventry Building Society and Barclays PLC also picked up smaller businesses amid growing competition and a push for scale, according to White & Case.

"Challenger banks across the UK and Western Europe are more mature and are likely to come under considerable pressure to deliver exits and/or transformational transactions for financial sponsors who have remained patient over the last five years," according to White & Case.

Regulatory headwinds

The key potential stumbling block to large-scale M&A comes from Europe's fragmented regulatory environment.

Banks, regulators and politicians have all spoken of the need for greater financial cooperation across the continent. A banking union with stronger pan-European players is considered essential to stimulating growth within Europe and improving its competitiveness on the global stage.

"Europe needs stronger, bigger banks to help it develop its economy and help it compete against the other major economic blocs," UniCredit CEO Andrea Orcel said in a Nov. 25 statement following the announcement of the BPM deal.

Turning the theory into practice has proved more challenging. UniCredit's tilt at Commerzbank provoked strong pushback from German politicians and unions, who are resisting a national champion falling into foreign ownership. The outcome of BBVA's bid for Sabadell is uncertain after Spanish authorities extended a review of the merger over concerns about reduced competition.

European regulators signaled a willingness to support larger transactions, but getting watchdogs' blessings is dependent on the individual cases, Jumabhoy said. A merger could face resistance from competition authorities if there are concerns about market concentration materially impacting customer choice, or from prudential authorities if concerns arise regarding the consolidated bank's capital health and financial stability, Jumabhoy said.

Even if approval is gained at the European level, individual countries can still block deals they feel are not in their own best interests.

Still, UniCredit's investment in Commerzbank "shows that despite significant hurdles associated with cross-border consolidation, institutions are still willing to engage under certain conditions," Scope's Troiano said.

Green shoots

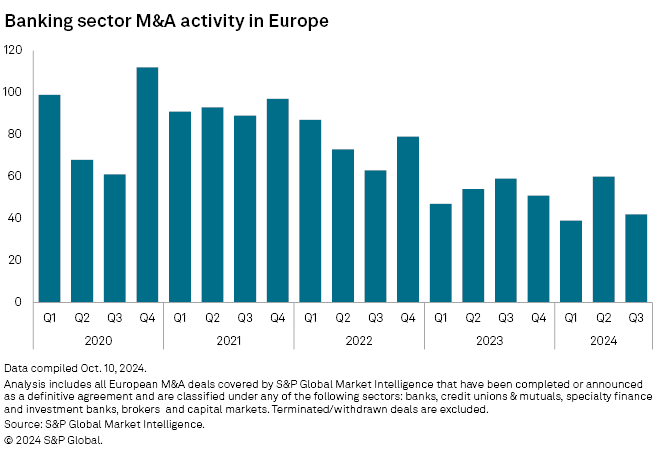

There were 141 announced or completed financial sector M&A deals in Europe in the first three quarters of 2024, compared to 160 in the same period a year ago, S&P Global Market Intelligence data shows. While deal numbers lag previous years' levels, deal values increased.

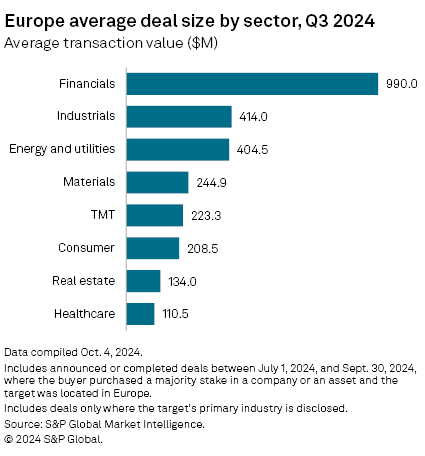

The sector had by far the highest average transaction value in the third quarter of 2024 across all industries, the data shows.

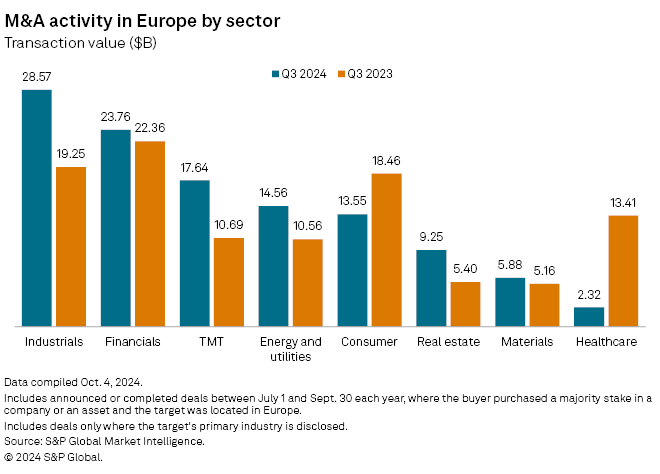

The financials sector booked the second-highest overall transaction value during the third quarter of 2024, after ranking second by overall transaction value in the second quarter of the year.

European M&A activity across all sectors is forecast to pick up in 2025, with large economies such as the UK and Germany seeing the most activity, said Filip Drazdou, associate at technology sector M&A advisory firm Aventis Advisors.

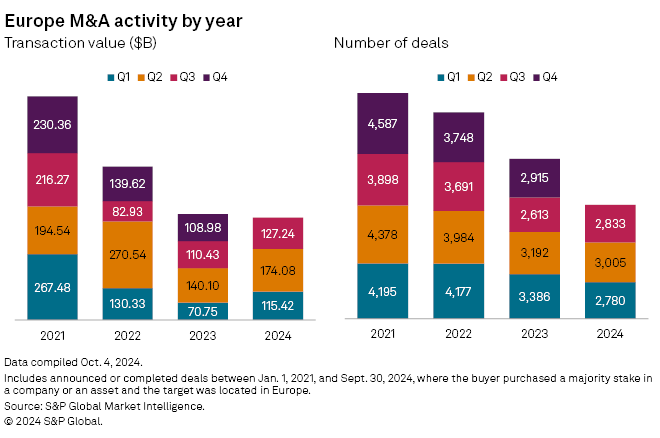

Larger deals have supported European M&A activity so far in 2024 with combined deal value for the first three quarters of the year almost at the level of full year 2023, Market Intelligence data shows.