Click here to participate in the 2025 Private Equity and Venture Capital Outlook Survey

_______________________________________________________

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Both sovereign wealth funds and pension funds deployed less capital into new deals as M&A markets cooled in 2022 and 2023. But only pension funds managed to reverse course in 2024.

The aggregate global value of sovereign wealth fund-backed investments, including coinvestments made in partnership with private equity, totaled $43.43 billion between Jan. 1 and Dec. 4 and was on track for a third-consecutive annual decline, according to S&P Global Market Intelligence data. Global pension funds, meanwhile, deployed $65.42 billion over that same period, a total already 71% higher than the $38.19 billion they spent on deals during all of 2023.

To understand why investment trend lines diverged for pensions and sovereign wealth funds in 2024, it helps to take a look at the preceding two years, a period when distributions from private equity funds slowed to a trickle, leaving many institutional investors with less cash on hand for new deals and fund commitments.

That was not as much of a problem for sovereign wealth funds enriched by strong oil and gas revenues. They racked up transactions totaling $170.43 billion across 2022 and 2023 compared with just $93.62 billion in transaction value for pensions over that period.

Sovereign wealth funds stayed relatively busy during the market downturn and took a pause in allocation in 2024.

Read more about pension fund and sovereign wealth fund investment activity in 2024.

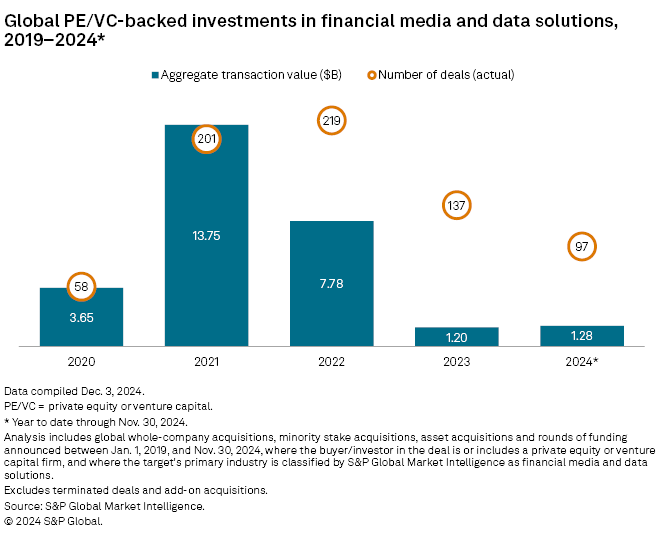

CHART OF THE WEEK: Private equity investment increases in financial media and data solutions

⮞ Private equity and venture capital-backed investments in the global financial media and data solutions industry totaled $1.28 billion through Nov. 30, up slightly from the $1.20 billion full-year 2023 total, according to Market Intelligence data.

⮞ The total does not include asset manager BlackRock Inc.'s planned $3.2 billion acquisition of investment data company Preqin Ltd., a deal that highlighted the value of private markets data when it was announced in June.

⮞ The largest private equity-backed deal in the sector between Jan. 1 and Nov. 30 was a $650 million round of funding for market intelligence platform AlphaSense Inc.

TOP DEALS AND FUNDRAISING

– Blackstone Inc., through funds managed by its private equity strategy for individual investors, made a minority investment of up to €250 million in Paris-based management and AI consulting services provider Sia Partners SAS.

– ArcLight Capital Partners LLC agreed to buy a limited liability company that owns a 25% stake in Gulf Coast Express Pipeline LLC from Phillips 66 for $865 million in cash. The about 500-mile pipeline transports natural gas to Agua Dulce, Texas, from the Permian Basin.

– Clayton Dubilier & Rice LLC and Permira Advisers Ltd. bought a 66.7% stake in French cybersecurity company Exclusive Networks SA.

– KKR & Co. Inc. and Bessemer Venture Partners led a $113 million funding round for accounting automation software company Aiwyn Inc.

– Affiliates of KKR invested in India-based quick service restaurant Rebel Foods Pvt. Ltd.

– Antin Infrastructure Partners raised €10.2 billion at the close of its fifth flagship fund. The Antin Flagship Fund V targets infrastructure investments across Europe and North America.

MIDDLE-MARKET HIGHLIGHTS

– Incline Management LP, doing business as Incline Equity Partners, sold power supply maintenance and repair services provider Unified Power Corp. Incline bought the company in 2019.

– Gryphon Investors Inc. sold industrial penetrant and synthetic grease maker Kano Laboratories LLC. The buyer was L Squared Capital Partners.

– Bluestone Investment Partners made a strategic investment in cybersecurity company Valiant Solutions LLC.

FOCUS ON: FINTECH

– AI-automated credit underwriting technology company ZestFinance Inc. raised $200 million in a growth funding round that included participation from returning investor Insight Venture Management LLC, doing business as Insight Partners.

– Consumer fintech banking platform Finco Services Inc., also known as Current, raised $200 million in a funding round from investors including Andreessen Horowitz LLC and General Catalyst Group Management LLC.

– Billing and integrated payments platform Chargezoom Inc. secured $11.5 million in a series A round led by Kickstart Fund.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter