Profitability is expected to remain the biggest risk for China's banking sector in 2025 as credit contraction persists amid slowing economic growth in the world's second-largest economy.

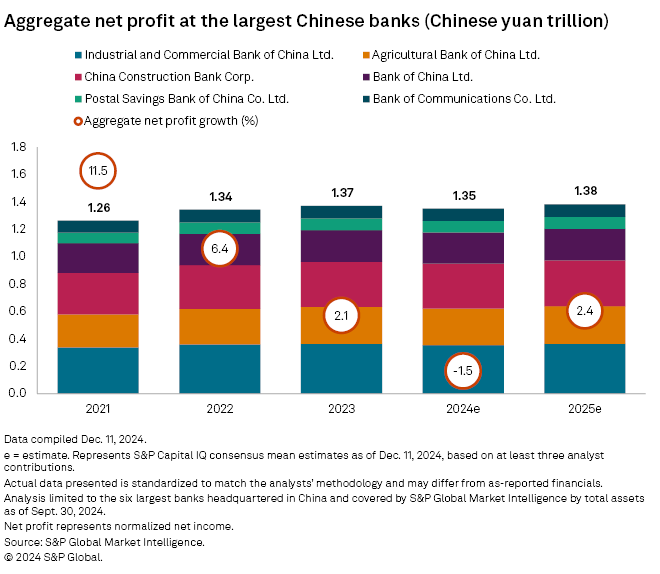

The combined net profit of China's six largest state-owned commercial banks — Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., China Construction Bank Corp., Bank of China Ltd., Bank of Communications Co. Ltd. and Postal Savings Bank of China Co. Ltd. — is projected to decline by 1.5% in 2024 to about 1.35 trillion yuan, according to S&P Capital IQ estimates. A mild recovery is anticipated in 2025, but earnings growth already slowed to 2.1% in 2023, down from 11.5% in 2021.

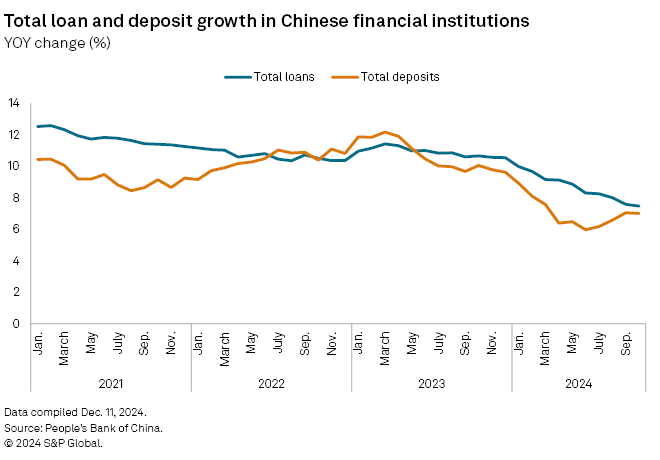

"With slowing credit growth — driven by weak demand from both corporations and consumers — and subdued interest margins, Chinese banks will struggle to protect their profitability," said Gary Ng, senior economist for Asia-Pacific at Natixis.

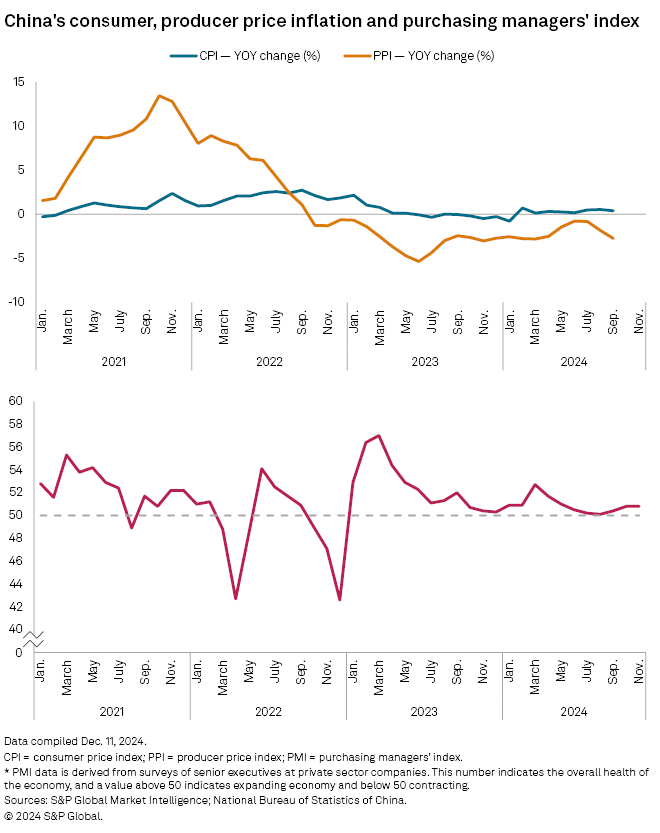

Chinese lenders previously managed to balance loan growth and margins, but "this time is different," Ng said, citing a slowing economy and stagnant inflation.

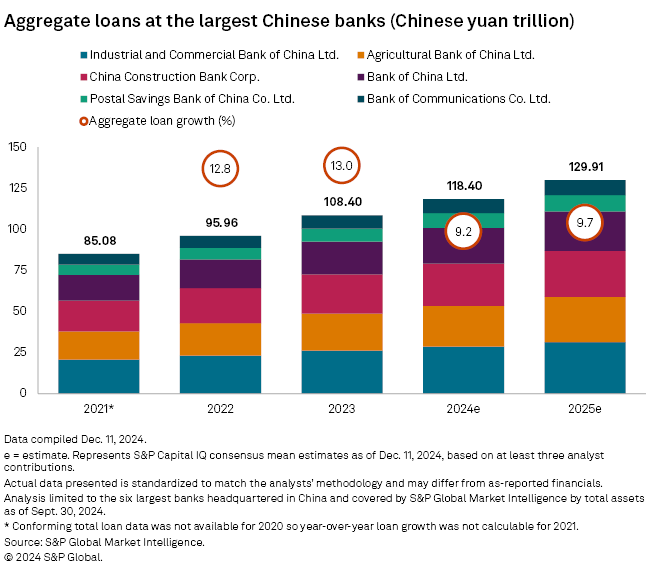

Loan growth at the six largest banks is forecast to slow to 9.2% in 2024 and 9.7% in 2025, from 13.0% in 2023, according to S&P Capital IQ estimates. Bank of Communications is expected to post the slowest growth at 6.0% in 2025.

Year-over-year bank loan growth hit a multiyear low of 7.48% in October, down 319 basis points from a year earlier, according to the People's Bank of China (PBOC). This decline occurred despite a slight recovery in deposit growth.

The six biggest banks accounted for 60.4% of the total net profit of the country's top 100 banks, according to the China Banking Association.

China is expected to maintain its GDP growth target of about 5% in 2025, consistent with the prior two years. While the economy grew 5.2% in 2023, meeting the target, S&P Global Ratings forecast slower growth of 4.8% in 2024, 4.1% in 2025, and 3.8% in 2026, weighed down by a prolonged property market downturn.

Policy measures

Authorities have introduced measures to address these risks, including allowing homeowners to renegotiate mortgage terms to reduce interest rates on 34 trillion yuan in outstanding loans and a reported capital injection of up to 1 trillion yuan for the six biggest banks.

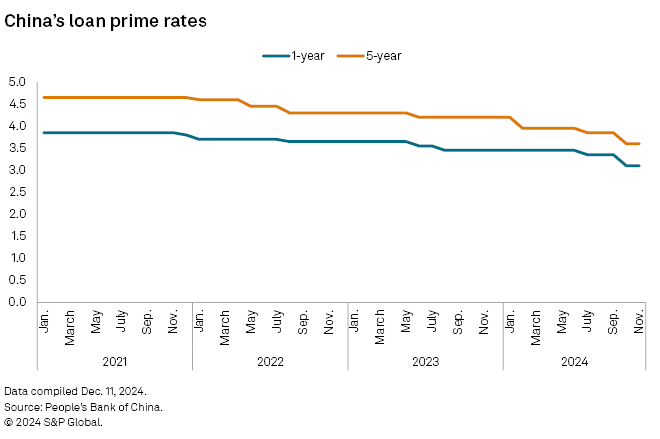

The PBOC has pursued policy easing, cutting benchmark lending rates to record lows in October and implementing a 12 trillion yuan debt swap package in November to ease local government debt burdens. Local governments, which rely heavily on property sales for revenue, remain vulnerable to the real estate slump, further exacerbating credit risks for the banking system.

Local government debt and the property sector downturn could persist for another five to seven years, Ng said, describing them as "gray rhinos" that are the number two and three risks, respectively, to the banking sector.

"We expect to see flattish earnings growth for the big six," said Jingjing Weng, senior analyst for China Equity at Eastspring Investments, in an email interview. Weng attributed the pressure to narrowing net interest margins (NIM) caused by rate cuts, local government debt swaps and rising nonperforming loans in the retail sector.

In the third quarter, aggregate NIM at China's commercial banks stood at 1.53%, down 20 bps year over year, according to the National Financial Regulatory Administration. Return on capital, a key profitability metric, fell to 8.77%, down 14 bps from the prior quarter, after remaining in the mid-double digits for much of the past decade.

Releasing bad debt provisions will anchor banks' earnings growth and support dividend payouts, Weng said.

The upcoming capital injection is expected to restore lending capacity, strengthen operations and enhance banks' ability to address local government debt and property market challenges. Weng added that the debt swap program would help contain credit costs.

"Credit demand has been too weak for a boost amid the shrinking property market, while banks have already lent to some borrowers at lower-than-treasury yields," said Jefferies in a Dec. 1 note.

With further capital injections into state-owned banks to stabilize the financial system, "[the] PBOC would be able to conduct more rate cuts despite unsustainable bank NIMs," Jefferies said, projecting an additional 30 to 50 bps policy rate reduction by the end of 2025.

Lingering property risks

The property sector remains a key risk for Chinese banks despite efforts to reduce exposure in recent years, said Ryan Tsang, managing director at S&P Global Ratings, during a Dec. 3 webinar.

"We expect the property nonperforming assets, including nonperforming loans, special-mention loans, forborne loans and other problem assets, to bounce between 5.5% and 5.9% in the next two years," Tsang said. This ratio ranged from 5.6% to 6.5% between 2021 and 2023, Tsang added.

While housing sales may stabilize in the second half of 2025, uncertainty surrounding US tariffs on Chinese exports could dampen market sentiment and consumer confidence. This would likely weigh on property sales, prolong the sector's downturn and increase pressure on banks, Tsang said.

As of Dec. 18, US$1 was equivalent to 7.29 Chinese yuan.